Facebook co-founder Mark Zuckerberg endured five hours of questions in the US Senate on Tuesday, at one point conceding what’s probably inevitable: tighter government oversight of social media in general and his firm in particular. “My position is not that there should be no regulation,” he said, trying to get in front of what appears to be a rising political tide of change. “I think the real question as the internet becomes more important in people’s lives is what is the right regulation.”

Continue reading

Monthly Archives: April 2018

Macro Briefing: 11 April 2018

Trump consider robust military strike against Syria: NY Times

Air traffic control agency warns of possible missile strikes into Syria: Reuters

Russia vetoes US resolution that condemns suspected gas attack in Syria: AP

Trump at crisis point with Mueller investigation: The Hill

China outlines plan for more foreign investment in its financial sector: Reuters

Facebook’s Zukerberg endures 5 hours of Congressional grilling: NY Times

Business groups band together to fight Trump’s trade tariffs: Bloomberg

Wholesale inflation in US increased more than expected in March: Reuters

US wholesale trade inventories surged 1% in Feb, a plus for Q1 GDP: MarketWatch

US small business optimism slips, but still close to record high: MarketWatch

US consumer watchdog agency forgoes enforcement actions under Trump: AP

Atlanta Fed’s GDPNow estimate of US Q1 GDP growth slips to 2.0%: Atlanta Fed

Consumer Inflation Expected To Rise Further Over Fed’s 2% Target

Chicago Fed President Charles Evans has been one of the central bank’s doves and so it’s notable that he’s now talking like a hawk, at least on the margins. In a speech on Friday, he said the Fed’s goal of 2% inflation remains on track, which means that “continuing our slow, gradual increases will be appropriate to get us to the point where monetary policy isn’t really providing more lift to the economy.”

Continue reading

Macro Briefing: 10 April 2018

Trump says US has “a lot of options militarily” for possible Syria strike: Politico

Trump lawyer Cohen under scrutiny for possible bank fraud: WaPo

China’s president discusses plans to further open country’s economy: CNBC

Investors react positive to China president’s economic speech: Bloomberg

GOP tax plan expected to raise growth and boost budget deficit: CNBC

Global debt reached an all-time high of $237 trillion in 2017: IIF

Iran warns that US will “regret” ditching nuclear deal: Reuters

New US sanctions threaten Russia’s ranking as a leading emerging market: FT

GOP tax cuts at federal level triggering wave of tax hikes in US states: Politico

US deficit expected to rise above $1 trillion in 2020: Bloomberg

Across-The-Board Losses For Asset Classes Last Week

All the major asset classes declined in April’s first week of trading, based on a set of exchange-traded products. The losses market the first broad sweep of weekly red ink for markets since early February.

Continue reading

Macro Briefing: 9 April 2018

Syria, Russia say Israel launched missile strike on Syrian air base Wall St Journal

Hungary’s nationalist prime minister wins third term in power: Reuters

Trump predicts China will blink first in trade dispute with US: Bloomberg

Trump administration officials soften tone on trade dispute with China: WSJ

N. Korea says it will discuss denuclearization: NY Times

Kudlow: White House considering plans to undo parts of spending bill: Wash Exam

US hiring growth slowed sharply in March: Bloomberg

German industrial production fell by the most in over 2 years in Feb: Reuters

Forward curve for 1 month overnight indexed swap rate inverts: Bloomberg

Many US state govts struggling with weak revenue growth: The Economist

Book Bits | 7 April 2018

● Last Resort: The Financial Crisis and the Future of Bailouts

By Eric A. Posner

Summary via publisher (University of Chicago Press)

The bailouts during the recent financial crisis enraged the public. They felt unfair—and counterproductive: people who take risks must be allowed to fail. If we reward firms that make irresponsible investments, costing taxpayers billions of dollars, aren’t we encouraging them to continue to act irresponsibly, setting the stage for future crises? And beyond the ethics of it was the question of whether the government even had the authority to bail out failing firms like Bear Stearns and AIG. The answer, according to Eric A. Posner, is no. The federal government freely and frequently violated the law with the bailouts—but it did so in the public interest.

Continue reading

US Job Growth Slows In March, But Annual Pace Holds Steady

Companies in the US hired substantially fewer workers in March than economists expected, according to this morning’s monthly update from the Labor Department. But the sharp deceleration in growth looks like monthly noise, based on the steady moderate pace for the year-over-year increase in private employment.

Continue reading

Spike In Market Volatility Dents Momentum Factor’s Dominance

Momentum-based strategies have led the factor-investing horse race for US equities in recent history, but the latest surge in market volatility may be its undoing. For the trailing 30-day period, the momentum factor’s modest loss leaves it in last place, based on a set of ETFs tracking key US-based factor strategies. By contrast, the best-performing factor strategy for this time window – core small-cap stocks – has managed to post a modest increase.

Continue reading

Macro Briefing: 6 April 2018

Trump considers an additional $100 billion in tariffs on China’s goods: Retuers

China vows to counter US protectionism “to the end, and at any cost”: Bloomberg

ECB board member says trade fears already pinching economy: Reuters

Fed chair Powell expected to defend gradual rate hikes: MarketWatch

Jobless claims in US jumped to three-month high last week: MarketWatch

US firms announce sharply higher number of job cuts in March: CNBC

US trade deficit near 10-year high in February: Wall St Journal

13 big mutual fund firms agree to rstart reporting active share data: Reuters

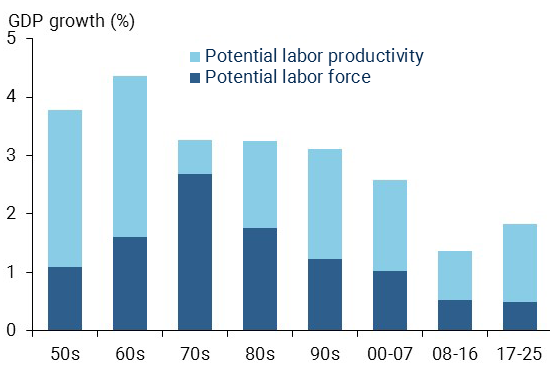

Slower labor force growth is a headwind for US GDP growth: SF Federal Reserve