Jerome Powell, the newly installed chairman of the Federal Reserve, advised in his public debut as head of the central bank that “there’s always a risk of a recession at any point in time, but I don’t see it as at all high at the moment.” Instead, he told the House Financial Services Committee that “I would expect the next two years on the current path to be good years for the economy.”

Continue reading

Monthly Archives: February 2018

Macro Briefing: 28 February 2018

UN report: N. Korea ‘providing materials’ for Syria chemical weapons: BBC

Fed Chair Powell hints at more than 3 rate hikes this year: CNBC

Global stocks continue to fall after Powell’s comments: Bloomberg

Can the low jobless rate in US continue to fall? No one knows: NY Times

US durable goods orders fell 3.7% in Jan and biz inv slumped again: MW

US Trade deficit widens in Jan, hinting at more pressure on Q1 GDP: MW

GDPNow estimate of US Q1 GDP growth drops to 2.6%: Atlanta Fed

Wholesale inventories for Jan rise 0.4% in US: CNBC

US house prices still rising, but signs of softer pace emerging: HousingWire

Richmond Fed Mfg Index rises to 2nd highest level on record: Bond Buyer

How did low-vol strategies fare in recent market turbulence? Wealth Mgt

Treasury yields rise after Fed chair’s testimony in House: Reuters

Modest Pickup In Growth Expected For US GDP In Q1

The median estimate for US GDP growth in the first quarter is on track for a modest acceleration, according to the median of several forecasts compiled by The Capital Spectator. If the projection is correct, output will strengthen over the 2.6% rise for last year’s fourth quarter.

Continue reading

Macro Briefing: 27 February 2018

IEA: US to overtake Russia as world’s largest oil producer in 2019: Reuters

Gun control efforts face headwinds in Senate: Politico

What to watch for in today’s testimony by Fed Chair Powell: MarketWatch

Global stocks rise to 3-week highs ahead of Fed chief’s debut in Congress: Reuters

St Louis Fed President is”concerned that [rate hikes go] too far too fast”: Reuters

Fed’s Quarles: “I am fairly optimistic about… the economy”: CNBC

US economy expanded at a slightly softer pace in January: Chicago Fed

IRS forces Coinbase, a cryptocurrency broker, to report records: Digital Trends

Dallas Fed: mfg business activity at highest level since 2005: San Antonio Exp News

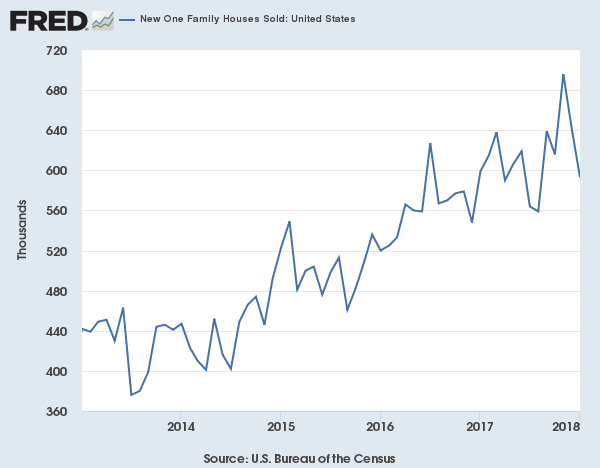

New home sales in US fell to a 5-month low in Dec: CNBC

Commodities Lead In Mixed Week For Major Asset Classes

Broadly defined commodities posted the strongest performance last week among the major asset classes, based on a set of exchange-traded products. The gain follows renewed expectations that inflationary momentum may be firming up in the US and around the world.

Continue reading

Macro Briefing: 26 February 2018

China lays groundwork for Xi Jinping to hold presidency indefinitely: WaPo

Mexico’s president cancels White House visit after call with Trump: LA Times

Treasury yields dip ahead of new Fed chief’s first congressional testimony: MW

Peter Navarro, a trade skeptic in the White House, is promoted: NY Times

Buffett: patience is required in a world of high-priced equities: Bloomberg

Firmer pricing for transport costs point to another inflation factor: Reuters

Data breaches reach an all-time high in 2017: Thales

US flu season is the worst since 2009-2010: FiveThirtyEight

Is factor allocation superior to conventional asset allocation? Alpha Architect

Relative strength in junk bonds may be positive sign for stocks: FMD Capital

Bridgewater’s short on European equities goes into overdrive: Barron’s

US financial stress level ticks lower for first time in five weeks: St. Louis Fed

Book Bits | 24 February 2018

● It’s Better Than It Looks: Reasons for Optimism in an Age of Fear

By Gregg Easterbrook

Summary via publisher (Public Affairs)

Is civilization teetering on the edge of a cliff? Or are we just climbing higher than ever? Most people who read the news would tell you that 2017 is one of the worst years in recent memory. We’re facing a series of deeply troubling, even existential problems: fascism, terrorism, environmental collapse, racial and economic inequality, and more. Yet this narrative misses something important: by almost every meaningful measure, the modern world is better than it ever has been. In the United States, disease, crime, discrimination, and most forms of pollution are in long-term decline, while longevity and education keep rising and economic indicators are better than in any past generation. Worldwide, malnutrition and extreme poverty are at historic lows, and the risk of dying by war or violence is the lowest in human history. It’s not a coincidence that we’re confused–our perspectives on the world are blurred by the rise of social media, the machinations of politicians, and our own biases.

Continue reading

Tech Sector Momentum Still Dominates After Market Turbulence

The surge in market volatility earlier this month took a toll far and wide, but tech’s leadership endures, based on a set of sector ETFs. A fund that holds a diversified mix of technology shares is trading below its recent highs, but the sector has largely bounced back from the early February correction and continues to dominate in the year-over-year column vs. the rest of the field.

Continue reading

Macro Briefing: 23 February 2018

US set to impose more sanctions on N. Korea: Reuters

Blackrock says it will talk with gunmakers about Florida shooting: Reuters

FCC officially publishes regs that will repeal net neutrality rules in April: Engadget

US jobless claims last week fell to 2nd lowest level since the recession: MW

Leading Economic Index for US rose in Jan, signaling “robust” growth: Conf. Board

US inflation trend probably ticked up in Feb, according to alt-data estimate: WSJ

Private data suggests China’s economic growth is slowing: Asia Times

Avg college endowment fund lagged stock/bond mix over last decade: NY Times

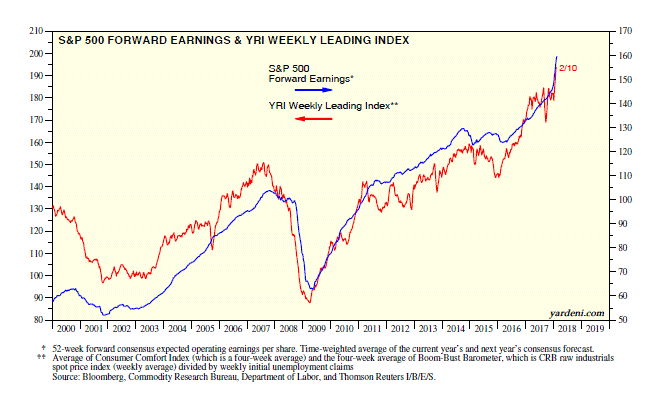

S&P 500 forward earnings estimates surging in 2018: Yardeni Research

Tough Times For Large-Cap Value Stocks

The long-run historical return premium linked to value stocks remains intact if you’re measuring performance across decades, but the strategy of favoring inexpensively priced shares has had a rough run lately.

Continue reading