The Federal Reserve remains on track to raise interest rates again in December, according to the futures markets. But the wisdom for another round of policy tightening is drawing more criticism in the wake of a surge in stock market volatility and signs that economic growth has slowed in the US, China and Europe.

Continue reading

Monthly Archives: October 2018

Macro Briefing: 31 October 2018

Eurozone GDP growth in Q3 slumped to four-year low: NY Times

US dollar rises to highest level in more than a year: Reuters

US charges Chinese military officers with theft of jet engine data: Reuters

China’s Mfg PMI for Oct points to slowest growth in over two years: CNBC

Reeling from financial stress, GE cuts its 119-year-old dividend to one cent: CNN

Annual trend for US home prices slips below 6% rise for first time in a year: S&P

Conference Board: US Consumer Confidence Index at 18-year high in Oct: CNBC

Election forecast still favors Democrats for retaking House: FiveThirtyEight

Has The Rebound In US Consumer Spending And Income Peaked?

Most economic measures continue to paint an upbeat profile for the US, but yesterday’s September report on consumer spending and income hints at the possibility that softer growth is approaching. There’s still no clear sign of rising recession risk on the immediate horizon, but it’s reasonable to wonder if the surge in economic activity following Donald Trump’s election two years ago is now in the process of reversing and giving way to a lesser rate of expansion.

Continue reading

Macro Briefing: 30 October 2018

US preparing new tariffs on remaining Chinese imports if talks fail: Bloomberg

Trump expects a ‘great deal’ with China on trade: Reuters

US to send 5,200 US troops to border to stop migrant caravan: Fox

If Dems take the House, expect a lot of new investigations: NY Times

Germany’s Angela Merkel will step down as chancellor in 2021: BBC

What will follow the Merkel era in Germany? Slate

Consumer spending in US was solid in Sep; income growth was sluggish: Reuters

US PCE inflation remained tame in September: WSJ

The earth’s topical zone is expanding 30 miles per decade: Yale Environment 360

S&P 500 fell to lowest close in nearly six months on Monday: USA Today

US Bonds Edged Up Last Week As Stocks Tumbled Worldwide

A rush into safe-haven US Treasuries dominated last week’s trading action for winners amid a rout in equity markets around the world, based on profiling the major asset classes via a set of exchange-traded products.

Continue reading

Macro Briefing: 29 October 2018

Pittsburgh synagogue shooting suspect due in court today: CNN

US Homeland Security Secretary: ‘This caravan is not getting in’: Politco

2nd migrant group headed for US tries to force entry into Mexico: Fox

Brazil elects right-wing former military officer as president: BBC

Another setback for Germany’s governing after state election: BBC

Germany’s Merkel to quit as head of her Christian Democratic party: Bloomberg

IBM to acquire Redhat as Big Blue focuses on cloud computing: CNBC

US economic output slowed in Q3, but still posted solid 3.5% gain: MW

Gender gap has opened up for views on American economy: NY Times

Is bear market for stocks lurking if Democrats take House? Bloomberg

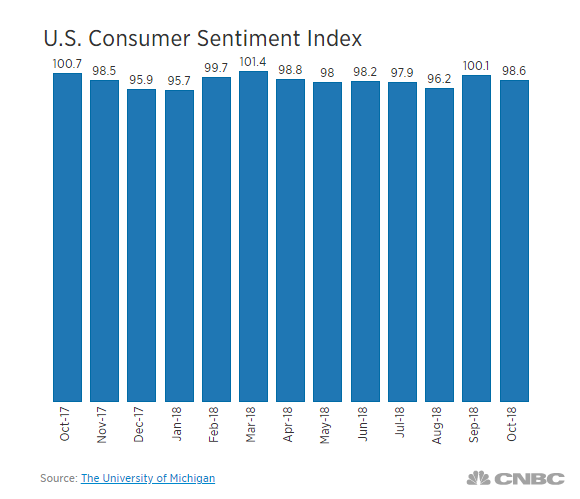

US consumer sentiment eases in Oct but remains at historically high levels: CNBC

Book Bits | 27 October 2018

● Money: 5,000 Years of Debt and Power

By Michel Aglietta

Summary via publisher (Verso)

As the financial crisis reached its climax in September 2008, the most important figure on the planet was Federal Reserve chairman Ben Bernanke. The whole financial system was collapsing, with little to stop it. When a senator asked Bernanke what would happen if the central bank did not carry out its rescue package, he replied, “If we don’t do this, we may not have an economy on Monday.” What saved finance, and the Western economy, was fiscal and monetary stimulus – an influx of money, created ad hoc. It was a strategy that raised questions about the unexamined nature of money itself, an object suddenly revealed as something other than a neutral signifier of value. Through its grip on finance and the debt system, money confers sovereign power on the economy. If confidence in money is not maintained, crises follow. Looking over the last 5,000 years, Michel Aglietta explores the development of money and its close connection to sovereign power.

Continue reading

US Growth Slowed In Q3, But Annual Pace Continued To Improve

US GDP growth beat expectations in today’s “advance” estimate of third-quarter data. Output increased by an annual 3.5% (seasonally adjusted real rate), the Bureau of Economic Analysis reported earlier today. The gain is slightly above The Capital Spectator’s 3.3% nowcast (based on several sources) from earlier this week. Although the Q3 advance marks a solid rise, today’s results reaffirm expectations that growth has decelerated following Q2’s sizzling 4.2% surge.

Continue reading

Explaining The “Robot” ETF’s Bull Run With Factor Analysis

Bloomberg last week published an intriguing story about a new exchange traded fund (ETF) that uses artificial intelligence (AI) to outperform market indexes and active managers alike. The implication: a new era of AI-driven investing has dawned, putting the standard applications of indexing at a disadvantage. Yet a closer look at the so-called Robot ETF’s results via a factor-analysis lens tells a different story and one that can be explained with a mix of large-cap, small-cap and micro-cap equity betas. In turn, replicating the Robot ETF’s performance, which Bloomberg claims “leaves pros in the dust,” is a simple matter of holding a trio of plain-vanilla index funds.

Continue reading

Macro Briefing: 26 October 2018

Mail bomb threat widens, including package sent to former VP Joe Biden: BBC

Florida mail facility in focus for bombmaker investigation: CNN

Trump may close southern border as migrant caravan nears: USA Today

China and Japan pledge to forge closer ties: Reuters

ECB chief says recession risk is low for Eurozone economy: NY Times

Global stocks on track for worst week in five years: Reuters

US pending home sales in September posted first gain since June: NAR

Wholesale inventories in August up more than initially estimated: Reuters

US jobless claims rose slightly last week but remain near 45yr low: MW

Trade deficit in US widened for fourth straight month in Sep: CNBC

US durable goods orders rebounded in September: CNBC