Republican narrowly leads in Ohio special election in GOP stronghold: Politico

China’s exports accelerate despite trade war with US: Reuters

Iran’s foreign minister says US will not stop Iran oil exports: Reuters

Trump says US GDP growth could soon top 5%: The Hill

US set to impose 25% duties on extra $16 billion in Chinese imports: Bloomberg

Tight labor market is headwind for hiring at small businesses: Fox

US job openings edged up in June, close to record high: MarketWatch

Monthly Archives: August 2018

Value Investing For US Equities Continues To Rebound

Several months ago I reviewed the case for thinking that the long-suffering value factor for US equity investing was in the process of reviving. At the time, the evidence was sketchy but the outlook was encouraging. Fast forward to early August and the bullish trend looks a bit stronger for this corner of equities.

Continue reading

Macro Briefing: 7 August 2018

Ex-Trump aide testifies he committed crimes with Manafort: The Hill

US hits Iran with new economic sanctions: The Guardian

EU vows to counter US sanctions on Iran: Politco

As Brexit deadline approaches, UK looks to the Trump factor: Bloomberg

Beijing says China will not surrender to US ‘trade blackmail’: CNBC

India-US trade dispute is simmering: CNBC

California wildfire, largest in state history, continues to rage: Reuters

Corporate boards have ok’d 80% rise in stock buybacks vs. year ago: NY Times

Analysts lowered S&P 500 Q3:2018 earnings estimates by 0.6%: Factset

US REITs Surged Last Week While Foreign Real Estate Tumbled

Securitized real estate shares dominated last week’s performance rankings at the extremes for the major asset classes, based on a set of exchange-traded products. US real estate investment trusts (REITs) posted the highest return for the week through August 3 while foreign REITs/real estate suffered the biggest loss.

Continue reading

Macro Briefing: 6 August 2018

Trump says his son met Russian for political dirt on Clinton: BBC

Tax cuts drive surge in profits at big US firms: WSJ

JPMorgan Chase’s Dimon: “be prepared” for 5% yield on 10yr Treasury: Bloomberg

Turkish lira at record low after US says it’s reviewing trade with Turkey: Reuters

PMI: Global economic growth dips to 4-month low in July: IHS Markit

US trade deficit widened in June for first time in 4 months: Bloomberg

US Services PMI reflects strong growth in July: IHS Markit

ISM Non-Mfg Index fell to 11-month low in July: MarketWatch

Nonfarm payrolls up by less-than-expected 157,000 in July: CNBC

US economy added jobs for 94th month as wage growth remains muted: WaPo

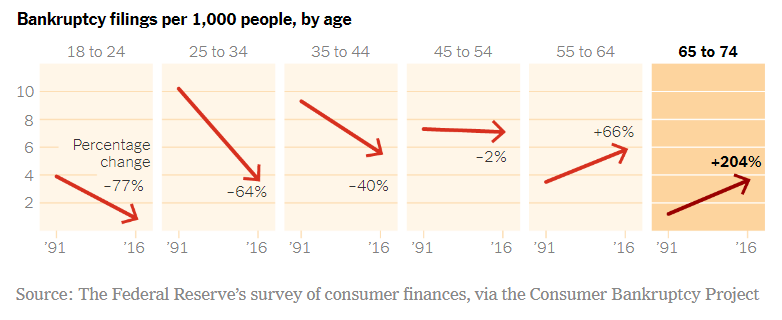

Bankruptcy rate among older Americans up sharply since 1991: NY Times

Book Bits | 4 August 2018

● Crashed: How a Decade of Financial Crises Changed the World

By Adam Tooze

Review via The Economist

Four big themes emerge from Mr Tooze’s account of the post-2008 era. The first was the immediate post-crisis response, in which the banks were rescued and both the monetary and fiscal taps were loosened. The second was the euro-zone crisis, which hit Greece and Ireland hardest, but also affected Portugal, Italy and Spain. The third was the shift in the developed world after 2010 to a more austere fiscal policy. The fourth was the rise of populist politics in Europe and America.

Continue reading

US Private Sector Job Growth’s Annual Pace Held Steady In July

Companies in the US added a moderate 170,000 employees to their ranks in July (seasonally adjusted), according to this morning’s update from the US Labor Department. The gain was well below June’s upwardly revised 234,000 increase but the latest rise represents a middling increase vs. recent history. Looking through the monthly noise paints a brighter picture by suggesting that the labor market’s expansion is ongoing and steady.

Continue reading

Research Review | 3 August 2018 | Sustainable (ESG) Investing

Does ESG Matter for Asset Allocation?

Joachim Klement (Fidante Partners)

July 12, 2018

The integration of ESG [environmental, social and governance] factors into the investment process is increasingly becoming mainstream for institutional investors. However, investors struggle with how to incorporate ESG criteria into their top-down asset allocation decisions.

In this report we show how ESG criteria can be systematically and consistently integrated into the asset allocation process. Our approach can be used for almost any multi-asset portfolio without materially reducing return expectations or increasing portfolio risk.

Continue reading

Macro Briefing: 3 August 2018

U.S. Sec. of State: N. Korea’s efforts to denuclearize fall short of pledge: Reuters

Analysts are upbeat about today’s employment report for July: MarketWatch

Eurozone Composite PMI: economic growth slowed at start of Q3: IHS Markit

Apple’s market value crosses $1 trillion mark: USA Today

The rise of giant companies dominates US economy: NY Times

Bank of England lifted interest rates to 0.75%, highest since 2009: BBC

Jobless claims in US up slightly but still near record low: Reuters

US job cuts fell to the lowest level of the year in July: CG&S

Factory orders in US up for second month in June: CNBC

These exporting areas of world economy at highest risk for climate change: Axios

Risk Premia Forecasts: Major Asset Classes | 2 August 2018

The expected risk premium for the Global Market Index (GMI) edged higher in July, inching up to an annualized 4.9% — slightly above the previous month’s estimate. The projected return over the “risk-free” rate is a long-run estimate for GMI, an unmanaged market-value-weighted portfolio that holds all the major asset classes.

Continue reading