Pelosi secures deal to be next Speaker of the House: Slate

Developments in Mueller probe whip up impeachment talk among Dems: Fox

UK prime minister survives leadership vote: CNBC

Britain’s weakened prime minister heads to Brussels for help: Reuters

IEA: US influence in global oil market set to rise: CNBC

Rising US-China tensions over South China Sea stocking fears of clash: SCMP

Criticism of indexing (still) falls flat: Barry Ritholtz

US consumer inflation (headline) slowed to 2.2% annual rate in Nov: MW

Monthly Archives: December 2018

Mideast Stocks On Track As Top-Performing Region For 2018

With less than three weeks before the last trading session of the year, equity markets in the Mideast appear set to deliver the strongest (and perhaps only) gain for 2018 among the world’s major regions, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 12 December 2018

Trump says he’ll consider shutting gov’t over border wall: Bloomberg

CFO of China’s tech giant Huawei released on bail in Canada: CNN

China detains former Canadian diplomat: SCMP

Trump says Fed rate hike ‘would be foolish’: Reuters

Vanguard founder Bogle: buy bonds to hedge ‘unstable’ US gov’t and Brexit: FN

Global equity valuations at 5-year lows: WSJ

UK Prime Minister Theresa May faces no-confidence vote today: WSJ

Protests in France threaten to undermine Macron’s economic reforms: NY Times

US small business optimism remains high but outlook turns cautious: CNBC

Treasury Market’s Inflation Forecast Plunges

The implied inflation outlook via Treasury yield spreads in recent months has been pricing in a possibility that inflation has peaked. The forecast is debatable, but right or wrong the government bond market is doubling down on that bet.

Continue reading

Macro Briefing: 11 December 2018

Impeachment risk is rising for Trump: Bloomberg

US and China start new round of trade talks: WSJ

White House plans to roll back clean water rules: Axios

Trump administration promotes fossil fuels at climate change meeting: Time

UK’s May heads to Europe to salvage her crumbling Brexit deal: Guardian

Macron offers to raise minimum wages after French protests: BBC

US sanctions North Korean officials amid stalled nuclear talks: ABC

Former Fed Chair Yellen is worried about excessive corporate debt: CNBC

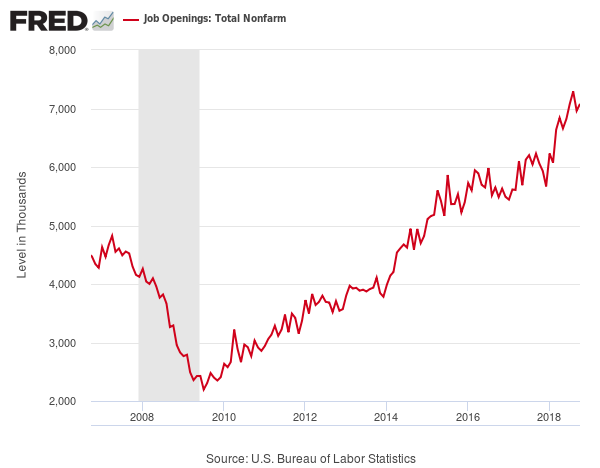

US job openings rebounded in Oct, near record high: CNBC

Commodities And Bonds Rose Last Week As Stocks Tumbled

US and foreign stock markets fell sharply last week as broadly defined commodities and bonds gained ground, according to a set of exchange-traded products representing the major asset classes. Growing concern over several economic and political risk factors have been weighing on stocks and the week ahead appears set to start with a new round of volatility.

Continue reading

Macro Briefing: 10 December 2018

China summons US envoy over Huawei CFO’s arrest in Canada: Bloomberg

Europe’s top court rules UK can unilaterally halt Brexit process: CNN

Wall Street banks pore over data in search of business-cycle clues: Bloomberg

UK Prime Minister May must decide today on putting Brexit deal to a vote: Time

Familiar risks await US economy in 2019: NY Times

Eurozone GDP growth in Q3 dipped to slowest pace in four years: RTE

US hiring slowed in Nov; wage growth at highest rate in nearly a decade: WSJ

Consumer debt posted biggest gain in 11 months in Oct: Bloomberg

Wholesale trade sales in US up 6.8% for year through Oct: MDM

US Consumer Sentiment Index unchanged at elevated level in Dec: MW

Book Bits | 8 December 2018

● Delivering Alpha: Lessons from 30 Years of Outperforming Investment Benchmarks

By Hilda Ochoa-Brillembourg

Summary via Amazon

From a former World Bank Executive and renowned investor―a detailed roadmap to adding consistent, sustainable value to globally diversified portfolios. For many investors, alpha is akin to the Holy Grail. Risk-adjusted returns above benchmarks―alpha―are particularly challenging to achieve even with a sound strategy. Hilda Ochoa-Brillembourg is an expert on alpha. Over the past four decades, she and her team consistently exceeded benchmarks and delivered appreciable value added on their investments. In Delivering Alpha, she reveals the principles and methods employed in her investment strategies, along with insights drawn from her personal life. She shows how timing, market awareness, price, and relative value to the investor are critical drivers of effective investment decisions. Ochoa-Brillembourg also debunks common investment myths that often trip up both new and experienced investors.

Continue reading

Growth Rate For US Payrolls Continued To Slow In November

The pace of hiring at companies slowed in November, according to this morning’s monthly update from the Labor Department. The softer-than-projected gain pared the year-over-year trend to a three month low. The economy’s still creating a healthy number of jobs, but today’s results reaffirm the view that US growth has peaked.

Continue reading

Low Volatility Stocks Take The Lead In 2018’s US Factor Race

The latest bout of turbulence in the stock market has reshuffled leadership for US equity factor strategies, leaving the low-volatility strategy as this year’s front runner, based on a set of ETFs. Growth and momentum are still posting gains this year, but they’re now trailing, slightly, low vol. One thing that hasn’t changed: value stocks remain in the hole on a year-to-date basis, based on trading for 2018 through yesterday’s close (Dec. 6).

Continue reading