● Money and Government: The Past and Future of Economics

By Robert Skidelsky

Summary via publisher (Yale University Press)

The dominant view in economics is that money and government should play only minor roles in economic life. Economic outcomes, it is claimed, are best left to the “invisible hand” of the market. Yet these claims remain staunchly unsettled. The view taken in this important new book is that the omnipresence of uncertainty makes money and government essential features of any market economy. Since Adam Smith, classical economics has espoused non-intervention in markets. The Great Depression brought Keynesian economics to the fore; but stagflation in the 1970s brought a return to small-state orthodoxy. The 2008 global financial crash should have brought a reevaluation of that stance; instead the response has been punishing austerity and anemic recovery. This book aims to reintroduce Keynes’s central insights to a new generation of economists, and embolden them to return money and government to the starring roles in the economic drama that they deserve.

Continue reading

Monthly Archives: November 2018

Fed Expected To Lift Rates Next Month, But A Pause May Follow

Economic headwinds may lead to a pause in 2019 for the Federal Reserve’s plans to raise interest rates, the central bank’s chairman said earlier this week. But Jerome Powell outlined a mostly positive view of the US economy and market sentiment continues to price in a moderately high probability that the Fed will lift its target rate at next month’s policy meeting.

Continue reading

Macro Briefing: 16 November 2018

North Korea tests ‘high-tech’ weapon: CNN

Florida’s US Senate race headed for manual recount: Reuters

Brexit deal triggers political crisis; UK Prime Minister fights for survival: Reuters

S. East Asia may be forced to choose between US and China: Bloomberg

Fed considers a rate pause in 2019: Bloomberg

US District Court appears to indict WikiLeaks founder Julian Assange: NBC

Business inventories in US rose slightly in September: Reuters

US jobless claims rose last week but labor market remains tight: WSJ

NY and Philly Fed indexes show manufacturing sector still solid: MW

Oil-price slide points to end of global reflation trend: Lance Roberts

US retail surged in October following back-to-back declines: MarketWatch

Commodities Continue To Dominate Deep-Value ETF Ranking

The slide in global markets in recent weeks has cut prices near and far, but the steepest declines for the trailing five-year return – a proxy for the value factor – are still linked with the dive in commodities. That was true for the deep-value list in October and the profile is intact in today’s update, which reflects trading through yesterday (Nov. 14).

Continue reading

Macro Briefing: 15 November 2018

Death toll rises to 56 in Northern California’s fire: NBC

Liability costs from California fires threaten electric utility PG&E: CNN

China outlines trade concessions to US ahead of G20 meeting: Bloomberg

Two UK ministers quit after May announces cabinet backs Brexit deal: Reuters

Israel’s political turmoil creates challenges for US Mideast peace plan: Bloomberg

Fed Chairman Powell is “happy about the state of the economy right now”: MW

Business inflation trend in Nov ticked down to annual 2.2% pace : Atlanta Fed

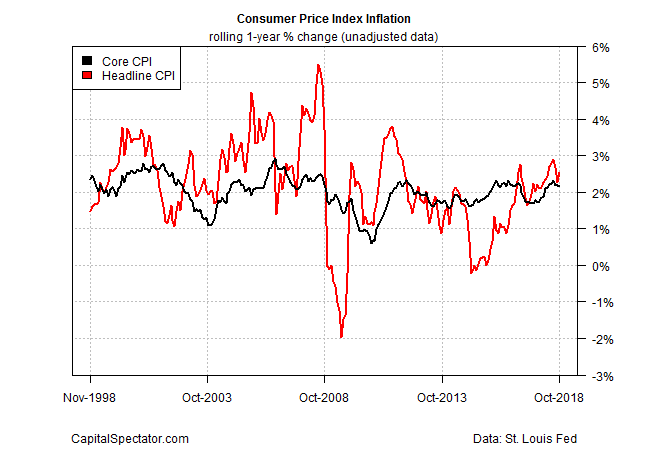

US consumer inflation trend edged up in Oct as core inflation slipped: MW

Behavioral Risk Is Highest In The Early Years Of A New Investment

It’s old news that managing expectations is usually the main challenge in finding success with an investment strategy. To paraphrase Pogo in the quest to earn a respectable return through time, we’ve met the enemy of prudent behavior and he is us. Less obvious is the tendency for this behavioral risk to go to extremes early on in the period immediately following the establishment of a new investment. By comparison, a decade or more into the holding period — assuming you make it that far — is relatively safe from a behavioral perspective.

Continue reading

Macro Briefing: 14 November 2018

UK and EU reach provisional agreement on Brexit: CNBC

Democratic gains rise a week after mid-term elections: NY Times

China’s retail spending trend slows as industrial output picks up: Reuters

German economy shrank in Q3, first decline since 2015: Bloomberg

Japan’s economy contracted in Q3 due to natural disasters: Japan Times

Several bearish factors continue to weigh on crude oil prices: MW

Spain will ban all gas-powered cars by 2040: Gizmodo

Analysts expect headline consumer inflation to rise 0.3% in Oct vs. Sep’s 0.1%: MNI

US small business optimism held near record high in Oct: NFIB

US Economic Output Running Well Above Potential GDP Estimate

The recent run of strong growth in GDP is welcome news, but from the perspective of policymakers there are signs that the economy may be approaching its maximum output capacity. In turn, this analysis provides the Federal Reserve with another reason to continue squeezing monetary policy.

Continue reading

Macro Briefing: 13 November 2018

Audio recording seems to link Khashoggi killing to Crown Prince: NY Times

Democrat wins US Senate race in Arizona: CBS

Lawsuits and accusations swirl as Florida recount battle deepens: WaPo

N. Korea maintains secret missile bases, defying promises to US: Reuters

Gaza launches barrage of rockets at Israel: CNN

Amazon chooses New York and Northern Virginia for HQ2 locations: WSJ

SF Fed President: more rate hikes needed with full US employment: MNI

Moody’s: global credit conditions expected to weaken in 2019: P&I

US gasoline prices slide for a fifth straight week: 24/7 Wall Street

Expect rise in number of economic surprises for the US: Vanguard

Crude oil falls for 12th straight session, longest decline on record: Bloomberg

US REITs Led Last Week’s Partial Rebound In Asset Classes

Roughly half of the major asset classes posted gains last week, led by a strong increase in US real estate investment trusts (REITs), based on a set of exchange-traded products.

Continue reading