The trend in consumer spending posted an encouraging profile during the last full month of the Obama adminstration’s tenure, prompting some analysts to reaffirm the case for another round of raising interest rates.

Continue reading

Monthly Archives: January 2017

Most Markets Posted Gains Last Week

Global markets were mostly higher last week, led by stocks in emerging markets and the US, based on a set of exchange-traded products representing the major asset classes. The losses were relatively contained, with US real estate investment trusts (REITs) taking the biggest hit.

Continue reading

Book Bits | 28 January 2017

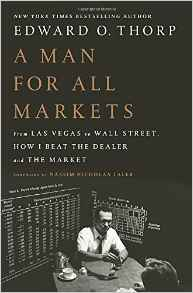

● A Man for All Markets: From Las Vegas to Wall Street, How I Beat the Dealer and the Market

By Edward O. Thorp

Summary via publisher (Random House)

The incredible true story of the card-counting mathematics professor who taught the world how to beat the dealer and, as the first of the great quantitative investors, ushered in a revolution on Wall Street. A child of the Great Depression, legendary mathematician Edward O. Thorp invented card counting, proving the seemingly impossible: that you could beat the dealer at the blackjack table. As a result he launched a gambling renaissance. His remarkable success—and mathematically unassailable method—caused such an uproar that casinos altered the rules of the game to thwart him and the legions he inspired.

The incredible true story of the card-counting mathematics professor who taught the world how to beat the dealer and, as the first of the great quantitative investors, ushered in a revolution on Wall Street. A child of the Great Depression, legendary mathematician Edward O. Thorp invented card counting, proving the seemingly impossible: that you could beat the dealer at the blackjack table. As a result he launched a gambling renaissance. His remarkable success—and mathematically unassailable method—caused such an uproar that casinos altered the rules of the game to thwart him and the legions he inspired.

Continue reading

US Q4 GDP Growth Slows As Annual Pace Remains Middling

Economic activity increased 1.9% in last year’s fourth quarter, the Bureau of Economic Analysis reports, slightly below expectations. Compared with the strong 3.5% rise in Q3, today’s update looks worrisome. But closer inspection, using year-over-year comparisons, shows that nothing much has changed – moderate growth endures. In fact, the trend picked up a bit.

Continue reading

Trade War Or Bust?

In its first week in office, the Trump administration has reaffirmed that trade agreements are in the crosshairs. The Trans Pacific Partnership Agreement (TPPA) was the first victim. Trade between Mexico and the US appears to be the next domino to fall. The US stock market, so far, doesn’t seem to have a problem with the rise of anti-trade actions and rhetoric in Washington. But the slowing and perhaps the reversing of the decades-long policy of embracing free trade comes with risks for the US economy.

Continue reading

The Capital Spectator Named A Top Econ/Finance Blog

FocusEconomics, a consultancy, named The Capital Spectator as one of the “Top Economics & Finance Blogs of 2017”. It’s a high honor, in part because CapitalSpectator.com appears with 100 other distinguished sites. I’m familiar with most of the bloggers who made the cut, but there are several sites that are new to me. Overall, it’s an amazing list of resources for econ and finance. Congrats to all!

Softer Growth Expected For Tomorrow’s US Q4 GDP Report

US economic growth is widely expected to decelerate in tomorrow’s “advance” GDP release for the fourth quarter after a strong increase in Q3. Most forecasters see output rising in the low-2% range, roughly unchanged from last month’s review and well below the robust 3.5% expansion in Q3 (based on the seasonally adjusted annual rate).

Continue reading

Analyzing Portfolios With Risk-Factor Profiles

Most investment portfolios are a collection of risk factors, such as exposure to credit and equity risk. Monitoring and managing these factors is critical. The standard approach is reviewing portfolios through a plain-vanilla asset allocation lens – 60% stocks, 30% bonds, 10% cash, for instance. But the standard methodology is a blunt instrument. For a clearer view of what’s driving your portfolio, decomposing risk with factor-based analysis offers a higher level of insight.

Continue reading

US Business Cycle Risk Report | 24 January 2017

Economic growth kept recession risk low in the final month of 2016. After wobbly readings in the first half of last year, the macro trend has strengthened in recent months and near-term projections point to a modest acceleration in this year’s first quarter.

Continue reading

A Quiet Trading Week As Trump Assumes Presidency

Global markets traded in a tight range last week, based on a set of exchange-traded products representing the major asset classes. The subdued trading ended the week through Jan. 20 with a new US President and prices that were little changed from the previous week’s close.

Continue reading