US economic growth was revised up to a 3.3% pace in yesterday second GDP estimate for the third quarter – the strongest quarterly rise in three years. Fourth-quarter estimates look upbeat too, holding out the possibility that output will rise by 3%-plus for three quarters in a row. If the Q4 prediction is correct, the US will post its best cumulative three-month advance since the 2014:Q3-2015:Q1 run.

Continue reading

Monthly Archives: November 2017

Macro Briefing: 30 November 2017

GOP tax bill moves closer to final vote in Senate: Reuters

Trump nominates Marvin Goodfriend to Fed’s board of governors: NY Times

OPEC expected to extend oil production cuts: Reuters

Fed Chair Yellen tells Congress recovery is “increasingly broad based”: Reuters

Q3 GDP growth revised up to 3.3%–highest in 3 years: Bloomberg

Pending homes sales revives 3.5% after post-hurricane bounce-back: CNBC

2-year Treasury yield ticks up to new post-recession high — 1.78%: Treasury.gov

Should Investors Worry About North Korea’s Missile Tests?

North Korea on Wednesday announced that it had launched another missile to test its nuclear-strike capability, which reportedly can now reach the United States. Should we be concerned? Yes, of course. For obvious reasons, every citizen of Planet Earth should be alarmed when a war-mongering government threatens to use nuclear weapons. But as investors, Kim Jong Un’s provocations should be treated as noise.

Continue reading

Macro Briefing: 29 November 2017

North Korea tests missile that could hit the US: CNN

GOP tax bill clears another hurdle in Senate Budget Committee: RTT

Risk of US gov’t shutdown rising as Trump and Dems bicker: The Hill

Powell tells Congress that case is strengthening for rate hike: Bloomberg

Nat’l Retail Federation: Holiday shopping off to a strong start: MNI

Consumer Confidence Index for US rises to 17-year high: Bloomberg

US home price index rises 6.2% y-o-y in Sep, beating expectations: CNBC

Strong gain for FHFA house price gauge in Q3: Builder

Richmond Fed mfg index rises to 24-year high in Nov: Richmond Fed

Forecasts Anticipate Another Solid Rise For US Q4 GDP Growth

US economic growth in the fourth quarter is expected to hold at or near the solid 3% pace that’s been reported in Q2 and Q3, according to several recent forecasts. If the outlook is accurate, US GDP growth could post its strongest and longest run of quarterly increases in over a decade.

Continue reading

Macro Briefing: 28 November 2017

Radio signals hint at upcoming N. Korean nuclear test: Reuters

Two GOP senators could prevent tax bill from a vote: Reuters

Incoming Fed chief expects “rates to rise somewhat further” Bloomberg

Manufacturing growth rate slows in Texas but still “solid”: Dallas Fed

S&P maintains “stable” rating on India’s debt: RTT

Japan’s government: economy remains “in a moderate recovery”: MNI

Bitcoin at $40,000? Hedge fund manager thinks it’s possible: CNBC

Crash risk for Bitcoin is 80%: MarketWatch

How to short Bitcoin: Bloomberg

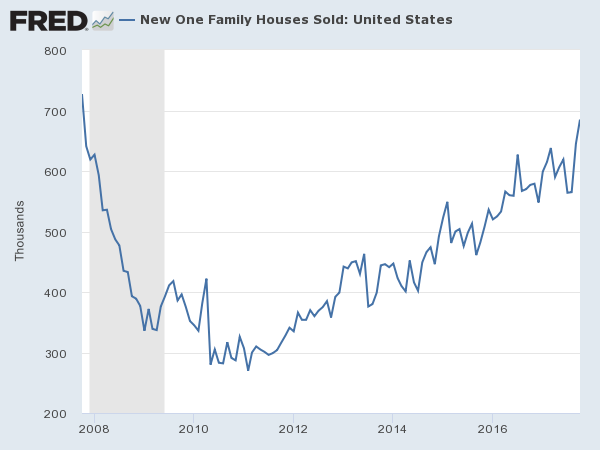

New home sales surge in October, rising to 10-year high: Reuters

Across-The-Board Gains For Markets Last Week

Buyers lifted prices in all the major asset classes last week, based on a set of exchange-traded products. The gains mark the first run of uniformly positive weekly results in three months.

Continue reading

Macro Briefing: 27 November 2017

Indonesia authorities call for 100,000 to evacuate after volcano erupts: Guardian

A possible gov’t shutdown and other challenges confront Congress in Dec: Politico

Holiday shopping season starts strong, driven by strong rise in online sales: RTT

ECB warns that “fake data” threatens economic and financial stability: Reuters

South Africa’s credit rating cut to junk status by S&P: RTT

US growth eases in Nov via PMI data but still running at “solid” pace: IHS Markit

Bitcoin approaching $10,000: Bloomberg

Drilling triggers a surge in earthquakes in Texas and other states: SciAm

Book Bits | 25 November 2017

● Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global Elite

By Jake Bernstein

Summary via publisher (Henry Holt)

A hidden circulatory system flows beneath the surface of global finance, carrying trillions of dollars from drug trafficking, tax evasion, bribery, and other illegal enterprises. This network masks the identities of the individuals who benefit from these activities, aided by bankers, lawyers, and auditors who get paid to look the other way. In Secrecy World, the Pulitzer Prize winning investigative reporter Jake Bernstein explores this shadow economy and how it evolved, drawing on millions of leaked documents from the files of the Panamanian law firm Mossack Fonseca—a trove now known as the Panama Papers—as well as other journalistic and government investigations. Bernstein shows how shell companies operate, how they allow the superwealthy and celebrities to escape taxes, and how they provide cover for illicit activities on a massive scale by crime bosses and corrupt politicians across the globe.

Continue reading

Tech-Stock Momentum Accelerates

Technology shares have surged recently, leaving the rest of US equity sectors in the dust, based on a set of ETFs. Sector leadership appeared to be shifting to tech from financials at the end of last month. Nearly four weeks later, the transition is complete and there’s no doubt which sector dominates the upside momentum rankings for one-year performances.

Continue reading