House passes tax bill–focus now turns to Senate: Reuters

World’s largest sovereign wealth fund considers selling oil stocks: Bloomberg

US industrial output surges in Oct after hurricane disruptions fade: Reuters

US jobless claims rise to 6-week high: Bloomberg

Confidence among US home builders rises to 7-month high in Nov: Housing Wire

Philly Fed manufacturing index falls in Nov but still signaling growth: RTT

Nasa tool predicts which coastal cities will be flooded from global warming: CNN

Yale’s David Swensen says low stock market vol is “profoundly troubling”: CFR

Will AI’s use in financial markets raise systemic risk? VoxEU

2-Year Treasury yield rises to nine-year high — 1.72%: Reuters

Monthly Archives: November 2017

Real M0 Money Supply’s Annual Trend Is Positive For Third Month

The Federal Reserve is widely expected to raise interest rates again at next month’s FOMC meeting. Using the futures market for Fed funds as a guide, another round of tightening is a virtual certainty. The ongoing rebound in the inflation-adjusted monetary base, however, suggests that there’s still room for debate.

Continue reading

Macro Briefing: 16 November 2017

Johnson is the first GOP senator to oppose tax-reform bill: Politico

US retail sales rose a moderate 4.6% for y-o-y change through Oct: USA Today

US core inflation up 1.8% y-o-y in Oct–first acceleration since Jan: Bloomberg

NY Fed Mfg Index falls but still pointing to healthy growth: RTT

Year-ahead business inflation expectations inch up to 2.0%: Atlanta Fed

Business inventories in US unchanged in Sep: Reuters

A handshake suggests warmer relations between China and Japan : NY Times

Will global economic growth keep the bull market humming? MarketWatch

S&P 500 slumps to a three-week low: Bloomberg

The Risk Of Estimating Risk

The US stock market has defied the odds this year, or so it appears, by running hotter and staying calmer for longer than expected, based on a variety of risk metrics. It’s unclear if this is due to a failure of the risk metrics, irrational exuberance run amuck, or both.

Continue reading

Macro Briefing: 15 November 2017

Zimbabwe’s military appears to take over government: NY Times

China to send envoy to N. Korea: Bloomberg

Report finds that richest 1% own half the world’s wealth: USA Today

India will lead world’s energy demand growth through 2040: IEA

Senate committee reviews Trump’s authority to use nuclear weapons: ABC

Wholesale inflation in US for Oct posts biggest rise in over 5 years: Reuters

US small business optimism near record high in October: CNBC

Japan’s Q3 GDP rises 0.3%–longest growth run since 2001: Nikkei

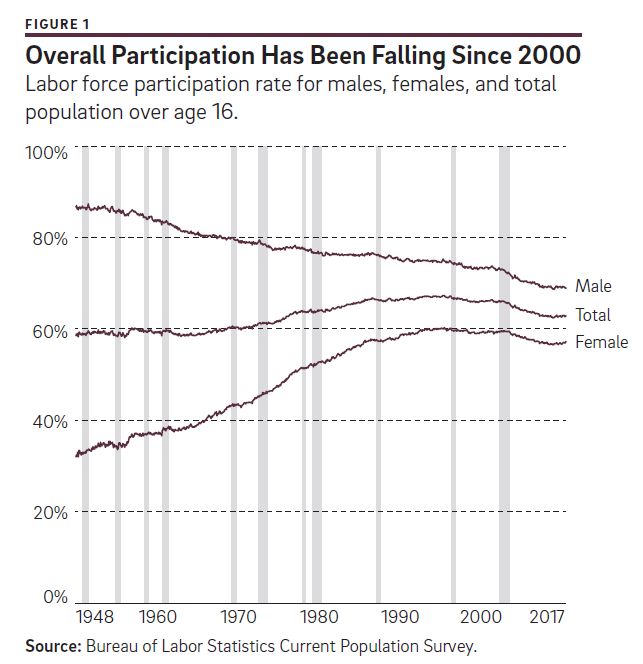

The US labor-force participation rate has been sliding for 17 years: Philly Fed

Will US Inflation Tick Higher In 2018?

The Federal Reserve has been trying to lift the inflation trend in recent years with limited success. Key measures of the price trend remain below the central bank’s 2.0% target and recent data point to more of the same for the immediate future. But there are hints that the inflation is stabilizing, perhaps laying the groundwork for creeping higher in the new year.

Continue reading

Macro Briefing: 14 November 2017

Republicans aim to prevent Moore from becoming a Senator: The Hill

Trump claims progress on changing rules to cut US trade deficit: Bloomberg

Lebanon’s political crisis threatens wider troubles for Middle East: WaPo

Economists upbeat on US growth outlook in new Philly Fed survey: MNI

China’s industrial output and retail spending growth tick down in Oct: RTT

China leads world with fastest supercomputers: CNET

Maybe low stock-market volatility is normal: Bloomberg

US economy near full employment; implies more rate hikes: Fed Watch

US year-ahead inflation outlook ticks up to 2.6%, a 6-month high: NY Fed

US REITs Rise For A Second Week

Real estate investment trusts (REITs) in the US surged last week, posting the strongest gain among the major asset classes, based on a set of exchange-traded products. The rise marks the second weekly increase in a row for securitized real estate.

Continue reading

Macro Briefing: 13 November 2017

Iran-Iraq earthquake kills hundreds: USA Today

Trump meets Philippine president, says they have “great relationship”: BBC

GOP leaders predict the House will pass tax-reform bill this week: Politico

US Consumer Sentiment pulls back in Nov after reaching 13-year high: CNBC

Why is the US Treasury yield curve flattening? Bloomberg

Dir. of research at SF Fed: wage growth is above trend and picking up: MNI

Eurozone on track for strong growth and low inflation: Bloomberg

US Q4 GDP nowcast continues to print at strong +3.85%: Now-casting.com

Book Bits | 11 November 2017

● Dollars and Sense: How We Misthink Money and How to Spend Smarter

By Dan Ariely and Jeff Kreisler

Summary via publisher (HarperCollins)

We think of money as numbers, values, and amounts, but when it comes down to it, when we actually use our money, we engage our hearts more than our heads. Emotions play a powerful role in shaping our financial behavior, often making us our own worst enemies as we try to save, access value, and spend responsibly. In Dollars and Sense, bestselling author and behavioral economist Dan Ariely teams up with financial comedian and writer Jeff Kreisler to challenge many of our most basic assumptions about the precarious relationship between our brains and our money. In doing so, they undermine many of personal finance’s most sacred beliefs and explain how we can override some of our own instincts to make better financial choices.

Continue reading