Trump will announce decision on Iran nuclear deal today: Reuters

Iran’s currency near record lows ahead of Trump decision on nuclear deal: Reuters

More Venezuelan soldiers are deserting ahead of presidential election: Bloomberg

China’s trade surplus with US rises more than expected in April: CNBC

US consumer credit growth slowed in March to 6-month low: MW

Fed chairman: markets expect gradual rate hikes: Bloomberg

White House looking for bigger-than-expected spending cuts: Fiscal Times

Former Fed governor: the Fed should consider its own cryptocurrency: NY Times

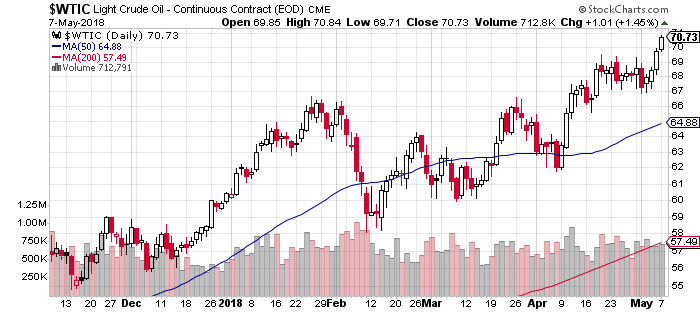

US oil prices top $70 on Monday for first time since Nov 2017: Reuters

Monthly Archives: May 2018

US Real Estate Investment Trusts Top Markets For Second Week

Real estate investment trusts (REITs) in the US again posted the biggest weekly gain among the major asset classes, based on a set of exchange-traded products. The ongoing bounce for REITs contrasts with a generally down week for most markets over the five trading days through May 4.

Continue reading

Macro Briefing: 7 May 2018

Lava flows from Hawaii’s volcano eruption intensify: ABC

Iran and Israel issue warnings as deadline nears for Iran nuclear deal: NY Times

N. Korea says Trump’s claims about upcoming summit are “misleading”: CBS

Oil prices rise to 3-1/2 year high: MarketWatch

Nafta trade talks face critical juncture this week: Reuters

Democrats under pressure to focus on economy: The Hill

US job growth rebounded in April after sluggish rise in March: Reuters

Germany’s manufacturing orders fell for 3rd month in March: MarketWatch

California to become first state to require solar panels in new homes: Tech Times

California’s economy now world’s 5th largest, ahead of UK: LA Times

PMI survey data shows global economic activity ticked up in April: IHS Markit

Book Bits | 5 May 2018

● Collusion: How Central Bankers Rigged the World

By Nomi Prins

Interview with author via KALW

Prins argues that since the global financial crisis, big banks have massively profited from access to cheap money. She writes, “No significant regulations have been introduced to fix the structural problems behind the last financial crisis. Banks and the markets have been subsidized by conjured-money policy.” She calls it a heist that enables the most powerful banks and central bankers to run the world. How can this rigged system be dismantled?

Continue reading

April Employment Growth Picks Up After A Weak Gain In March

US companies added 168,000 workers in April, moderately more than the 138,000 gain in the previous month, which marked the softest increase since last September, the Labor Department reports. The advance kept the annual trend steady, which suggests that moderate growth for the labor market overall remains a reasonable forecast for the near term.

Continue reading

Research Review | 4 May 2018 | Equity Risk Premium

The Equity Risk Premium in 2018

John R. Graham and Campbell R. Harvey (Duke University)

March 27, 2018

We analyze the history of the equity risk premium from surveys of U.S. Chief Financial Officers (CFOs) conducted every quarter from June 2000 to December 2017. The risk premium is the expected 10-year S&P 500 return relative to a 10-year U.S. Treasury bond yield. The average risk premium is 4.42% and is somewhat higher than the average observed over the past 18 years. We also provide results on the risk premium disagreement among respondents as well as asymmetry or skewness of risk premium estimates. We also link our risk premium results to survey-based measures of the weighted average cost of capital and investment hurdle rates. The hurdle rates are significantly higher than the cost of capital implied by the market risk premium estimates.

Continue reading

Macro Briefing: 4 May 2018

US-China trade talks end with no deal: Bloomberg

US warns China over militarization of the South China Sea: Reuters

US job cuts fall 40% in April after surging in March: CG&C

Jobless claims in US rise after falling to lowest level since 1969: MW

Worker productivity in US rose at sluggish rate in Q1: WaPo

US Services PMI ticks up to 3-mo high in April, signaling solid growth: IHS Markit

ISM Mfg Index: growth downshifts in US services sector in April: CNBC

Solid pace of US factory orders points to ongoing mfg growth: Freight Waves

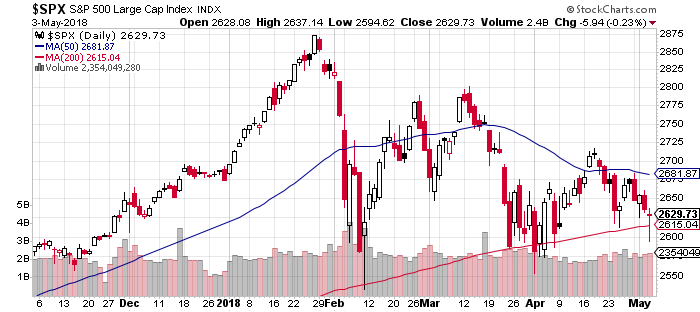

S&P 500 tests 200-day moving average intra-day and then bounces higher:

Is A New Bear Market Lurking For The US Stock Market?

A wobbly equity market, expectations for higher interest rates and weaker economic growth in the first quarter have inspired some pundits to claim that bear-market risk for stocks has spiked higher in recent weeks. Perhaps, but there’s still room for debate, based on a review of key indicators.

Continue reading

Macro Briefing: 3 May 2018

Fed leaves rates unchanged but remains on track for more hikes: WSJ

Fed appears to be tolerant of higher inflation: Bloomberg

Trade talks between US and China set to begin in Beijing: Reuters

Trump will likely withdraw from Iran nuclear deal: Reuters

Giuliani says Trump paid hush money: NY Times

Eurozone inflation data surprises with softer rise in April: Reuters

ADP: US private employment growth slowed in April but remained solid: MW

Uptick in global mfg PMI inspires forecasts of stronger global growth: Bloomberg

Will The Fed Offer Guidance Today On Inflation Expectations?

The Federal Reserve is expected to leave interest rates unchanged in today’s monetary policy announcement, but firmer inflation in recent months lays the foundation for hikes in the months ahead.

Continue reading