N. Korea’s offer to suspend nuclear tests is greeted with suspicion: Reuters

Gary Cohn, Trump’s top economic adviser, will resign: NY Times

Some analysts see deeper chaos in White House after Cohn’s departure: Politico

US weighs new limits on Chinese imports and investments: Bloomberg

The US-China rivalry is increasingly about technology: NY Times

Which US industries, companies will take a hit in a trade war? CBS

US factory orders declined in Jan–first monthly slide in 6 months: Reuters

The rise in China’s debt boom is almost without precedent: FT Alphaville

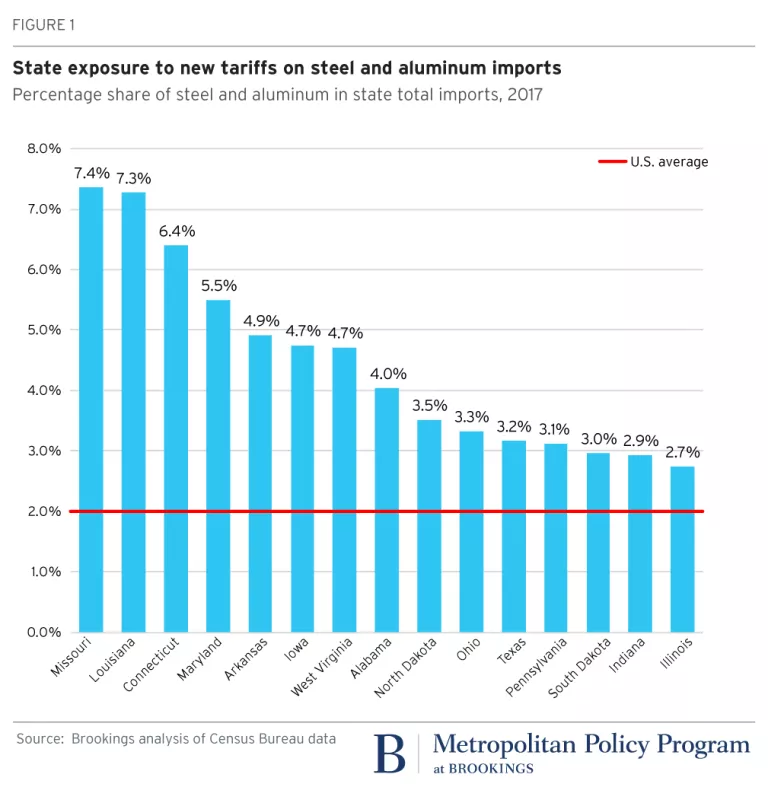

Ranking the potential blowback from Trump’s tariffs on US states: Brookings

Monthly Archives: March 2018

Momentum Factor Still Leads After Surge In Market Volatility

The US stock market this year has taken investors on a white-knuckled ride, but the momentum factor’s performance leadership has remained a constant in the US equity factor space, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 6 March 2018

EU proposes 25% retaliatory tariff on US goods: Bloomberg

Republican lawmakers pressure Trump to abandon trade tariffs: The Hill

N. Korea announces “agreement” with S. Korea to advance dialogue: Reuters

Washington is first state to pass net neutrality protections: Medium

ISM Non-Mfg Index edges lower in Feb: RTT

PMI: US services sector econ activity accelerates to 6-mo high in Feb: IHS Markit

Critics bemoan Fidelity’s decision to raise equity risk in target date funds: Reuters

An aging rail tunnel into Manhattan is a key risk factor for US economy: Bloomberg

Global All-Industry Output Index ticks up to 41-month high in Feb: IHS Markit

Most Asset Classes Fell Last Week

Last week’s trading ended in the red for all but one of the major asset classes, based on a set of exchange-traded products. US inflation-linked Treasuries edged higher over the five trading days through Mar. 2 while losses weighed on everything else.

Continue reading

Macro Briefing: 5 March 2018

Populist uprising looms in Italy after Sunday’s parliamentary election: Reuters

South Korea’s envoys meet North Korea’s Kim Jong-un in Pyongyang: BBC

China worries are linked with US aircraft carrier visit to Vietnam: Time

Germany’s political gridlock ends as Merkel forms governing coalition: Time

IEA: US shale oil output will surge over next 5 years: Reuters

China sets 6.5% growth target: Bloomberg

US Consumer Sentiment Index eased in Feb to 2nd highest level in 14 years: MW

Krugman: new trade tariffs may lift US inflation rate: NY Times

Trillion-dollar-plus US budget deficits on the horizon for years to come: CRFB

Book Bits | 3 March 2018

● The Truth Machine: The Blockchain and the Future of Everything

By Michael J. Casey and Paul Vigna

Summary via publisher (St. Martin’s Press)

Big banks have grown bigger and more entrenched. Privacy exists only until the next hack. Credit card fraud is a fact of life. Many of the “legacy systems” once designed to make our lives easier and our economy more efficient are no longer up to the task. Yet there is a way past all this—a new kind of operating system with the potential to revolutionize vast swaths of our economy: the blockchain. In The Truth Machine, Michael J. Casey and Paul Vigna demystify the blockchain and explain why it can restore personal control over our data, assets, and identities; grant billions of excluded people access to the global economy; and shift the balance of power to revive society’s faith in itself. They reveal the disruption it promises for industries including finance, tech, legal, and shipping.

Continue reading

Was There A Stock Market Bubble? Did It Burst?

It took longer than usual, but the priced-for-perfection bull run has taken a body blow in recent weeks. That’s good news for investors with relatively long time horizons since lower prices equate with higher expected returns. Meantime, with the benefit of hindsight, let’s consider how a pair of econometric tools have fared for monitoring bubble risk and bull/bear market regimes. The question before the house: Have these metrics provided any value for managing risk in an effort to cut through the noise and anticipate trouble based solely on the hard data? As a preview, I’ll argue “yes,” but with caveats.

Continue reading

Macro Briefing: 2 March 2018

Tariffs announced by President Trump trigger widespread criticism: Politico

Trump’s tariffs are seriously flawed from an economic perspective: The Atlantic

Worries about a new trade war reverberate in Asia: Reuters

Russia’s Putin claims a new weapon that exploits US vulnerabilities: NY Times

US jobless claims fell last week to lowest level since 1969: MarketWatch

Consumer spending edged higher as personal income soared in Jan: AP

ISM Mfg Index rose in Feb, close to 14-year high: RTT

US Mfg PMI slipped in Feb, but still close to 3-year high: IHS Markit

Construction spending in US was flat in January: Fox

Most Americans (70%) have a positive view of foreign trade: Gallup

Major Asset Classes | February 2018 | Performance Review

The winning streak hit a wall in February. For more than a year, global markets have been trending higher, in some cases with an unbroken run of monthly gains. But the party came to a full stop last month. For the first time in more than two years, all the major asset classes posted losses for the calendar month (except for cash, based on the S&P US T-Bill 0-3 Month Index, which edged up in February).

Continue reading

Macro Briefing: 1 March 2018

Trump tells lawmakers to pass new gun-control legislation: LA Times

Trump expected to impose tariffs on steel, aluminum imports today: Bloomberg

Are the buzzards circling over Trump’s infrastructure plan? Fiscal Times

US Q4:2017 GDP growth revised down slightly to 2.5%: The Hill

Pending Home Sales Index for US fell 4.7% in January: Reuters

Chicago PMI slumps to 6-month low for February: MarketWatch

Is a debt crisis brewing for the US? The Grumpy Economist

Larry Summers: The next recession could outlast 2008-09 slump: Bloomberg

US stock market’s 10-mo winning streak, longest since 1959, ended in Feb: CNBC

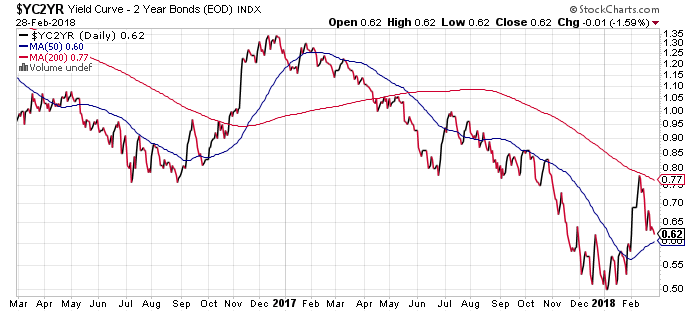

Yield curve continues to flatten after Fed Chair’s upbeat macro outlook: Reuters