Securitized real estate securities in the US posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products. During a week a mixed results for global markets overall, the strong advance in real estate investment trusts (REITs) is a conspicuous upside outlier.

Continue reading

Monthly Archives: August 2018

Macro Briefing: 20 August 2018

This week’s US-China trade talks face challenges: CNBC

White house rejects Turkey’s offer for releasing pastor: WSJ

US Sec. of State cites possible ceasefire in Afghanistan: Politico

Taiwan president’s US visit angers China: NY Times

China using Iranian tankers to sidestep US sanctions on Iran: Reuters

Eight years of bailouts for Greece officially end today: CNN

Trump administration says conserving oil is no longer economically crucial: PBS

US Leading Economic Index points to solid growth for rest of year: CB

Strong economic activity powered corporate results in Q2: CNBC

Politics shapes views on economy going into mid-term elections: NY Times

US consumer sentiment fell to 11-month low in August: MarketWatch

Book Bits | 18 August 2018

● Land of the Fee: Hidden Costs and the Decline of the American Middle Class

By Devin Fergus

Summary via publisher (Oxford University Press)

Politicians, economists, and the media have put forth no shortage of explanations for the mounting problem of wealth inequality – a loss of working class jobs, a rise in finance-driven speculative capitalism, and a surge of tax policy decisions that benefit the ultra-rich, among others. While these arguments focus on the macro problems that contribute to growing inequality, they overlook one innocuous but substantial contributor to the widening divide: the explosion of fees accompanying virtually every transaction that people make. As Devin Fergus shows in Land of the Fee, these perfectly legal fees are buried deep within the verbose agreements between vendors and consumers – agreements that few people fully read or comprehend. The end effect, Fergus argues, is a massive transfer of wealth from the many to the few: large banking corporations, airlines, corporate hotel chains, and other entities of vast wealth.

Continue reading

QuantStrat TradeR Blog Reviews The Capital Spectator’s R Book

The estimable Ilya Kipnis at QuantStrat TradeR just published a very generous review of my recently published book on R — Quantitative Investment Portfolio Analytics In R: An Introduction To R For Modeling Portfolio Risk and Return

. The kind words are all the more gratifying when you consider that Kipnis, an independent consultant, is an authority on R coding as it relates to investment and trading analytics, as his many blog posts over the years demonstrate.

US Business Cycle Risk Report | 17 August 2018

Geopolitical risk is rising, but if there’s a price to pay in terms of sharply softer economic growth or worse for the US it’s not showing up in the numbers, at least not yet. With most of the July data published the macro profile remains upbeat and near-term projections suggest the positive trend will persist.

Continue reading

Macro Briefing: 17 August 2018

US Treasury Sec: Turkey faces more sanctions without pastor’s release: Bloomberg

China’s weak currency will be in focus in trade talks with US: CNBC

US Attorney General issues order to accelerate deportations: Reuters

China “training for strikes” on US targets, Pentagon report warns: BBC

Walmart reports best sales growth in a decade: CNN

Is US economic growth peaking? MarketWatch

US housing starts edged up in July but fell vs. year-earlier level: MW

Jobless claims fell last week, near post-recession low: WSJ

Philly Fed Mfg Index slumps in August to lowest level in 21 months: MW

Fed Remains On Track To Raise Rates Again In September

The recent turmoil in emerging markets hasn’t deterred the Federal Reserve from lifting interest rates at next month’s monetary policy meeting, according to analysts, Fed funds futures, and the recent trend in inflation-adjusted base money supply.

Continue reading

Macro Briefing: 16 August 2018

Senior Chinese officials to visit US for trade talks: Politico

Trump revokes former CIA Director Brennan’s security clearance: The Hill

US retail spending up more than expected in July: LA Times

Growth in US industrial output slowed sharply in July: CNBC

NY Fed Mfg Index posted solid gain for August: NY Fed

Business inflation expectations remain steady at 2.1% for Aug: Atlanta Fed

US builder confidence in Aug fell to lowest level in 2018: HousingWire

Productivity in US jumped to highest level in over 3 years in Q2: MW

Benchmark 10yr Treasury yield trending lower again, dipping to one-month low:

An Analyst Says Asset Allocation “In Serious Decline.” Really?

A Forbes columnist last week warned that asset allocation is falling on hard times. Rob Isbitts, founder and chief investment officer of Sungarden Investment Research, writes that “if you started investing in a typical asset allocation strategy any time since mid-2012, your returns have been progressively worse.” Using a set of BlackRock asset allocation ETFs as evidence, he says the standard asset allocation strategy has “lost its mojo.”

Continue reading

Macro Briefing: 15 August 2018

A hodgepodge of results for Dems and GOP in Tuesday’s primaries: Politico

Turkey raises tariffs on US imports as banking authorities support lira: Reuters

US warns of more tariffs for Turkey if pastor isn’t freed: Reuters

Democrats and Republicans shunning capitalism: Yahoo Finance

Are US trade tariffs on China part of a grander strategic policy? SCMP

Be wary of using one indicator for factor analysis: ETF.com

US stock market rise is close to longest bull market on record: LPL

US small business optimism in July edged up to 2nd highest level in 45 years: NFIB

Active management’s death has been greatly exaggerated: Barry Ritholtz

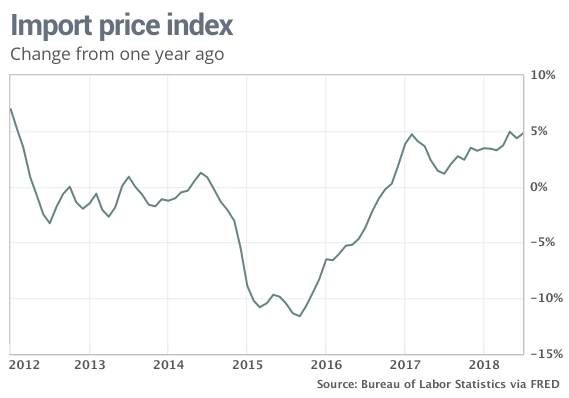

US y-o-y import prices tick up to 6-1/2-year high in July: MarketWatch