Financial stocks remain the top-performing US sector for the one-year trend, based on a set of ETFs, but tech’s recent surge suggests that a leadership change may be near.

Continue reading

Monthly Archives: October 2017

Macro Briefing: 31 October 2017

Former Trump campaign aides indicted in Mueller’s Russia probe: The Hill

Trump says indictments don’t prove he colluded with Russia: NY Times

House considering corporate tax cuts that phase in slowly: Bloomberg

Car sales fuel biggest rise in US consumer spending since 2009: Bloomberg

Is White House ready for Nov.’s commercial talks with China? Reuters

GDPNow’s first Q4 estimate for US growth is 2.9% vs. 3.0% in Q3: Atlanta Fed

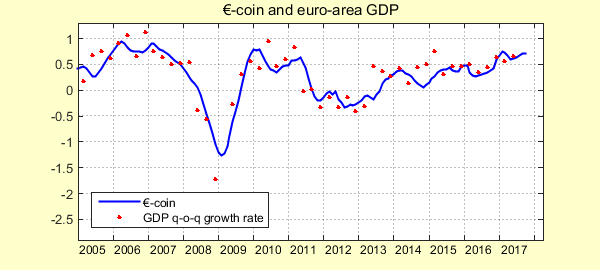

Eurozone’s Oct. 3-mo. GDP growth estimate ticks up to 0.72%: €-Coin Indicator

Commodities Popped Last Week Amid Weakness Elsewhere

Broadly defined commodities rose last week, posting the strongest advance for the major asset classes, based on a set of exchange-traded products. The increase is an outlier during a week when most markets fell.

Continue reading

Macro Briefing: 30 October 2017

Today’s expected indictments raise political risk for White House: Politico

Fed Governor Powell is the front runner for new Fed chairman: The Hill

Trump’s tax plan under scrutiny as House vote nears: Reuters

US economic growth at solid 3.0% in Q3 despite hurricanes: LA Times

Consumer Sentiment Index for US rises to 13-year high in Oct.: Bloomberg

Roughly 1/4 of Q3 GDP rise due to inventory accumulation: Econobrowser

Plans to manage China’s debt have global economic implications: Bloomberg

The US Business Cycle Risk Report: Update For Oct. 29, 2017

The Oct. 29 edition of The US Business Cycle Risk Report has been published and emailed to subscribers.

For subscription information and a sample issue, click here.

Book Bits | 28 October 2017

● Unfinished Business: The Unexplored Causes of the Financial Crisis and the Lessons Yet to be Learned

By Tamim Bayoumi

Summary via publisher (Yale University Press)

There have been numerous books examining the 2008 financial crisis from either a U.S. or European perspective. Tamim Bayoumi, deputy director in the strategy, policy, and review department at the IMF, is the first to explain how the Euro crisis and U.S. housing crash were, in fact, parasitically intertwined. Starting in the 1980s, Bayoumi outlines the cumulative policy errors that undermined the stability of both the European and U.S. financial sectors, highlighting the catalytic role played by European mega banks that exploited lax regulation to expand into the U.S. market and financed unsustainable bubbles on both continents.

Continue reading

US Q3 GDP Rises Faster Than Expected

US economic growth was surprisingly resilient in the third quarter, according to this morning’s preliminary estimate from the Bureau of Economic Analysis. Output increased 3.0%, well above the 2.5% consensus forecast via Econoday.com and only slightly below Q2’s solid 3.1% advance.

Continue reading

Replicating Indexes In R With Style Analysis (Part II): Global Macro

Imitation, Oscar Wilde famously observed, “is the sincerest form of flattery that mediocrity can pay to greatness.” The observation echoes the objective for using Professor Bill Sharpe’s style analysis to replicate investment indexes that, for one reason or another, can’t be purchased directly. If we can obtain an index’s returns, there’s a pretty good chance that we can reverse engineer the asset allocation and recreate the portfolio with publicly traded securities.

Continue reading

Macro Briefing: 27 October 2017

Spain set to impose direct rule on Catalonia on Friday: Reuters

US Defense Secretary in S. Korea emphasizes diplomacy: ABC News

House approves budget and clears the way for tax reform: NY Times

ECB announces it will slowly begin winding down QE stimulus: RTT

Pending Homes Sales Index for US close to 3-year low in September: CNBC

US jobless claims rise after dipping to four-decade low: MarketWatch

US merchandise trade deficit in August at four-month high: Bloomberg

10-year Treasury yield rises to 2.46% on Thursday — highest since March:

Will Value Investing Rise From The Dead?

Value investing may not be a victim of the grim reaper, but the strategy’s certainly giving a convincing impression of a cadaver.

Continue reading