Slicing and dicing the US equity market into factor buckets is, at its core, an effort to enhance return by engineering more control over risk management. A key part of this framework is recognizing that risk and return for the stock market overall is a byproduct of multiple factors, such as shares trading at low valuations or posting strong price momentum in the recent past. In turn, it’s reasonable to assume that a set of factor ETFs will exhibit relatively low correlations with one another, offering a degree of diversification otherwise unavailable via standard portfolio designs for capturing equity beta. To test that assumption, let’s review the return correlations for a broad set of factor ETFs in recent history.

Continue reading

Daily Archives: November 6, 2018

Macro Briefing: 6 November 2018

Democrats appear to have an edge in today’s election: FiveThirtyEight

Facebook discloses possible election meddling by Russia: USA Today

Trump’s decision to deploy troops to border will cost $200M-$300M: CNN

Supreme Court refuses to hear appeal over net neutrality rules: The Hill

China’s VP: China is ready to resolve trade dispute with US: CNBC

Services PMI for US reflects “strong” business activity for Oct: IHS Markit

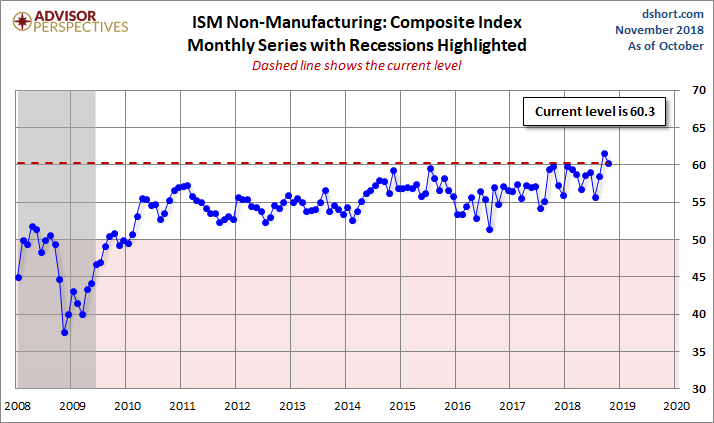

US ISM Non-Mfg Index for Oct reflects “strong growth”: CNBC