Shares of technology stocks remain the trend leader but healthcare’s recent strength suggests a changing of the guard may be near, based on a set of sector ETFs ranked by one-year return. Meanwhile, telecom is the only US sector nursing a loss for the year-over-year change, although real estate stocks are close to dipping into negative terrain.

Continue reading

Monthly Archives: January 2018

Macro Briefing: 26 January 2018

Trump denies that he tried to fire special counsel for Russia probe: LA Times

Demand surge for risk assets triggers “tactical pullback” warning: Bloomberg

US economy expected to post brisk growth in today’s Q4 GDP report: Reuters

US Leading Index up in Dec, predicting “strong economic growth” for 1H 2018: CB

US jobless claims rose last week to 233,000, but remain low: WSJ

New home sales in US fell more than forecast in Dec: Bloomberg

Manufacturing growth picked up in Kansas City Fed region: Bond Buyer

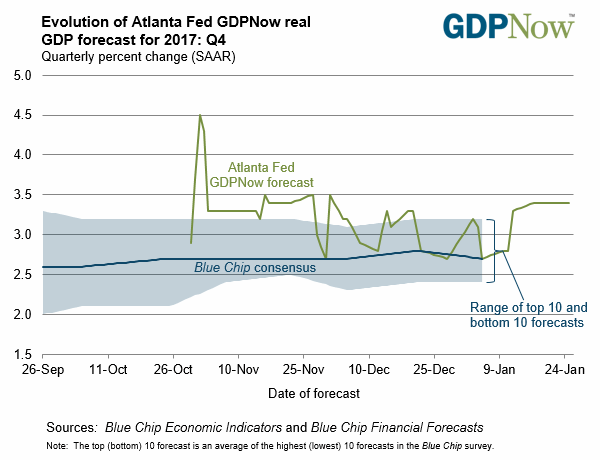

Atlanta Fed’s revised Q4 GDP nowcast holds steady at 3.4%: Atlanta Fed

US Q4 GDP Growth Expected To Hold Steady Near 3%

Tomorrow’s preliminary GDP report for the fourth quarter is on track to post a growth rate at or near the roughly 3% pace that’s prevailed in the previous two quarters, according to several estimates. If the projection is accurate, the US economy will log another healthy gain in quarterly output, reaffirming recent evidence that the macro trend picked up speed in 2017.

Continue reading

Macro Briefing: 25 January 2018

Trump says he’s willing to testify under oath in Russia probe: Reuters

Trump urges Turkey to scale back Kurdish offensive in Syria: The Hill

Will a strong euro delay a rate hike at the European Central Bank? Reuters

Oil jumps to three-year high: MarketWatch

US PMI: strong mfg start for 2018 as services sector growth eases: IHS Markit

Eurozone PMI: survey data for Jan reflects strongest growth in 12 years: IHS Markit

Japan Mfg PMI rises to three-year high in December: IHS Markit

US dollar falls to 3-year low against foreign currencies: CNBC

FHFA Home Price Index rose 0.4% (s.a.) in Nov, up 6.5% y-o-y: MND

Is A Weaker Dollar A Plus For US Economic Growth?

Treasury Secretary Steven Mnuchin says that a softer dollar will juice US economic growth. Speaking at the World Economic Forum in Davos, Switzerland, he advises that “obviously a weaker dollar is good for us as it relates to trade and opportunities.” Does that mean that tracking the dollar’s value in foreign exchange markets offers insight into projecting US GDP in the near term? Alas, no. A preliminary look at the numbers suggests the relationship between a broad measure of the US dollar and GDP growth is mostly noise.

Continue reading

Macro Briefing: 24 January 2018

Senate approves Powell as Fed chairman: Bloomberg

CIA Director says N. Korea may use nukes for “coercive” purposes: CNN

Montana implements net neutrality rules following FCC repeal: The Hill

Economists expect global growth to reach 8-year high in 2018: Reuters

US Treasury Secretary says a weaker dollar benefits US economy: Bloomberg

Is positive sentiment at Davos meeting a contrarian indicator? Guggenheim

One-sixth of millennials have saved $100,000 or more: USA Today

Richmond Fed Mfg Index: growth slows to 3-mo low in Jan: Richmond Fed

Employment up in half of US states in 2017; no change in other half: Labor Dept

US Business Cycle Risk Report | 23 January 2018

US economic output remained strong in December, according to a review of key indicators. Echoing the profile in recent history, the numbers continue to reflect a virtually nil probability that a recession has started.

Continue reading

Macro Briefing: 23 January 2018

Government shutdown ends as Trump signs funding bill into law: USA Today

Chasm between Dems and GOP widens after shutdown drama: Bloomberg

Trump announces 30% tariff on imported solar technology: The Hill

China has options for responding to Trump’s import tariffs: Bloomberg

IMF report advises that “global economic activity continues to firm up”: IMF

PA court decision on state’s congressional map gives Dems an edge: Politco

VP Pence announces accelerated US embassy move to Jersusalem: LA Times

Chicago Fed Nat’t Activity Index reflects faster US growth in Dec: Chicago Fed

10-year Treasury yield ticks up to 2.66%, highest since 2014: CNBC

Emerging Markets Stocks Lead While US Bonds Retreat

Equities in emerging markets posted the strongest advance among the major asset classes last week, based on a set of exchange-traded products. US bonds, meanwhile, continued to slide, delivering last week’s biggest setback for broadly defined markets.

Continue reading

Macro Briefing: 22 January 2018

US gov’t shutdown spills over into Monday: The Hill

Eric Trump tells Fox News shutdown is “good thing for us” politically: CBS

Turkish troops roll into Syria, toward US-backed Kurdish fighters: Bloomberg

US Consumer Sentiment Index dips to six-month low in January: Bloomberg

UK retail spending plunged in Dec following Black Friday surge: MNI

Oxfam: 82% of wealth created in 2017 went to world’s richest 1%: BBC

US gov’t shutdown history shows limited influence on stock market: MarketWatch

Hedge Fund Research: Hedge funds end 2017 with record-high assets: P&I

US asset flows in 2017 accelerated into passive while active retreated: Morningstar