Investing in a Multi-Asset Multi-Factor World

Alexandar Cherkezov (Invesco), et al.

August 31, 2017

In this article, we advance the use of factor investing across multiple asset classes. It turns out that style factors well established in the equity domain – such as value, momentum or quality – do extend to other asset classes as well. Even more so, multi-asset multi-factors significantly expand the investment opportunity set relative to a traditional multi-asset universe. Seeking to exploit this potential, we put forward an innovative diversified risk parity strategy that is designed to strive for maximum diversification in the multi-asset multi-factor world. To illustrate the strategy’s merits, we investigate its stylized facts vis-à-vis more standard allocation approaches.

Continue reading

Monthly Archives: November 2017

Macro Briefing: 10 November 2017

Trump says US will no longer tolerate “chronic trade abuses”: BBC

Differences within GOP on tax reform may delay (or derail?) bill: Politico

The odds for substantial tax reform don’t look promising: The Atlantic

US jobless claims rise more than expected for week through Nov 4: Reuters

This year’s stock market rally is all about earnings: MarketWatch

Buffett, Gates, and Bezos have more wealth than half US population: Fortune

Is another government shutdown lurking for the US? Fiscal Times

US Q4 GDP growth estimate holds steady at a solid 3.3%: Atlanta Fed

Momentum Still Dominates For US Equity Factor Performances

As horse races go, this one’s not even close. The momentum factor continues to leave the rest of the field in the dust for the major US equity factor strategies, based on the one-year trend via a set of ETFs.

Continue reading

Macro Briefing: 9 November 2017

Trump gives China a pass for “taking advantage” of US on trade: CBS News

US firms announce trade deals with China during Trump’s trip: Reuters

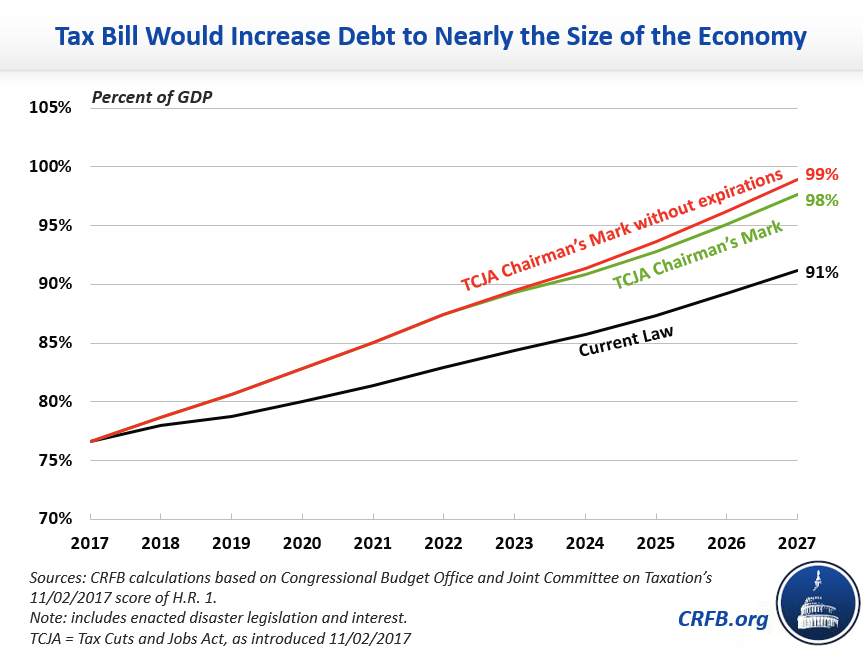

CBO: GOP tax reform will raise federal deficit by $1.7 trillion over 10yrs: CNBC

China’s inflation rises to fastest pace in 9 months in October: RTT

Is the GOP’s hold on Congress at risk after Dem’s electoral victories? NY Times

Citigroup CEO says US gov’t may issue its own digital currency: Bloomberg

Will EU use Brexit deadlock to force UK firms to relocate to Europe? Telegraph

Morningstar’s new style box profiles alt funds’ diversification benefits: M-Star

Conventional wisdom is wrong: ETFs have been tested under fire: Bloomberg

A Key Treasury Yield Spread Narrows To Lowest Level In A Decade

A widely followed measure of the Treasury yield curve dipped on Tuesday (Nov. 7) to its flattest level in a decade, based on daily data published by Treasury.gov. The gap between the 10-year and 2-year rates fell to 69 basis points yesterday – the lowest since Nov. 2007.

Continue reading

Macro Briefing: 8 November 2017

Democrats score first electoral wins in Trump era: Politico

Trump’s agenda for his two-day China visit: trade and N. Korea: AP

China’s trade surplus with US narrows in Oct: Reuters

N. Korea dismisses Trump’s diplomatic outreach: CNN

Job openings in US remain strong in Sep: CNBC

Consumer credit rises in Sep, touching 10-month high: ABA Banking Journal

US economic growth has defied forecasts by the left: RCP

Economic confidence in US remains positive in Oct: Gallup

Replicating Indexes In R (Part III): Socially Responsible Investing

In previous installments of replicating indexes I profiled the style-analysis methodology and presented an example using a hedge fund index. Now let’s turn to a strategy of replicating the S&P 500 Index with a handful of stocks that are considered socially responsible investments (SRI).

Continue reading

Macro Briefing: 7 November 2017

Trump in S. Korea talks of using military force if necessary: Reuters

Rising energy stocks help lift markets in Europe and Asia on Tuesday: WSJ

Is a war brewing between Saudi Arabia and Lebanon? Reuters

Global growth rate ticks up in October, according to survey data: IHS Markit

Eurozone growth is strong at start to Q4; job pace at decade high: IHS Markit

Hedge funds are a key force driving Bitcoin to a record $7400: NY Times

Crude oil rises to two-year high: Bloomberg

Commodities Lead Markets For Second Week In A Row

Broadly defined commodities posted the strongest gain for the major asset classes last week, based on a set of exchange-traded products. The advance marks the second time in as many weeks that commodities topped the performance list.

Continue reading

Macro Briefing: 6 November 2017

More than two dozen killed in church shooting in Texas: CNN

Saudi prince with hefty US investments is arrested: LA Times

Trump in Asia says Japan is “winning” with free trade: USA Today

US commerce secretary kept investments linked to Russia, Putin: NY Times

US job growth rebounds in Oct but wage growth slows: Reuters

ISM Non-Mfg Index edges up to 9-year high in Oct: CNBC

US Services PMI in Oct points to “strong” growth: IHS Markit

Factory orders in US rise 1.4% in Sep: ABC News

Sep US trade deficit widens; 2017 on track to exceed 2016: Politico

House tax bill expected to add $2 trillion-plus in US debt: CRFB