The US 10-year Treasury yield has been on a tear over the past two months, its rise fueled by persistent high inflation and ongoing increases in short-term interest rates by the Federal Reserve. But CapitalSpectator.com’s fair-value model suggests the 10-year rate’s upside bias is now limited, although strong momentum forces could easily push the benchmark yield higher still in the immediate future.

Indeed, the 10-year yield closed at 4.02% yesterday (Oct. 17), the highest level since 2008.

To the extent that tighter monetary policy is a factor driving the 10-year yield higher, more of the same is expected in upcoming FOMC meetings. Fed funds futures are pricing in a near certainty of another 75-basis-points rate hike at the Nov. 2 meeting, followed by 69% implied probability for a repeat performance on Dec. 14.

Tenaciously elevated inflation is keeping the Fed on a hawkish path. Notably, last week’s update on consumer prices for September show that core CPI edged up on a year-over-year basis, reaching a 40-year high.

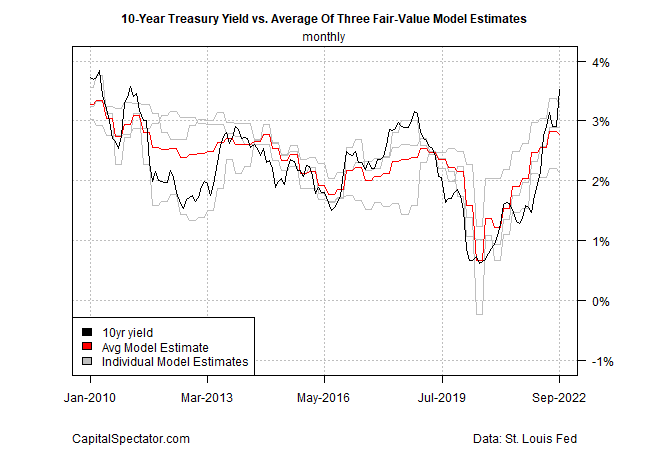

Factoring in a broader measure of economic and market inputs, however, suggests that the 10-year rate is lofty relative to the average estimate of three models (see details here).

Although no one should confuse fair-value modeling with a reliable tool for timing bets on short-term changes in interest rates, today’s update suggests that the upside potential is limited for the benchmark yield. That’s based on today’s revised data that shows the 10-year rate exceeds the average model estimate by the widest margin in four years, based on analysis through September.

The implication: the 10-year rate is vulnerable to a reversal, or at least holding steady. What might convince the crowd to reprice the benchmark yield lower, or at least put the selling on hold? New signs of peak inflation are on the short list of factors, along with firmer evidence that the economy is slowing and/or recession risk is rising, as it appears to be.

The combination of a hawkish Fed that’s committed to taming inflation is expected to slow the economy, perhaps unleashing a new recession in the near term. That one-two punch suggests that inflation will fall, perhaps sharply, in the months ahead. On that basis, the case for a flat/lower 10-year yield is plausible.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report