US companies continued to add workers at a moderately healthy pace in May, according to yesterday’s update of the ADP Employment Report. Private employment increased 178,000 last month, slightly above the 163,000 gain in April. Meanwhile, the one-year gain held at roughly 1.8% — a pace that’s been endured so far in 2018.

Continue reading

Monthly Archives: May 2018

Macro Briefing: 31 May 2018

Secretary of State Pompeo dines with top N. Korean official in NY: CBS

Trump set to impose steel, aluminum tariffs on Europe on Thursday: Reuters

Federal Reserve takes steps to loosen Volcker rule on big banks: The Hill

US Q1 GDP growth revised down to 2.2% from 2.3%: MarketWatch

Higher energy prices trigger sharp rise in Eurozone inflation in May: AP

Fed’s Beige Book: US economy grew moderately as manufacturing picks up: WSJ

Economists raise expectations for US Q2 GDP growth: Bloomberg

US trade deficit narrowed in April to six-month low: Bloomberg

ADP: US private-sector job growth picks up to 178,000 gain in May: USA Today

Will Italy’s Political Turmoil Derail The Fed’s Rate-Hike Plans?

Italy’s political crisis triggered a risk-off event yesterday that sharply cut US Treasury yields. The 2-year rate fell to 2.32%, the lowest in more than a month as the benchmark 10-year yield fell to a two-month low of 2.77%.

Continue reading

Macro Briefing: 30 May 2018

Italy’s political crisis poses risks for the global economy: NY Times

Asian stocks extend losses after sharp drop in US equities: Reuters

Trump announces US moving ahead with trade tariffs on China: New York Mag

China says it will respond to ‘reckless’ US trade threats: Reuters

US home prices rose a solid 6.8% in March from year-earlier level: USA Today

Texas factory activity increased in May, reaching a 12-year high: Bond Buyer

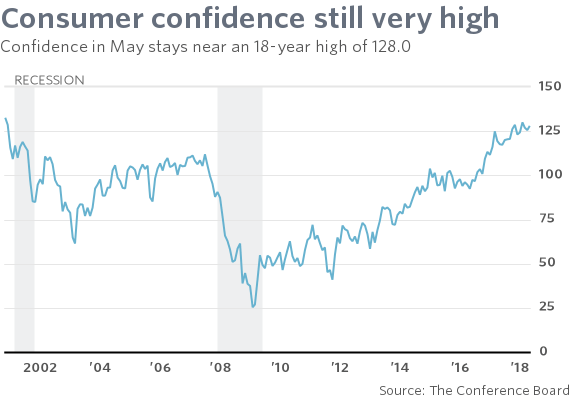

US Consumer Confidence Index up in May, close to 18-year high: MarketWatch

Momentum Continues To Lead For US Equity Factor Returns

The US stock market has been on a roller coaster for much of 2018, but the surge in volatility hasn’t derailed momentum’s leadership for US equity factors, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 29 May 2018

N. Korea sends top aide to US for pre-summit talks: Bloomberg

Trump presses aides to move ahead with US-N. Korea summit: CNN

Russia says reports of US troops in Poland could bring “counteraction”: Newsweek

Italy’s political crisis triggers heavy selling in European markets: Reuters

OECD chief: global growth still needs fiscal-policy support: CNBC

NY Fed’s nowcast for Q2 GDP growth ticks down to still-solid 3.01% rise: NY Fed

Oil prices set for longest run of losses since February: Bloomberg

German 10-year government bond yield falls to new 2018 low:

Remember The Veterans

It’s Memorial Day in the US — a day to honor the men and women in the military who paid the ultimate price to serve and defend their country. It’s also the perfect day for Americans to honor the wounded vets who made it home. Please consider a donation to your favorite charity that supports veterans or:

It’s Memorial Day in the US — a day to honor the men and women in the military who paid the ultimate price to serve and defend their country. It’s also the perfect day for Americans to honor the wounded vets who made it home. Please consider a donation to your favorite charity that supports veterans or:

Disabled American Veterans

Paralyzed Veterans of America

To all the American Vets… thank you for your service!

US Real Estate Shares Rose Sharply Last Week

Real estate investment trusts (REITs) posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 28 May 2018

S. Korea calls for more talks with North; US planning Trump-Kim meeting: Reuters

Political crisis erupts in Italy amid calls for impeaching president: BBC

Italy names former IMF official as interim prime minister: Reuters

China sends ships to confront US Navy near disputed islands in S. China Sea: Time

China-Iran summit planned to avoid disruption amid nuclear deal doubt: Reuters

US durable goods orders fell in Apr, mainly due to drop in aircraft orders: MW

US consumer sentiment holds steady in May at elevated level: WSJ

Oil prices tumble on concerns of rising supply: MW

World trade volume: sharp slowdown in annual growth to 2.1% in March: CPB

Book Bits | 26 May 2018

● Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State

By Paul Tucker

Review via Reuters Breakingviews

How much influence should central bankers wield in a democracy? That’s the question Paul Tucker ponders in “Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State”… Central bankers are being sucked into deeply political decisions over how the government is financed, and how income is distributed. Yet these “overmighty citizens” have no electoral legitimacy. At the same time, frustrated voters in the West have turned to demagogues. As a result, central bank independence is under threat.

Continue reading