The US economic profile hit some turbulence in yesterday’s updates on retail sales and consumer inflation in January. The surprisingly soft spending data suggest that the macro trend has moderated in the kickoff to 2018 while pricing pressure can no longer be counted on to remain unusually low. Reviewing the latest reports in terms of annual changes raises fresh concerns for the months ahead, but it’s still premature read the updates as clear warning signs for the economy.

Continue reading

Monthly Archives: February 2018

Macro Briefing: 15 February 2018

Shooting at Florida high school claims 17 victims: Sun Sentinel

S. Africa’s president resigns, leaving a challenge for successor: Bloomberg

US consumer inflation up more than expected in January: Reuters

US retail spending was broadly lower in January: USA Today

Weak retail sales and higher inflation may overstate macro headwinds: Bloomberg

BofA Merrill Lynch survey: 70% of fund managers see trouble ahead: MarketWatch

Dec US business inventories increased more than expected: MarketWatch

Businesses’ Year-Ahead Inflation Expectations Hold Steady: Atlanta Fed

Revised data shows Eurozone Q4 GDP growth was strong at 0.6%: RTT

GDPNow estimate for US Q1 growth decelerates to 3.2%: Atlanta Fed

Treasury Market’s Inflation Outlook Dips From Four-Year High

The Treasury’s market’s implied inflation forecast last week reached the highest level since 2014, reflecting growing concern that pricing pressure is heating up. But the reflation trade has cooled this week, providing support for some analysts who argue that inflation fears are exaggerated. A reality check is due to arrive in today’s January update on the Consumer Price Index (CPI).

Continue reading

Macro Briefing: 14 February 2018

US forces killed dozens of Russian mercenaries in Syria last week: Bloomberg

US intelligence agencies: Russia may interfere in Nov election: Reuters

Cleveland Fed’s Mester could be the Fed’s next vice chair: WSJ

US small business optimism rose more than forecast in Jan: Bloomberg

Is Wall Street’s inflation fear overblown? MarketWatch

Japan’s current expansion is the longest since the 1980s: Reuters

California is booming, but is also preparing for the next recession: NY Times

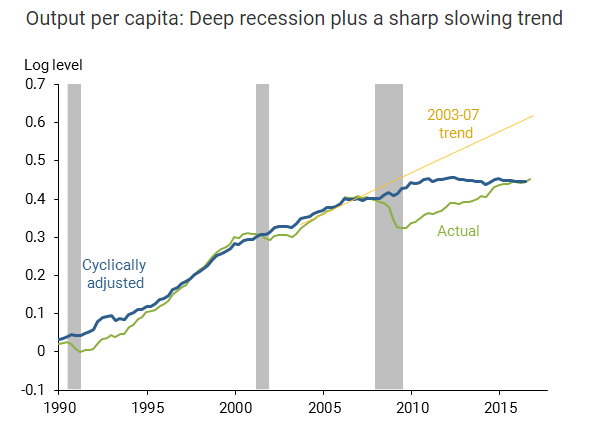

Weak recovery due to low productivity growth, falling labor participation: SF Fed

Despite Market Turmoil, Momentum Factor Still Dominates

The recent spike in stock market volatility has dented the momentum factor’s powerful bull run, but the strategy continues to reign supreme over its main competitors in the US equity factor space, based on a set of proxy ETFs.

Continue reading

Macro Briefing: 13 February 2018

Trump’s infrastructure plan receives mixed reviews in Congress: The Hill

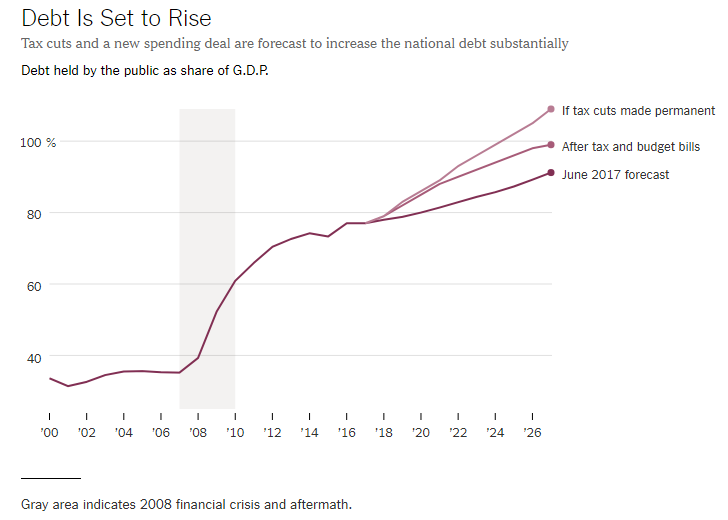

White House budget allows for hefty increases in federal deficit: NY Times

China may impose anti-dumping duties amid trade tensions: AP

Will US economic growth reduce the risk of bear market in stocks? Reuters

Turmoil in US markets and fiscal policy inspire broader int’l allocation: Reuters

US Treasury runs $49 bill. budget surplus, down slightly from year ago: MW

Goldman Sachs predicts 10-year Treasury will rise to 3.5%: Bloomberg

10-year yield continued rising on Monday, reaching 2.86% — a new 4-year high:

A Second Week Of Losses Weigh On All The Major Asset Classes

Red ink continued to spill across all the major asset classes last week, based on a set of exchange-traded products. The declines mark the second straight week of across-the-board selling.

Continue reading

Macro Briefing: 12 February 2018

Trump will roll out $1.5 trillion infrastructure plan on Monday: Politico

US budget director: rates may “spike” due to jump in budget deficit: Bloomberg

Vice President Pence raises possibility of US-North Korea talks: Reuters

White House staff roiled by domestic abuse allegations: The Hill

Is the UK considering a second Brexit vote? NY Times

US wholesale trade inventories rise more than expected in Dec: RTT

Capital Group Chairman and CEO: return of volatility is healthy: Capital Group

The era of big US deficits is back: NY Times

Book Bits | 10 February 2018

By Annie Duke

Summary via publisher (Portfolio)

Annie Duke, a former World Series of Poker champion turned business consultant, draws on examples from business, sports, politics, and (of course) poker to share tools anyone can use to embrace uncertainty and make better decisions. For most people, it’s difficult to say “I’m not sure” in a world that values and, even, rewards the appearance of certainty. But professional poker players are comfortable with the fact that great decisions don’t always lead to great outcomes and bad decisions don’t always lead to bad outcomes.

Continue reading

Is It A Bear Market Yet?

The latest plunge in the US stock market left the S&P 500’s drawdown at a bit more than 10%. That’s the amount of red ink that brings usually out the “correction” label. The latest slide has also inspired fresh chatter about the possibility that a bear market is near, which is widely defined as a drop of 20%-plus.

Continue reading