Payrolls for US companies increased by a seasonally adjusted 185,000 in July, which is moderately below Econoday.com’s consensus estimate for a 210,000 advance. The gain marks the smallest rise in three months, according to this morning’s release of the ADP Employment Report. Meanwhile, the year-over-year pace continued to weaken, sliding to a 2.26% gain for the year through last month—the slowest annual growth rate in more than a year.

Continue reading

Monthly Archives: August 2015

Health Care & Energy: US Sector Momentum At The Extremes

The US stock market has witnessed its share of turbulence in recent months, but the jump in price volatility hasn’t dented the leadership role of the health care sector. At the opposite extreme: energy companies continue to dominate the field in the category of downside momentum.

Continue reading

Initial Guidance | 5 August 2015

● US factory orders rise in June–first increase in 3 months

● US small-business borrowing rises to record in June

● Redbook: US retail sales advance in July

● CoreLogic’s US Home Price Index surges 6.5% for year through June

● Eurozone retail sales sharply lower in June

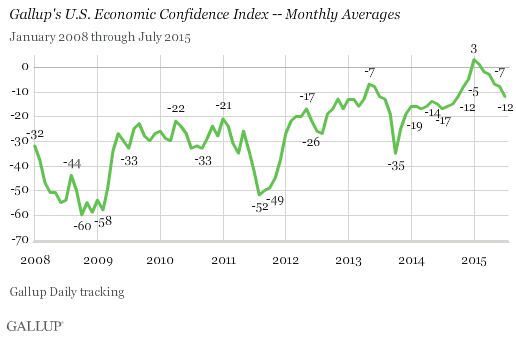

● Gallup’s US Economic Confidence Index falls to 9-month low in July

ADP Employment Report: July 2015 Preview

Private nonfarm payrolls in the US are projected to increase by 227,000 (seasonally adjusted) in tomorrow’s July update of the ADP Employment Report, based on The Capital Spectator’s average point forecast for several econometric estimates. The average projection is modestly below June’s increase.

Continue reading

Risk Premia Forecasts | 4 August 2015

The expected risk premium for the Global Market Index (GMI) ticked up in July, touching a two-month high. GMI — an unmanaged, market-value weighted mix of the major asset classes — is projected to earn an annualized 3.7% over the “risk-free” rate in the long term. (For details on the equilibrium-based methodology that’s used to generate the forecasts each month, see the summary below). Today’s updated estimate, which is based on data through the close of last month, increased 10 basis points from the previous projection.

Continue reading

Initial Guidance | 4 August 2015

● US personal spending +0.4% and income +0.2% in June

● US auto sales surge 5.3% in July

● ISM: US manufacturing growth ticks down in July

● US construction spending rises by a sluggish 0.1% in June

● Gallup: US consumer spending flat in July

Major Asset Classes | July 2015 | Performance Review

A partial rebound was in play in July after widespread losses dominated the global markets during the previous two months. Notably, last month witnessed a sharp increase in US real estate investment trusts (REITs)–the first increase after three monthly declines. Stock markets in the developed world were mostly higher in July as well. But July was no stranger to selling in some corners, including hefty declines in emerging-market stocks and bonds and a dramatic slide in commodities overall.

Continue reading

Initial Guidance | 3 August 2015

● US employment costs decelerated sharply in Q2

● US consumer sentiment softens more than expected in July

● Puerto Rico misses bond payments over the weekend

● PMI: Eurozone manufacturing output rises “solidly” in July

● PMI: manufacturing decline in China accelerates in July

● Greek stock market crashes on Monday after 5-week shutdown

ISM Manufacturing Index: July 2015 Preview

The ISM Manufacturing Index is expected to post a modest increase to 54.3 in tomorrow’s update for July vs. the previous month, based on The Capital Spectator’s average point forecast for several econometric estimates. The prediction is well above the neutral 50.0 mark and so the current outlook still calls for moderate growth for this benchmark of economic activity in the US manufacturing sector.

Continue reading

Book Bits | 1 August 2015

● Unmade in China: The Hidden Truth about China’s Economic Miracle

By Jeremy R. Haft

Summary via publisher (Polity)

If you look carefully at how things are actually made in China – from shirts to toys, apple juice to oil rigs – you see a reality that contradicts every widely-held notion about the world s so-called economic powerhouse. From the inside looking out, China is not a manufacturing juggernaut. It s a Lilliputian. Nor is it a killer of American jobs. It s a huge job creator. Rising China is importing goods from America in such volume that millions of U.S. jobs are sustained through Chinese trade and investment.

Continue reading