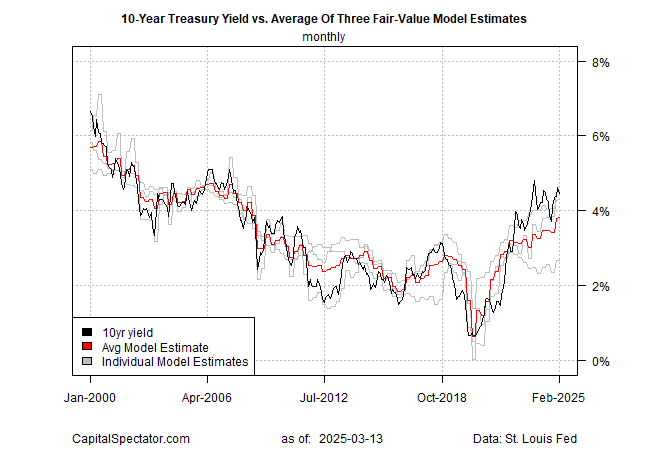

The market premium for the US 10-year Treasury yield ticked up in February to the highest spread since 2008. The estimate is based on the average “fair value” calculation via three models run by CapitalSpectator.com.

The slight increase in the average market premium last month follows a sharp rise in the spread in January, which reversed the previous slide that had taken the estimated premium down to levels that were close to the “normal” range that prevailed before the pandemic.

Focusing on the spread directly reminds that the market premium remains elevated compared with the pre-pandemic range.

One possible reason for the higher market premium is the demand for extra compensation for higher uncertainty on a range of risk factors that are relevant for the bond market. For example, expectations that inflation will remain higher for longer remains a concern. The rise in federal debt, which analysts say isn’t sustainable, is another factor. Meanwhile, the Trump administration’s legislative priority of making current tax cuts permanent has sparked warnings from fiscal hawks and independent analysts of a potential “debt spiral.”

The rising possibility of a global trade war is another risk factor that may be playing a role in keeping the market premium elevated. This line of analysis is driven by expectations that higher tariffs will raise inflation in some degree, perhaps only on a temporary basis.

Inflation unexpectedly eased in February, but the data doesn’t reflect the latest increase in tariffs. The softer pace of pricing pressure “is encouraging news, though it doesn’t tell us much about where inflation is headed,” said Oren Klachkin, Nationwide Financial Markets economist. “With tariffs possibly set to push goods prices higher … we see inflation risks as tilted to the upside.”