● Capitalism: A Global History

● Capitalism: A Global History

Sven Beckert

Review via The New Yorker

Beckert identifies “two diametrically opposed stories”: capitalism either deserves credit for the rise in living standards and longevity or stands condemned as an “insatiable demon.” His book addresses “a deep frustration that so many of the stories we tell about capitalism are incomplete and sometimes just plain wrong.” He invites readers to study capitalism “with a sense of wonder, surprise, and astonishment—not because it is ‘good’ or ‘bad’ but because of its world-shaping power, and because understanding it is crucial to navigating our shared future.”

In the course of the next eleven hundred pages, this sales pitch starts to seem a little disingenuous. By the time Beckert arrives at our “neoliberal” era, he has given himself over to open lamentation: everything has been ruthlessly priced, “even human reproduction.”

Happy Thanksgiving!

Revived Expectations For Rate Cut Keep Bond Market Humming

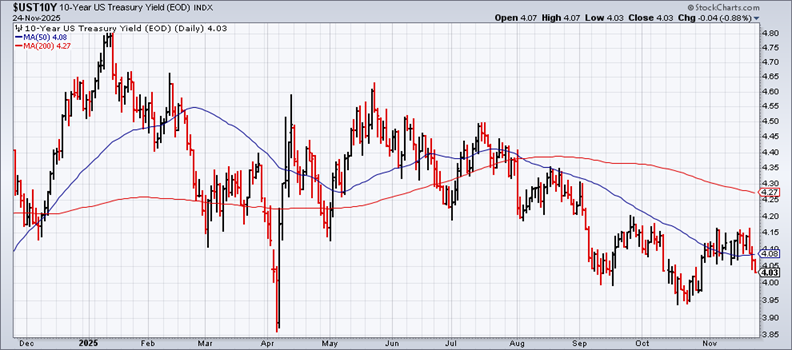

Investor sentiment on the outlook for another rate cut has been volatile lately, but comments from Federal Reserve officials in recent days has turned the tide back in favor of the doves.

Macro Briefing: 25 November 2025

Fed Governor Christopher Waller on Monday said he favored cutting interest rates at the Fed’s Dec. 10 policy meeting. Since the last Fed meeting, “most of the private sector and anecdotal data that we’ve gotten is that nothing has really changed. The labor market is soft. It’s continuing to weaken,” he said. The 10-year Treasury yield on Monday fell to 4.03%, the lowest level so far this month.

Recession Risk Is Low, But Softer Labor Market Raises Red Flags

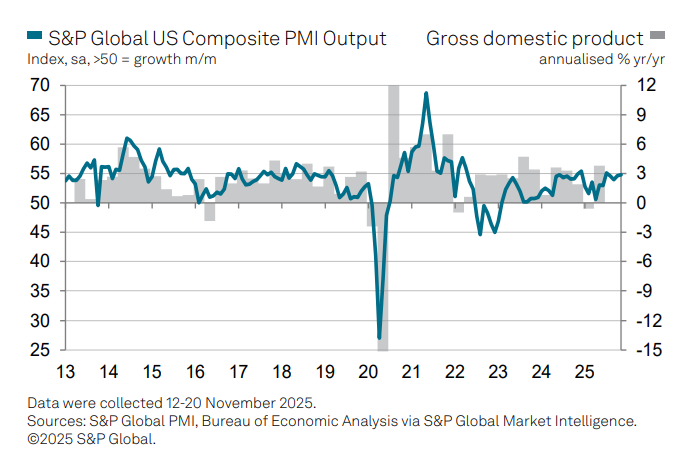

The delayed third-quarter GDP report will, presumably, be published eventually, but it’s ancient history at this point. The focus has turned to an array of data from various sources for October and November. A consensus view is still evolving, but the main takeaway at the moment is that recession risk still appears low so far in Q4.

Macro Briefing: 24 November 2025

US business activity accelerated for a second successive month in November, according to the US Composite PMI Output Index, a survey-based GDP proxy. “The upturn looks encouragingly broad-based for now, with output rising across both manufacturing and the vast services economy,” said Chris Williamson, chief business economist at S&P Global Market Intelligence. “A marked uplift in business confidence about prospects in the year ahead adds to the good news.”

Book Bits: 22 November 2025

● Company Men: The Invention of Shareholder Value and the Splintering of the American Economy

● Company Men: The Invention of Shareholder Value and the Splintering of the American Economy

Sean Delehanty

Summary via publisher (Chicago U. Press)

How an esoteric economic theory—and its most devout believers—changed the world forever. In the modern economy, stock price is king. The value of a corporation is measured in how it enriches its shareholders, even when doing so subtracts from long-term growth or social good. Greed, in the last half-century of corporate practice, has become very good. Company Men is a sweeping intellectual history of how shareholder value rose from the lesser-known edges of academic theory to the vanguard of corporate practice.

Hiring Rebounded In September, But The Trend Is Still Weakening

The return of the government’s monthly payrolls report delivered some upbeat news yesterday. Non-farm payrolls rose more than forecast in September. The data suggests the US economy ended the third quarter with a modest degree of relative strength. But a closer look at the numbers still points to ongoing weakness, which raises questions about the economy’s strength in the months ahead.

Macro Briefing: 21 November 2025

US payrolls rebounded in September, according to the Labor Department’s delayed report. Nonfarm payrolls rose by 119,000, beating the Bloomberg consensus forecast of 53,000, while August payrolls were revised down to a small contraction of 4,000 from the previously reported gain of 22,000. Job gains continue to be concentrated in a few industries, with healthcare & social assistance, and leisure & hospitality adding 87% of the jobs in September.

Fed’s Mixed Signals From Minutes Raise Doubts About Rate Cuts

Earlier this week we asked: Is Wall Street starting to second-guess the inflation outlook? The Fed’s adding to the suspense — minutes from the Oct. 28–29 policy meeting reveal growing doubts about the case for more rate cuts.