● Advice and Dissent: Why America Suffers When Economics and Politics Collide

By Alan Blinder

Interview with author via MarketPlace.org

When it comes to fiscal policy, it might seem like politicians and economists would work in lockstep. But in many cases, the politics come first — and that tends to lead to policies with not-so-sound data backing it up. And according to Princeton economics professor Alan Blinder, the fault might lie with economists as much as it does with politicians. In his new book, “Advice and Dissent: Why America Suffers When Politics and Economics Collide,” Blinder sets out to explore the troubled relationship between politicians and economists — and offer some solutions. Marketplace host Kai Ryssdal spoke with Blinder about his book.

Continue reading

Monthly Archives: March 2018

Research Review | 30 March 2018 | Portfolio Analysis

Factor Momentum

Robert D. Arnott (Research Affiliates), et al.

January 31, 2018

Past industry returns predict the cross section of industry returns, and this predictability is at its strongest at the one-month horizon (Moskowitz and Grinblatt 1999). We show that the cross section of factor returns shares this property, and that industry momentum stems from factor momentum. Factor momentum is transmitted into the cross section of industry returns via variation in industries’ factor loadings. Momentum in industry-neutral factors spans industry momentum; factor momentum is therefore not a by-product of industry momentum. Factor momentum is a pervasive property of all factors; we show that factor momentum can be captured by trading almost any set of factors. Factor momentum does not resolve the puzzle of momentum in individual stock returns; it significantly deepens this puzzle.

Continue reading

Macro Briefing: 30 March 2018

Russia orders 60 US diplomats out of country: Reuters

US consumer spending growth lagged income rise for 2nd month: Bloomberg

Consumer Sentiment Index for US advances to highest level since 2004: CNBC

Jobless claims in US fall to lowest level since 1973: MarketWatch

Sentiment reading for the Chicago PMI decreases to 12-mo low: Chicago PMI

Global mergers and acquisitions rise to record high in Q1: Reuters

VIX Index shows US equity market’s volatility nearly doubles in Q1: Bloomberg

Recent slide in big tech stocks has disproportionate effect on broad market: WSJ

10-Year/2-Year Treasury Yield Spread Falls Below 50 Basis Points

Two Federal Reserve officials have recently dismissed it. But a research note published this month by the San Francisco Fed paper advises that the yield curve is still a relevant economic signal for monitoring the business cycle. The disparate views within the central bank arise as the yield difference between the 10-year and 2-year rates continue to plumb new post-recession lows.

Continue reading

Macro Briefing: 29 March 2018

North and South Korea set date for talks at border: NY Times

China warns US not to open “Pandora’s box” of trade war: Reuters

German unemployment dips to record low in March: Bloomberg

Reports point to renewed oil-production cuts for OPEC: Reuters

US Q4 GDP growth revised up to 2.9% from 2.5%: MarketWatch

For 6th straight month, US trade deficit in goods widened in Feb: FreightWaves

Pending home sales in US increased 3.1% in February: HousingWire

Low risk is a predictor of financial crises: Vox EU

10yr-2yr Treasury yield spread falls below 50 basis points for first time since 2007:

Losses Dominate Year-To-Date Performances For US Equity Sectors

The revival of volatility in the US stock market this year has taken a toll on most equity sectors. Only two out of 11 sectors – consumer discretionary and technology – are posting year-to-date gains at the moment, based on a set of ETFs.

Continue reading

Macro Briefing: 28 March 2018

China: N. Korea’s Kim pledges to denuclearize and meet US officials: Reuters

US and South Korea revise trade deal: Reuters

US Consumer Confidence Index dips in Mar after 18yr high in Feb: CNBC

Home prices increase in all top-20 US cities in Jan: HousingWire

Mfg activity in Fed’s 5th district expands at slower pace in Mar: Richmond Fed

Eurozone economic sentiment falls to 6-month low in March: RTT

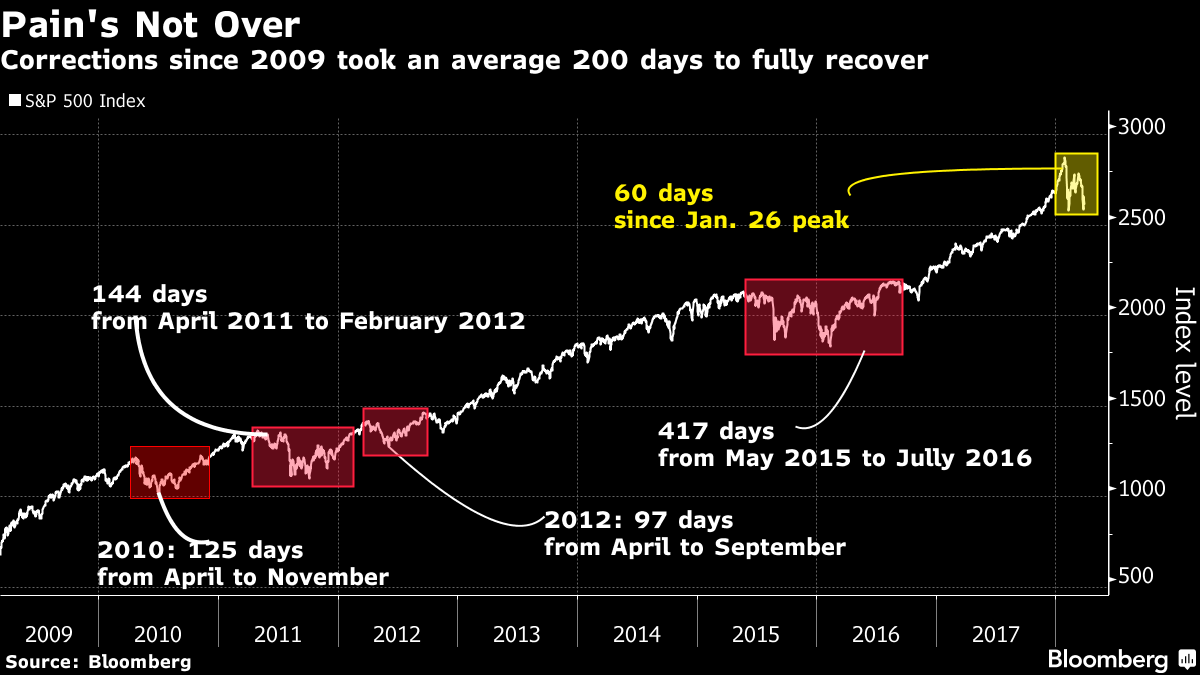

Analyst: stock mkt corrections since 2009 took avg 200 days to recover: Bloomberg

Another Fed Official Questions The Value Of Yield-Curve Signal

Cleveland Federal Reserve President Loretta Mester on Monday said that the recent flattening of the yield curve isn’t a sign that the US economy is weakening. Her comment follows a similar observation by Fed Chairman Jerome Powell, who suggested last week that low inflation in recent years has reduced the value of monitoring recession risk based on differences between long and short Treasury yields.

Continue reading

Macro Briefing: 27 March 2018

US and European Union plan to expel 100-plus Russian diplomats: Reuters

Russia vows retaliation for the mass explusion of its diplomats: CNN

N. Korea’s Kim reportedly visits China: Bloomberg

US and foreign stock markets rebound sharply as trade-war fears fade: BBC

Progressive groups press for a NY Fed chief who reflects diversity: NY Times

Cleveland Fed president supports rate hikes, says trade tensions are a risk: MW

Mfg growth slows in Dallas Fed’s district: Dallas Fed

US economic activity strengthens in February: Chicago Fed

Foreign Bond Markets Rallied Last Week On Trade-War Fears

Stock markets around the world tumbled last week over concerns about a possible trade war between the US and China. The risk-off posture generated renewed demand for bonds, particularly foreign bonds, which delivered the only gains last week for the major asset classes, based on a set of exchange-traded products.

Continue reading