House GOP ends Russia probe, finds no collusion: The Hill

Kudlow cited as favorite as new economic adviser to Trump: Bloomberg

Trump blocks Broadcom’s bid for Qualcomm, raising policy questions: Reuters

Republicans try to pull out win in today’s special House election in Penn: Time

UK expected to take “extensive measures” against Russia in poisoning case: BBC

US gov’t’s budget deficit in Feb is biggest in six years: Bloomberg

Boston Fed President: trade tariffs will have slight impact on economy: WaPo

Various measures of wages reflect muddled trend: NY Times

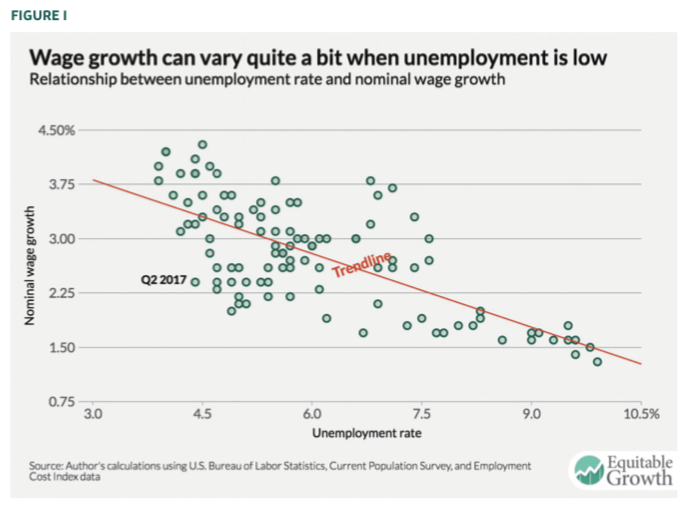

Wage growth can still vary quite a bit when jobless rate is low: WCEG

Monthly Archives: March 2018

US Stocks And REITs Top Last Week’s Winner’s List

Equities and real estate investment trusts (REITs) led most markets higher last week. Rebounding after a weak start to this month’s trading, nearly all the major asset classes posted gains in the first full week of March, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 12 March 2018

S. Korea: “no response” from N. Korea on talks with US: BBC

Kim Jong Un seeks a peace treaty with the US: Bloomberg

GOP makes final push to win special House election in Trump country: Politico

Putin’s Russia looks like a resurgent superpower: AP

China’s media defends official vote on removing presidential term limits: Reuters

BIS: China and Canada top list of economies at risk of banking crisis: Bloomberg

February jobs report reflects US labor market “in the sweet spot”: The Hill

Inventor of world wide web: large tech firms should be regulated: Guardian

How to invest in an aging bull market: USA Today

2-year Treasury yield ticks up, revisting 9-year high after strong jobs report: CNBC

Book Bits | 10 March 2018

● How Luck Happens: Using the Science of Luck to Transform Work, Love, and Life

By Janice Kaplan & Barnaby Marsh

Review via Kirkus Review

Seneca said it best: “Luck is what happens when preparation meets opportunity.” In this genial, upbeat overview, former Parade editor-in-chief Kaplan (The Gratitude Diaries: How a Year Looking on the Bright Side Can Transform Your Life, 2015, etc.) and risk-taking expert Marsh offer stories of those lucky moments in the lives of countless people. “To get lucky, you have to be in a place where opportunities are going to be around you,” said Marsh in one of the authors’ regular weekly conversations, which drive the narrative. Kaplan, a veteran journalist, is often out conducting interviews with famous and successful (and lucky) people, and she compares notes with Marsh, who provides insights from his own risk-related work (as a visiting researcher at Princeton and Harvard), as well as other findings in psychology, behavioral economics, and neuroscience.

Continue reading

US Private-Sector Employment Surged In February

Hiring at US companies accelerated in February, rising 287,000, the biggest monthly advance in nearly two years, according to the Labor Department. The faster increase translates into the strongest year-over-year rise since last August. The upbeat data gives the Federal Reserve another excuse to raise interest rates at the March 20-21 monetary policy meeting.

Continue reading

5 Questions For James Rosseau On Legal Shield’s Economic Indexes

Interest in alternative data sets has exploded in recent years as investors scour the world for relatively obscure numbers that may offer insights overlooked in standard economic releases. Some of these figures are genuinely useful for developing an edge in trading and portfolio design, but there’s plenty of junk, too. Accordingly, caveat emptor applies when it comes to new and often untested economic and financial indicators. One intriguing set of benchmarks that’s caught our attention comes by way of LegalShield, which sells legal services products. The firm also publishes several alternative economic data sets, including the LegalShield Real Estate Index. In early February, the company issued a press release that noted that this so-called leading indicator was predicting weakness for existing home sales. A few weeks later, the official January sales report did in fact reflect a decline, according to the National Association of Realtors. One accurate forecast could be luck, of course, but Legal Shield’s data is certainly worthy of a closer look as a potential source of deeper perspective on economic trends. For some context, The Capital Spectator posed five questions to James Rosseau, Legal Shield’s chief commercial officer, about the firm’s alternative economic benchmarks.

Continue reading

Macro Briefing: 9 March 2018

Trump agrees to meet with N. Korea’s Kim Jong Un: CNN

US-N. Korea summit may bring progress, but Asia also sees risks: NY Times

Trump OKs steel & aluminum tariffs, with exemptions for Mexico, Canada: Reuters

China warns of “strong” reaction to Trump’s tariffs: Fortune

GOP faces possibility of embarassing loss in special Penn. election: Bloomberg

European Central Bank takes another step away from stimulus: Reuters

Jobless claims in US jump after dipping to near-50-year low: MarketWatch

US employers announce 20% fewer job cuts in Feb vs. Jan: CG&C

US leads the world for imposing protectionist measures: Washington Post

Treasury Market’s Inflation Forecast At Highest Level In Five Years

The implied inflation outlook via 5-year Treasuries ticked up to the 2.10% mark this week for the first time since 2013. The increase matches the forecast for 10-year Notes, which have been estimating future inflation at or above the 2.10% mark since mid-February. The forecasts are based on the yield spreads for the nominal rates less their inflation-indexed counterparts.

Continue reading

Macro Briefing: 8 March 2018

Trump plans to impose steel tariffs despite threats of retaliation: Bloomberg

China has “necessary response” to new US trade tariffs: Guardian

Europe plans to retaliate if US imposes trade tariffs: NY Times

A wary US considers N. Korea’s offer of detente: Reuters

S. Korean officials head to US to brief Trump on N. Korea meeting: CNN

ADP: US private sector added a strong 235,000 jobs in Feb: USA Today

Consumer credit growth slows to four-month low: Bloomberg

US trade deficit widens to deepest gap in over 9 years: WSJ

Fed Beige Book: growth still positive as inflation picking up: MarketWatch

SEC says cryptocurrency exchanges must be registered: LA Times

US productivity flat in Q4 as pace of labor costs tick higher: MarketWatch

Fed funds futures continue to price in high probability of rate hike on Mar 21: CME

Profiling Asset Allocation Strategies With Style Analysis

In a series of recent articles I reviewed how style analysis can be used to replicate investment strategies and indexes using only historical returns (see here, here, and here). That’s a powerful application, but it only scratches the surface for productive uses of style analysis. What else can you do? Monitoring asset weights via a broad set of asset allocation funds is one possibility.

Continue reading