The federal government remains shuttered for a second day, as of mid-afternoon on Sunday (Jan. 21), Washington time. Senate moderates are struggling to find a political solution, albeit without success so far. Meantime, what should we expect for economic blowback if the political stalemate endures?

Continue reading

Monthly Archives: January 2018

Book Bits | 20 January 2018

● The Tyranny of Metrics

Summary via publisher (Princeton University Press)

By Jerry Z. Muller

Today, organizations of all kinds are ruled by the belief that the path to success is quantifying human performance, publicizing the results, and dividing up the rewards based on the numbers. But in our zeal to instill the evaluation process with scientific rigor, we’ve gone from measuring performance to fixating on measuring itself. The result is a tyranny of metrics that threatens the quality of our lives and most important institutions. In this timely and powerful book, Jerry Muller uncovers the damage our obsession with metrics is causing–and shows how we can begin to fix the problem.

Continue reading

Research Review | 19 January 2018 | The Business Cycle

Fama-French Factors and Business Cycles

Arnav Sheth and Tee Lim (Saint Mary’s College of California)

December 4, 2017

We examine the behavior of Fama-French factors across business cycles measured in various ways. We first split up the business cycles into four stages and examine the cumulative returns of factors in each of those stages. We then look at the behavior of the factors after a yield curve inversion starts and ends, as the relationship between yield curve inversions and recessions has been well-explored. We finally run a logistic regression to test the predictive power of the term spread on the NBER recession indicator. Our results show that there is an effect on the factors of each of our four stages, and there is limited predictive power from the recession probabilities. We believe this is of practical importance to portfolio managers who are factor-oriented in their approach.

Continue reading

Macro Briefing: 19 January 2018

House approves funding bill to keep gov’t open, but Senate may block it: The Hill

International Energy Agency: US oil output set for “explosive growth: Bloomberg

Consumer Financial Protection Bureau’s acting dir requests zero funding: Politico

US housing starts down sharply in Dec but post solid gain for 2017: WSJ

US jobless claims tumble to lowest level since 1973: Bloomberg

US Treasury yields at highest levels since 2014: Reuters

Scientists document a century-long bull market in global temperatures: NY Times

Has The Yield Curve Lost Its Mojo As A Business Cycle Indicator?

Maybe it’s due to a global savings glut. Or perhaps fear continues to lurk in the hearts of overseas investors, inspiring a constant flow into safe-haven Treasuries in spite of firmer economic activity.

Continue reading

Macro Briefing: 18 January 2018

GOP moves closer to avert gov’t shutdown, but risks still lurk: The Hill

Turkey may intervene in Syria unless US pulls support for Kurds: Reuters

US industrial production rises a strong 0.9% in December: USA Today

Housing Market Index for US ticks down in Jan after 18yr high: HousingWIre

Fed Beige Book: US economy, inflation rise at modest-to-moderate pace: CBS

Prof. Barry Eichengreen: Fed isn’t prepared for the next recession: Japan Times

China’s official economic data overstate the country’s growth rate: NY Times

Dow Jones Industrial Avg closed above 26,000 for first time: Wall Street Journal

Yield Curve Flattens As 2-Year Treasury Rate Rises Above 2%

The 2-year Treasury yield is above 2% for the first time in nearly a decade. This rate, which is seen as a key proxy for monetary policy expectations, ticked up to 2.03% on Tuesday (Jan. 16), based on daily data via Treasury.gov. The increase, coupled with a fractional dip in the benchmark 10-year Treasury yield to 2.54%, squeezed the widely followed spread 10-year/2-year spread to 51 basis points, matching the low reached last month that marks the smallest difference since 2007.

Continue reading

Macro Briefing: 17 January 2018

GOP plans stopgap funding to keep government open past Saturday: USA Today

US Secretary of State talks of possible war with North Korea: Bloomberg

22 states sue Federal government over repeal of net neutrality: The Hill

World Economy Forum survey: political and economic risks are rising: Reuters

NY Fed Mfg Index: growth ticked lower in Jan but still growing at solid pace: NY Fed

Will higher oil, currency prices force ECB to tighten monetary policy? Bloomberg

Bitcoin and other cryptocurrencies suffer sharp price declines: CNBC

Median 1yr consumer inflation expectations in Dec tick up to 10mo high: NY Fed

Growth Stock Rally Continues To Overshadow Value Investing

The exuberance in the US stock market of late may or may not be irrational, but the party atmosphere in the value corner of equities (companies that are inexpensively priced) is subdued vs. the celebratory surge for growth shares (firms expected to grow at above market rates). Although both measures of US companies in the large-cap space are posting solid gains, the gap in favor of growth has become conspicuously wide lately.

Continue reading

Macro Briefing: 16 January 2018

Risk of US government shutdown looms as Jan. 19 deadline approaches: CNN

Turkey’s president warns of attack against US-backed rebels in Syria: Reuters

Oil rises three-year high, supported by global growth and production cuts: Reuters

Wall Street eyes higher inflation in 2018: Bloomberg

Research claims “single actor” lifted Bitcoin to $1000 from $150: TechCrunch

China’s crackdown on Bitcoin accelerates: CNBC

Boeing unveils supersonic plane design for speeds up to Mach 5: Fox

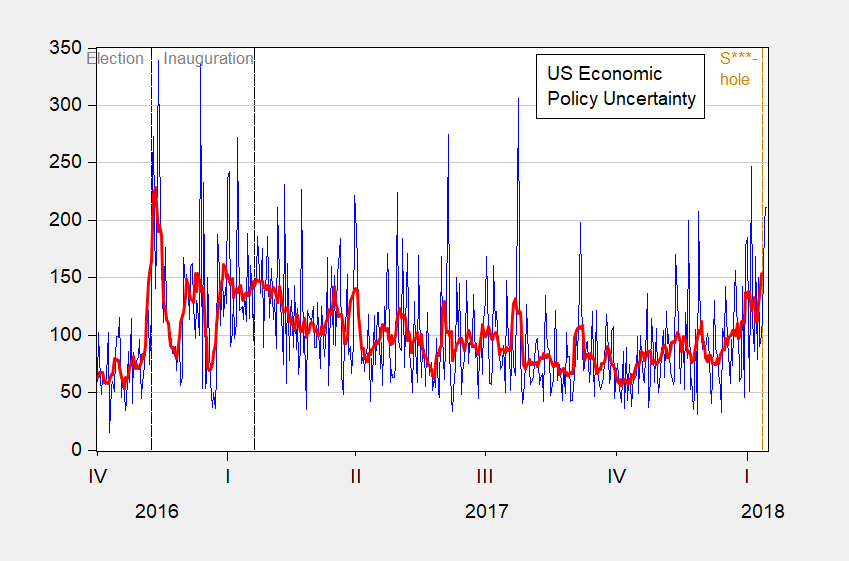

US policy uncertainty is rising: Econobrowser