A grim milestone for deaths in California’s fires: BBC

At WWI ceremony in France a warning: ‘old demons are rising again’: Time

Is climate change becoming too complex and divisive to solve? Axios

Global oil producers close to cutting production: Fox Business

Does Australia’s long-running expansion hold lessons for US policy? Bloomberg

US dollar close to 17-month high in early trading on Monday: Reuters

China says it will further open up its economy: Reuters

The vote recounts in Florida, Georgia and Arizona are razor close: NY Times

US wholesale inflation surged in Oct, highest pace in over 6 years: CNBC

US wholesale inventories in Sep rose a bit more than previously estimated: CNBC

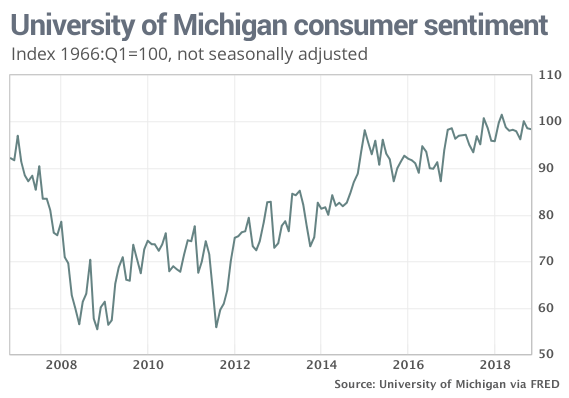

US Consumer Sentiment Index for Nov still reflects upbeat economic outlook: MW

Monthly Archives: November 2018

Book Bits | 10 November 2018

● Merger Masters: Tales of Arbitrage

By Kate Welling and Mario Gabelli

Summary via publisher (Columbia University Press)

Merger Masters presents revealing profiles of monumentally successful merger investors based on exclusive interviews with some of the greatest minds to practice the art of arbitrage. Michael Price, John Paulson, Paul Singer, and others offer practical perspectives on how their backgrounds in the risk-conscious world of merger arbitrage helped them make their biggest deals. They share their insights on the discipline that underlies their fortunes, whether they practice the “plain vanilla” strategy of announced deals, the aggressive strategy of activist investment, or any strategy in between on the risk spectrum. Merger Masters delves into the human side of risk arbitrage, exploring how top practitioners deal with the behavioral aspects of generating consistent profits from risk arbitrage.

Continue reading

Is The Treasury Market Predicting That US Inflation Has Peaked?

The Federal Reserve left interest rates unchanged yesterday, but the central bank continued to signal that a hike at next month’s policy meeting remains a possibility. The reasoning is that the US economy continues to post solid growth. But a closer look at the numbers suggests that the pace of expansion is slowing. There are also hints that the reflation trend over the past year or so may be rolling over. If so, the case could be weakening for more policy tightening.

Continue reading

Macro Briefing: 9 November 2018

Ex-marine identified as gunman in Thousand Oaks, Calif. shooting: CNN

Fed leaves rates unchanged, noting slowdown in business invesment: CNBC

China’s car sales declined for fourth month in October: Reuters

China’s inflation remained tame in October: Bloomberg

Trump rolls out regulation to limit asylum access at the US-Mexico border: Politico

Florida’s Senate race still in doubt and recount is likely: The Hill

Democrat pulls ahead in Arizona’s too-close-to-call Senate race: The Hill

Federal judge blocks Keystone XL pipeline construction: NY Times

US jobless claims ticked down last week, holding near multi-decade low: CNBC

Crude oil (W. Texas Int.) falls again, settling at lowest price since March: MW

Growth Continues To Crush Value This Year For US Equity Factors

The sharp swings in the stock market in recent weeks haven’t dented the year-to-date performance edge that’s prevailed for large- and small-cap growth stocks in the US over their value counterparts, based on a set of exchange-traded funds through yesterday’s close (Nov. 7).

Continue reading

Macro Briefing: 8 November 2018

US Attorney General Jeff Sessions resigned at Trump’s request: The Hill

Sessions’ resignation is stoking political firestorm on Capitol Hill: Politico

Fed expected to leave rates unchanged today and continue hiking in Dec: Reuters

Russia downplays prospects for relations with US after Dems take House: CNN

US mortgage applications close to four-year low: Bloomberg

Stock market bulls say gridlock is good in Washington: MarketWatch

China’s imports and exports in October exceeded forecasts: CNBC

US consumer borrowing growth slowed in Sep: MarketWatch

Policy sensitive 2yr Treasury yield ticks up to new post-recession high of 2.93%:

US Growth Slowdown Expected To Continue In Q4

Early estimates of GDP growth for the US in the fourth quarter point to another round of deceleration, based on the median for a set of projections compiled by The Capital Spectator. Although it’s still early in the quarter, leaving room for changes in the outlook based on incoming data, the preliminary numbers hint at the possibility that growth will continue to cool in the final three months of 2018.

Continue reading

Macro Briefing: 7 November 2018

Democrats take back the House; GOP holds Senate: MarketWatch

A Democratic House is eager to take on Trump: Politico

House Democrats will probably change US foreign policy: Reuters

How will the election results influence the stock market? CNBC

Global economic growth edged up at the start of Q4: IHS Markit

PMI data for Eurozone: growth slowed to lowest pace in over 2 years: IHS Markit

US job openings dipped in Sep but still near record high: CNBC

Profiling Factor ETF Correlations

Slicing and dicing the US equity market into factor buckets is, at its core, an effort to enhance return by engineering more control over risk management. A key part of this framework is recognizing that risk and return for the stock market overall is a byproduct of multiple factors, such as shares trading at low valuations or posting strong price momentum in the recent past. In turn, it’s reasonable to assume that a set of factor ETFs will exhibit relatively low correlations with one another, offering a degree of diversification otherwise unavailable via standard portfolio designs for capturing equity beta. To test that assumption, let’s review the return correlations for a broad set of factor ETFs in recent history.

Continue reading

Macro Briefing: 6 November 2018

Democrats appear to have an edge in today’s election: FiveThirtyEight

Facebook discloses possible election meddling by Russia: USA Today

Trump’s decision to deploy troops to border will cost $200M-$300M: CNN

Supreme Court refuses to hear appeal over net neutrality rules: The Hill

China’s VP: China is ready to resolve trade dispute with US: CNBC

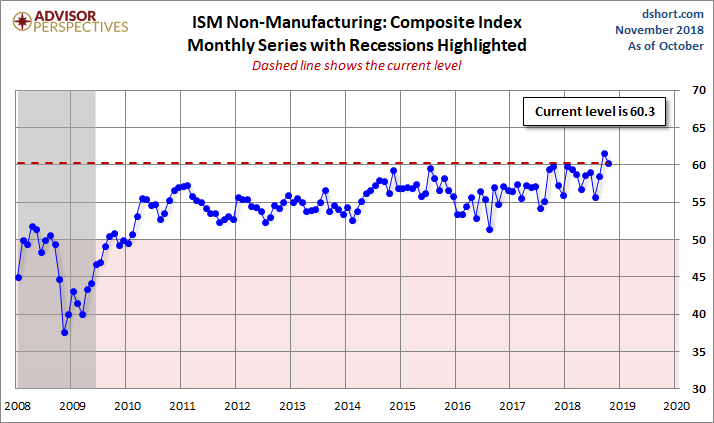

Services PMI for US reflects “strong” business activity for Oct: IHS Markit

US ISM Non-Mfg Index for Oct reflects “strong growth”: CNBC