Drug-resistant typhoid epidemic becoming “global concern”: Ars Technica

S. Korea says it’s discussing peace deal with N. Korea: Reuters

CIA chief met with N. Korea’s Kim Jong-un: NY Times

China’s President Xi planning to visit North Korea, says Chinese official: CNN

Republicans pushing for 2nd tax vote ahead of mid-term elections: Reuters

US housing starts rebound in March, up 10.9% vs. year-earlier level: MarketWatch

Industrial output in US rose more than expected in March: RTT

Analyst says VIX index signaling US stocks will continue to rebound: MarketWatch

BofA: Money managers’ global equity allocations fell to 18-mo low in April: P&I

Over half of next year’s nearly $1 trillion federal deficit due to new laws: CRFB

Monthly Archives: April 2018

Treasury Yield Curve Flattens As Retail Spending Rebounds

The difference between the 10-year and 2-year Treasury rates narrowed to 47 44 basis points on Monday (April 16) – the smallest gap since late-2007. The last time this widely followed spread was this close to zero the US economy was close to a recession. Is this indicator flashing a similar warning today? No, according to a broad reading of the economic data, which reflects a healthy trend. The question is whether the narrowing yield spread is still a reliable late-cycle warning that the macro profile will weaken in the months ahead?

Continue reading

Macro Briefing: 17 April 2018

Trump blocks Russia sanctions announced by his UN ambassador: Politico

Japan’s Abe and Trump will discuss N. Korea on Tuesday: Reuters

US retail sales rose sharply in March after 3 monthly declines: MarketWatch

NY Fed Mfg Index growth eases in April; 6-mo outlook plunges: NY Fed

China’s holdings of US Treasuries increased in February: Reuters

China’s economy grew 6.8% y-o-y in Q1, matching Q4’s pace: RTT

China says it will end foreign ownership caps on car firms by 2022: Reuters

US business inventories rose 0.6% in Feb, in line with expectations: RTT

US home builder sentiment strong but edges down in April: HousingWire

Japanese gov’t maintains moderate growth outlook for economy: MNI

Treasury 10yr/2yr yield curve continues to flatten, easing to 44 basis points:

Commodities Surged Last Week, Leading Most Markets Higher

Most of the major asset classes scored gains last week, with broadly defined commodities leading the way, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 16 April 2018

Russia’s Putin: another Western strike on Syria risks global “chaos”: Reuters

US ambassador to UN: new Russia sanctions to be announced soon: CNN

Missile strikes on Syria could strengthen Trump’s hand in N. Korea talks: CNBC

Former FBI Director Comey says Trump unfit to lead nation: The Hill

Is a war brewing for Israel and Iran? NY Times

China and Japan agree that a trade war would hurt global economy: Reuters

Study finds asset managers still “very dependent” on consultants: Inst Inv

US Consumer Sentiment Index falls in April to 3-month low: MarketWatch

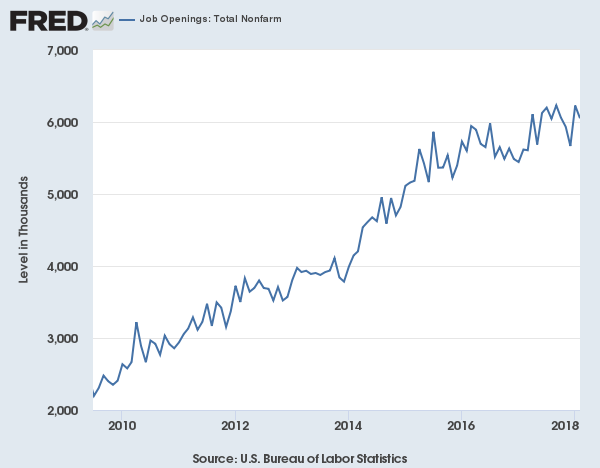

Job openings in US drop in Feb but still near record high: Bloomberg

Book Bits | 14 April 2018

● Can Democracy Survive Global Capitalism?

By Robert Kuttner

Summary via publisher (W.W. Norton)

One of our leading social critics recounts capitalism’s finest hour, and shows us how we might achieve it once again. In the past few decades, the wages of most workers have stagnated, even as productivity increased. Social supports have been cut, while corporations have achieved record profits. Downward mobility has produced political backlash. What is going on? Can Democracy Survive Global Capitalism? argues that neither trade nor immigration nor technological change is responsible for the harm to workers’ prospects. According to Robert Kuttner, global capitalism is to blame. By limiting workers’ rights, liberating bankers, allowing corporations to evade taxation, and preventing nations from assuring economic security, raw capitalism strikes at the very foundation of a healthy democracy.

Continue reading

How Long Will The Stock Market’s Momentum Party Last?

Is a death cross near? Yes, according to David Rosenberg, chief economist and strategist at Gluskin Sheff. Citing a laundry list of reasons for this year’s revival in market volatility, he told CNBC this week that the S&P 500’s 50-day average may soon slip below its 200-day average – a so-called death cross that market technicians say would signal a bearish shift for the market outlook.

Continue reading

Macro Briefing: 13 April 2018

Defense Secretary urges caution on possible military strike on Syrian: NY Times

Trump says US may rejoin Pacific trade pact: Reuters

Russian lawmakers propose ban on list of US imports: Reuters

US jobless claims drop by 9000, close to 45-year low: MarketWatch

Import price index for US was flat in March: MarketWatch

Weak foreign demand for Treasuries raises concerns on rate outlook: Bloomberg

Q1 earnings season starts on Friday with releases from banks: CNBC

IEA: OPEC’s plan to eliminate oil glut succeeds: Bloomberg

Eurozone industrial output fell for a third month in Feb: RTT

Pension crisis for state governments deepens: Pew Charitable Trusts

California to vote on breaking up into 3 states: Mercury News

Treasury Interest-Rate Spread Narrows To Lowest Level Since 2007

A widely followed measure of the Treasury yield curve has resumed its decline in recent days, dipping to its flattest level in more than a decade. The narrowing between long and short rates is generally considered a signal of weaker economic activity in the future. An inversion of the curve – short rates above long rates – would be a warning that a new US recession was brewing.

Continue reading

Macro Briefing: 12 April 2018

West considers Syria attack, which risks confrontation with Russia: Reuters

House Speaker to retire, scrambling GOP plans for mid-term elections: NY Times

Consumer inflation’s annual pace ticks up to one-year high: 2.4%: MarketWatch

Oil jumps to 3-year high on rising Mideast tensions: MarketWatch

Fed: trade-war risk outweighs inflation for setting monetary policy: Bloomberg

Facebook’s Zuckerberg faced tougher questions on 2nd day of testimony: c|net

All Fed policymakers say US economy is strengthening via FOMC minutes: Reuters

US federal deficit widened in first half of fiscal year: WSJ

CBO: US federal budget deficit on track to reach nearly 100% of GDP by 2028: CBO

Business inflation outlook edges up to 2.3% y-o-y, highest since 2011: Atlanta Fed