US Defense Secretary hints at miltary options for N. Korea: Reuters

US homebuilder sentiment dips in wake of hurricanes: HousingWire

Buybacks for S&P 500 stocks are down 25% since Q1 2016: MarketWatch

Another record high for US equities: MarketWatch

Market value of US gov’t debt as % of GDP near 70-year high: Dallas Fed

Monthly Archives: September 2017

US Stocks Led Global Equities Higher Last Week

Stocks in the US rebounded last week, posting their strongest weekly gain so far this year and topping the performance ranking for the major asset classes, based on a set of exchange-traded products.

Continue reading

Macro Briefing: 18 September 2017

Hurricane Maria is strengthening, heading for Carribean islands: CNN

Analysts blame weak retail sales and industrial output on hurricane: Reuters

Economists trim US Q3 GDP forecasts after soft-than-expected reports: CNBC

Consumer sentiment dips in Sep. as economic concerns rise: UoM

NY Fed mfg. index in Sep. sticks close to 3-year high: MarketWatch

US companies hold a huge chunk of corp. debt market: FT

US business inventories edge higher in July: FoxBusiness

BIS says rising cryptocurrency risk too big for central banks to ignore: BBG

Nominal US GDP growth stable but still below expectations: Macro Musings

US Business Cycle Risk Report: Update For Sep. 17, 2017

The Sep. 17 edition of The US Business Cycle Risk Report has been published and emailed to subscribers.

Book Bits | 16 September 2017

● Windfall: How the New Energy Abundance Upends Global Politics and Strengthens America’s Power

By Meghan L. O’Sullivan

Summary via publisher (Simon & Schuster)

Windfall is the boldest profile of the world’s energy resources since Daniel Yergin’s The Quest. Harvard professor and former Washington policymaker Meghan L. O’Sullivan reveals how fears of energy scarcity have given way to the reality of energy abundance. This abundance is transforming the geo-political order and boosting American power. As a new administration focuses on raising American energy production, O’Sullivan’s Windfall describes how new energy realities have profoundly affected the world of international relations and security. New technologies led to oversupplied oil markets and an emerging natural gas glut. This did more than drive down prices. It changed the structure of markets and altered the way many countries wield power and influence.

Continue reading

Research Review | 15 September 2017 | Portfolio Management

Asset Allocation in a Low Yield Environment

John Huss (AQR Capital Mgt.), et al.

August 17, 2017

The year 2016 saw bond yields fall to unprecedented low levels in major developed markets, with nominal yields on 10-year German and Japanese government bonds even turning negative. While yields have risen off their lows in 2017, we are still in a very low rate environment. Does this demand exceptional action from investors – even those who usually maintain a strategic allocation to global bonds? We find that it does not, instead it highlights the importance of diversification across many return sources.

Continue reading

Macro Briefing: 15 September 2017

N. Korea fires second missile over Japan: NY Times

US annual consumer inflation ticks up to 1.9% in August: BLS

US jobless claims drop sharply after previous week’s rise: Bloomberg

Revised US Q3 GDP growth estimate holds steady at 3.2%: Now-casting.com

US Consumer Comfort Index dips for second week: Bloomberg

Ross says N. Korea problem won’t stop US trade reform with China: Politico

US 2-year Treasury yield rises to highest since July: MarketWatch

Ranking US Equity Bull Markets During Economic Expansions

The S&P 500 Index edged up to another record high yesterday (Sep. 13), providing another reason to wonder: How long can this last? Mere mortals are clueless, but in the search for some historical perspective it’s reasonable to consider how the current bull run stacks up against its predecessors.

Continue reading

Macro Briefing: 14 September 2017

Trump blocks sale of US tech company to Chinese firm, citing security: BBC

Russia’s Kasperksy Lab’s software banned from US gov’t computers: NY Times

Trump’s outreach to Democrats on tax reform is dividing GOP: Politico

US producer prices in August rise at fastest rate since January: Reuters

Another record high for the US stock market: MarketWatch

Brazil’s main stock market index hits record for 3rd session: RTT

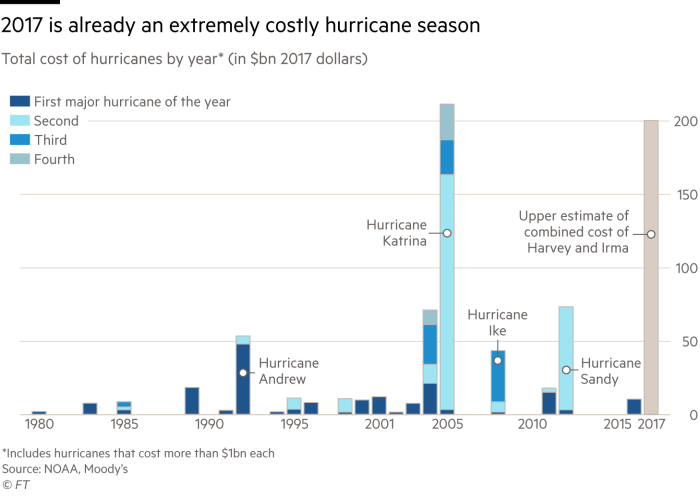

US 2017 hurricane costs to date estimated at highest level since 2005: FT

Annual Growth Rate For US Business Lending Slips To Six-Year Low

The year-over-year growth rate for commercial and industrial loans eased to 1.6% in July, according to last week’s update by the Federal Reserve. The deceleration, the slowest pace since April 2011, looks worrisome in the eyes of some analysts.

Continue reading