The global selloff in stock markets around the world this week has left equities in the Middle East and the US with the world’s only year-to-date gains for the major regions, based on a set of exchange-traded funds through yesterday’s close (Oct. 11).

Continue reading

Monthly Archives: October 2018

Macro Briefing: 12 October 2018

Amid rising trade tensions, Trump and Xi plan to meet in late November: WSJ

China’s exports surged in September: Reuters

Stocks in Europe and Asia rebound in Fridays’ trading: Bloomberg

Audio and video evidence proves Saudi journalist killed in consulate: WaPo

Firms rethink working with Saudi Arabia after journalist disappears: NY Times

Sidestepping the next recession could be difficult: The Economist

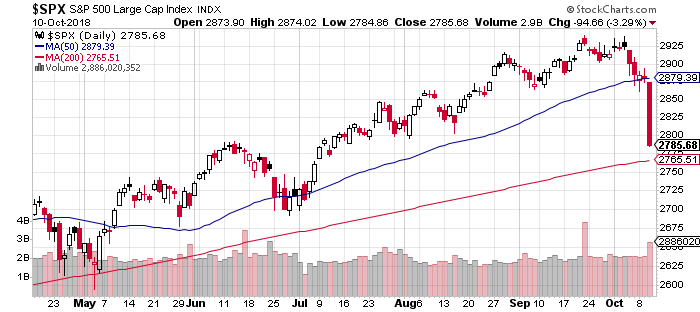

S&P 500 fell below 200-day avg on Thurs for first time since April: CNBC

Jobless claims rose last week but remain close to 49-year low: CNBC

US consumer inflation slowed in September: MarketWatch

Parsing Yesterday’s Stock Market Slide

No one knows if yesterday’s 3%-plus plunge in US equity prices is noise or the start of an extended decline. What we do know is that the slide wasn’t entirely unexpected given the strong relative and absolute performance of US stocks in recent history.

Continue reading

Macro Briefing: 11 October 2018

Hurricane Michael ravages Florida, heads to Carolinas: CNN

US arrests Chinese military intel official for economic espionage: NY Times

US intel: Saudi crown prince ordered detention of journalist Khashoggi: CNBC

US futures on Thursday point to another wave of selling: CNBC

Trump says Fed ‘Has Gone Crazy’ after sharp down day in stocks: BBG

US Treasury Sec: stock market slide is ‘normal correction’: CNN

US producer prices rebounded in September: Reuters

Wholesale inventories in US increased a strong 1% in August: MarketWatch

Business inflation expectations for Sep tick up to 2.3%, a 6-mo high: Atlanta Fed

Recession risk may be rising for California’s economy: NY Times

US stock market fell 3.3% on Wed, biggest daily drop since Feb: CNBC

What Are You Expecting From Gold In Your Portfolio Strategy?

Gold is deemed an essential piece of the asset allocation pie in some corners. The reasons vary, depending on the investor, although it’s not uncommon to hear rationales that sound more like religious sermons on the mystical properties of the yellow metal. From an econometric perspective, gold’s attributes for portfolio design are relatively ordinary by way of closely aligning with the inverse return of the US dollar. As such, using gold in portfolios can and arguably should be viewed as a quasi-forex trade as opposed to an all-weather hedge that can never go wrong.

Continue reading

Macro Briefing: 10 October 2018

Is China’s $1 trillion-plus Treasury portfolio a risk factor in a trade war? NY Times

Trump renews threat to slap more tariffs on Chinese imports: Reuters

IMF: investors are underestimating risk of a new financial crisis: Bloomberg

US Treasury secretary warns China on currency devaluation: FT

Hurricane Michael may be strongest storm to strike Florida’s Panhandle: WaPo

Nikki Haley, US ambassador to UN, surprises GOP with resignation: The Hill

Trump says Fed is hiking rates too fast: Politico

Sears reportedly close to bankruptcy filing: CNBC

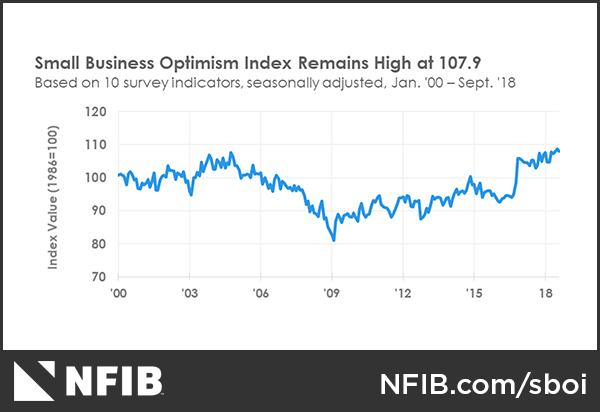

US Small Business Optimism Index remains close to 45-year high in Sep: NFIB

Deep-Value ETF Report: A Slightly Longer List

The search for deep-value plays in the ETF realm delivered a short list in August, when markets were humming far and wide. Let’s take a fresh review of the landscape in the wake of recent selling, which has pinched nearly every corner of global stocks, bonds, and real estate securities. Commodities have fared better in recent weeks, but this slice of the major asset classes was already suffering from a longer-run perspective and so there are still plenty of relative bargains on this front.

Continue reading

Macro Briefing: 9 October 2018

IMF: trade war will pinch economic growth in US and China in 2019: CNN

Trump ignores UN’s dire report on climate change: NY Times

Hurricane Michael strengthens as it approaches Florida’s panhandle: Reuters

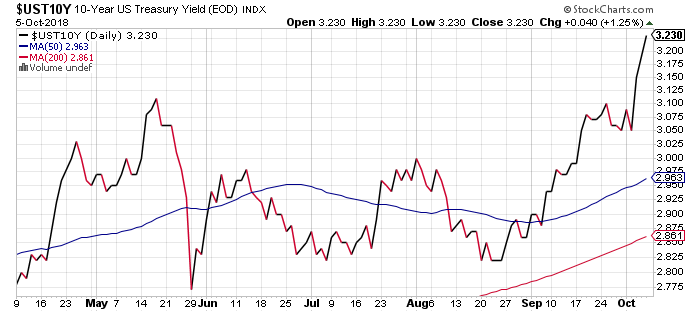

US Treasury yields edge up to new multi-year highs in early Tues trading: CNBC

Nobel prize in economics awarded for climate change and tech innovation: WaPo

No political fix expected for rising US debt load: Bloomberg

Commodities Posted Lone Gain Last Week For Major Asset Classes

With the exception of broadly defined commodities, all the major asset classes lost ground in the first week of October, based on a set of exchange-traded products. Stocks in emerging markets suffered the biggest setback among widespread losses in global markets.

Continue reading

Macro Briefing: 8 October 2018

Did GOP trade majorities in Congress for a conservative Supreme Court? CNN

Senate Majority Leader: opposition to Kavanaugh is ‘gift’ for GOP: WaPo

US Sec of State cited “fundamental disagreement” with China: BBG

N. Korea ready to allow inspections of its missile, nuclear sites: Reuters

Khashoggi case is a crisis for US-Saudi ties: WaPo

UN climate report: high risk of crisis from climate change by 2040: NY Times

Tropical Storm Michael may hit Florida’s Gulf Coast as hurricane: CBS

China’s central bank rolls out stimulus to shore up economy: SCMP

Far-right candidate wins first round of Brazil’s presidential election: BBC

US job growth cooled in Sep as unemployment rate fell to 3.7%: Reuters

10yr Treasury yield spiked to 3.23% last week, highest since 2011: