The stock market has been tumbling lately, which means that dramatic media headlines are roiling investor sentiment far and wide. As a result, recency bias threatens to overwhelm otherwise rational minds. To be fair, October looks pretty grim and the latest market rout could roll on… or not. But before you let your emotional demons take over all your decisions, take a moment to consider the historical perspective, which tends to be overlooked in times like these.

Continue reading

Monthly Archives: October 2018

Macro Briefing: 25 October 2018

Suspected package bombs sent to Obama, Clinton and CNN: Reuters

Is Trump’s diplomacy pushing China and Japan closer together? CNN

Worries over a trade war and tariffs are key factors in market selloff: CNBC

Is the Fed making a mistake on inflation outlook and raising rates? Yardeni.com

US Composite PMI for Oct: economic growth ticked up to 3-mo high: IHS Markit

Home Price Index for US up 0.3% in Aug as mid-Atlantic slumped 0.7%: HW

Fed’s Beige Book: wages, prices rising at “modest to moderate” pace: MW

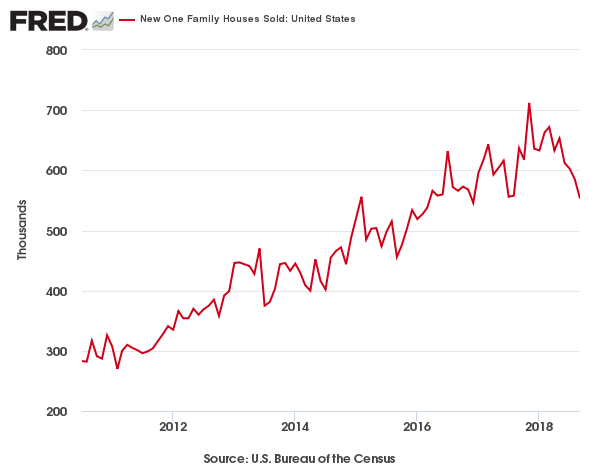

New home sales in US fell to lowest level in nearly 2 years in Sep: Reuters

Mideast Stocks Steady As Rest Of World’s Equities Fall

Equity markets in the Mideast remain the performance leader this year as selling takes a toll on the world’s other major stock market regions, based on a set of exchange-traded funds as of yesterday’s close (Oct. 23).

Continue reading

Macro Briefing: 24 October 2018

Saudi prince opens investment conference under cloud of Khashoggi case: AP

Italy and EU on collision course over debt and budget: The Atlantic

Trump accuses Fed chairman of threatening US economy with rate hikes: CNBC

Retail investors buy the dip in stocks as institutions sell: Bloomberg

Richmond Fed Mfg dips in Oct after setting record high in Sep: MarketWatch

Eurozone growth in Oct Sep fell to slowest pace in over two years: IHS Markit

US Economic Growth Expected To Cool In Friday’s Q3 GDP Report

The government’s initial estimate of third-quarter GDP for the US is on track to decelerate to a 3.3% increase in the release due at the end of this week, based on the median for a set of nowcasts compiled by The Capital Spectator. That’s a solid gain, but the estimate marks a substantially softer pace vs. the strong 4.2% rise reported for Q2.

Continue reading

Macro Briefing: 23 October 2018

Turkey’s president says there’s evidence that Khashoggi killing was planned: CNBC

Saudi foreign minister pledges full investigation into Khashoggi killing: Reuters

Trump vows to use military to address growing migrant caravan: Fox

US Navy warships sail through Taiwan Strait: ABC

Trump says US will build up nuclear arsenal: BBC

Supreme Court halts Commerce Secretary’s deposition re: census: Politico

Japan’s Abe will meet China’s Xi this week: CNBC

Leading Indicator of remodeling activity: slower growth for 2019 expected: JCHS

US jobless rate is lowest in decades, but wage growth remains weak: NY Times

Former Fed Chair Volcker sees trouble brewing just about everywhere: NY Times

Chicago Fed Nat’l Activity Index: US growth moderated slightly in Sep: Chicago Fed

US REITs Rebounded Sharply Last Week

Real estate investment trusts (REITs) in the US posted the biggest gain by far for the major asset classes last week, based on a set of exchange-traded products. By contrast, last week’s biggest loser: equities in emerging markets.

Continue reading

Macro Briefing: 22 October 2018

China criticizes Pompeo’s warning of hidden risks in Chinese investments: Reuters

US Treasury Secretary defends upcoming trip to Saudi Arabia: NY Times

Turkey’s president to reveal ‘details’ in killing of Saudi journalist: USA Today

Saudi Arabia: no plans for an oil embargo amid Khashoggi crisis: CNBC

Trump: US will pull out of decades-old nuclear arms treaty with Russia: CNN

Moody’s cuts Italy’s debt to one notch above junk status: Reuters

GOP leaders are clueless about Trump’s tax-cut plan: Bloomberg

US existing home sales slumped to three-year low in September: Bloomberg

China’s stock market surged for a second day on Monday: CNBC

Book Bits | 20 October 2018

● The Behavioral Investor

By Daniel Crosby

Summary via publisher (Harriman House)

In The Behavioral Investor, psychologist and asset manager Dr. Daniel Crosby examines the sociological, neurological and psychological factors that influence our investment decisions and sets forth practical solutions for improving both returns and behavior. Readers will be treated to the most comprehensive examination of investor behavior to date and will leave with concrete solutions for refining decision-making processes, increasing self-awareness and constraining the fatal flaws to which most investors are prone. The Behavioral Investor takes a sweeping tour of human nature before arriving at the specifics of portfolio construction, rooted in the belief that it is only as we come to a deep understanding of “why” that we are left with any clue as to “how” we ought to invest.

Continue reading

US Business Cycle Risk Report | 19 October 2018

The US economic trend remains solidly positive, but signs of slowing growth persist. For now, the risk of recession remains virtually nil and it’s unlikely that a downturn will start in the immediate future, according to broad set of indicators. But projections for next year, which remain highly speculative at this point, suggest that recession risk will rise – a forecast that deserves close attention as new data arrives in the weeks ahead.

Continue reading