● The Growth Delusion: Wealth, Poverty, and the Well-Being of Nations

By David Pilling

Review via Kirkus Reviews

“Growth for the sake of growth is the ideology of the cancer cell,” the environmental curmudgeon Edward Abbey was fond of saying. One suspects that Financial Times associate editor Pilling would endorse the view, though he puts things less stridently in this studied look at economic growth and its measures and mismeasures. “Economics,” he writes, “can present a distorted view of the world.” True enough, especially because a sine qua non of modern economics is gross domestic product, a calculation of all the things that happen in an economy. But as the author memorably notes, GDP is morally indifferent: it “likes pollution,” because money is spent to clean up environmental messes, and “likes crime because it is fond of large police forces and repairing broken windows.” War and catastrophe? No problem, from a GDP point of view. Pilling examines some of the ways that renegade economists have proposed to consider the true health of an economy, with all the externalities of economic activity taken into account, from various equations to happiness rankings to the Genuine Progress Index, one of the more interesting “measures of economic welfare.”

Continue reading

Monthly Archives: February 2018

US Hiring Rebounds In January But One-Year Trend Eases

Companies in the US added 196,000 workers in January, according to this morning’s report from the Labor Department. The gain beat expectations for a 172,000 increase, according to Econoday.com’s consensus forecast. The stronger print for the private sector isn’t really a surprise, considering the upbeat gain in the ADP Employment Report for January that was released earlier in the week. Today’s results reflect ongoing strength in the labor market, but the annual trend continues to signal that job growth, while still healthy, continues to decelerate.

Continue reading

Measuring Momentum’s Duration For The US Stock Market

Momentum-based investing strategies may be one of the most reliable drivers of alpha, but like all sources of excess return this factor premium waxes and wanes through time. Accordingly, deciding when to exit the trade (or reduce exposure to it) is no less critical than determining when to jump on the gravy train.

Continue reading

Macro Briefing: 2 February 2018

Analysts expect firmer job growth in today’s gov’t report for Dec: Reuters

GOP intel memo creates political firestorm in Washington: The Hill

US jobless claims fell to a low 230,000 last week: MarketWatch

US job cuts jump 38% in Jan vs. Dec but slip 2.8% in y-o-y change: CG&C

Severe winter weather pinches US car sales in January: USA Today

ISM Mfg Index for US slips in Jan but remains above 2017 avg: MarketWatch

US Mfg PMI in Jan signals strongest growth in three years: IHS Markit

US productivity ends 2017 with an unexpected decline in Q4: CFO

US workers rank health care as the country’s most critical issue: EBRI

Major Asset Classes | January 2018 | Performance Review

Stocks in emerging markets blasted out of the gate for the start of 2018, once again posting the strongest monthly gain for the major asset classes. Overall, most markets advanced in January, with three exceptions: US real estate trusts (REITs), which suffered the biggest loss last month, along with modest declines in US investment-grade bonds and inflation-indexed Treasuries.

Continue reading

Macro Briefing: 1 February 2018

Feud between Trump and FBI erupts into open battle: WaPo

White House seeks big cut in clean energy funding at Energy Dept: The Hill

Former Fed Chair Greenspan warns of bubbles in stocks and bonds: Bloomberg

Fed leaves rates unchange; expects higher inflation in 2018: Reuters

ADP: US private payrolls rose 234k in Dec, sharply above expectations: CNBC

Pending home sales rise 0.5%, the most since March: MarketWatch

Chicago PMI eased in Jan, pulling back from 9-year high: MarketWatch

US Employment Cost Index posts solid rise in 2017’s Q4: Reuters

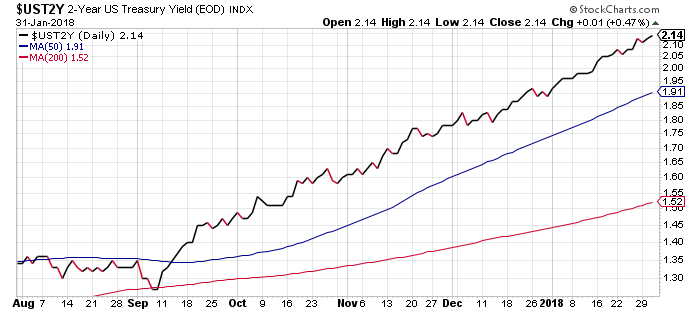

2-year Treasury yield’s bull streak continues, rising to 2.14%, a new 10yr high: