The recent economic slowdown has fanned worries that the US is headed for a rough year in 2020. But some analysts are practicing the art of seeing the glass half full and are now calling for improved odds that economic activity will pick up in the new year. All the usual caveats apply, of course, when mere mortals attempt to divine the future. But let’s run this idea through a mild stress test using hard data and a set of combination forecasts to see if the case for optimism holds up. As a preview, the results below imply that while it’s premature to rule out the possibility for firmer growth next year, The Capital Spectator’s view is that growth appears more likely stabilize at a relatively modest pace for the near term.

Let’s start by highlighting an analyst who disagrees. Dubravko Lakos-Bujas, JP Morgan’s chief U.S. equity strategist, sees a brighter future ahead. “The business cycle should begin to gain stronger traction by early 2020, providing further room for market upside and continued style and sector rotation,” he advised clients in a research note earlier this week. “We expect the rotation from Momentum into Value to persist as the global business cycle re-accelerates and puts upward pressure on bond yields and commodities.”

The case for optimism would be more compelling if the US-China trade war is resolved, if only in part. But let’s assume otherwise. On that basis, the potential for a positive surprise may ring clearer in the new year. For now, however, the analysis below is predicated on more of the same: stalemate in trade negotiations.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

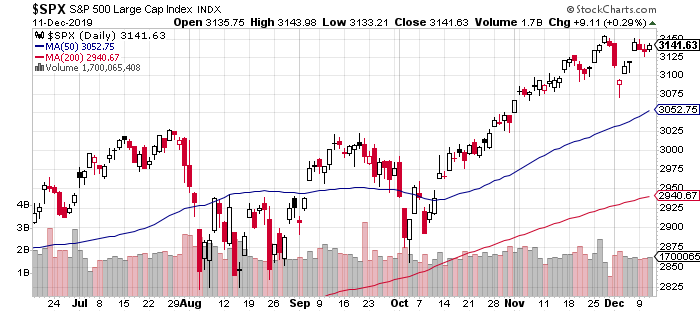

Nonetheless, Mr. Market favors the best-case scenario these days. Indeed, the S&P 500 is trading close to a record high, which implies that the crowd’s maintaining a positive outlook on economy.

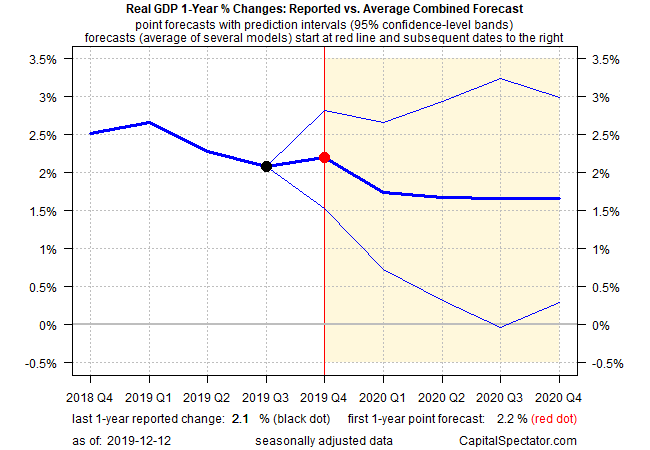

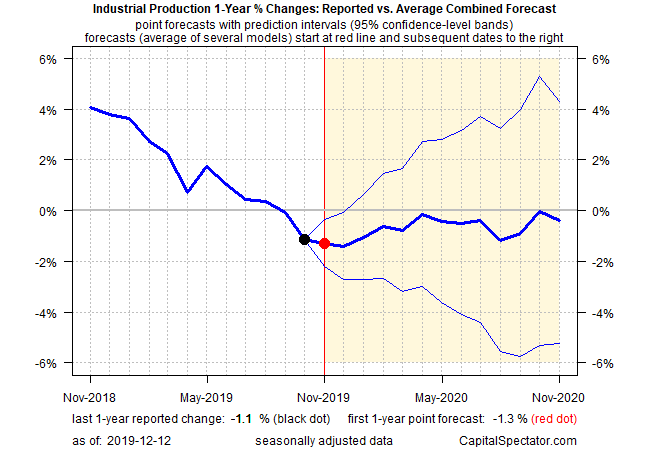

For perspective, let’s run some numbers by projecting a handful of key macro indicators using a combination methodology for forecasting the one-year trend. The goal is to minimize noise by focusing on year-over-year changes while slightly boosting the reliability of the projections by using the median forecast from a set of nine models. One caveat to consider: in the interest of brevity, the analysis below focuses on the point forecasts. In reality, the forward estimates presented can and probably will post a wider range of results, as shown by the confidence-level bands in the charts.

First up is GDP. The current estimate for the fourth-quarter anticipates a fractionally higher rate of growth: 2.2% vs. 2.1% in Q3. But for 2020 overall, the one-year trend is on track to slip to a roughly 1.5%-2.0% range. That’s enough to keep the US out of recession, but it’s weak tea for projecting a noticeable pick-up in growth. Note, too, that yesterday’s revised economic projections from the Federal Reserve also point to slow/slower GDP growth in 2020.

By contrast, the annual rate of growth for consumer spending looks set for a respectable improvement in early 2020. Herein is the strongest support for expecting better days for the macro trend. If optimism on Main Street remains upbeat, as it has recently, the case for an upside economic surprise in the months ahead may be firmer than it appears by looking though a GDP lens. On that note, tomorrow’s retail sales data for November (released on Friday, Dec. 13) will provide new perspective on the consumption outlook.

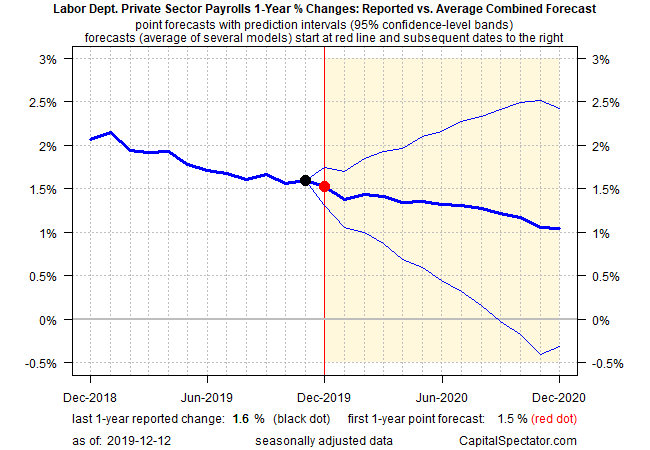

The fuel for higher consumer spending is employment, but on this front the outlook still calls for a gradually slowing trend. Private employment is still expanding by a moderately firm pace, but the growth rate still looks headed for deceleration in 2020. It’s debatable if the employment slowdown will crimp consumer spending, but at the moment it’s fair to wonder if the macro tailwind from the labor market will weaken in the year ahead.

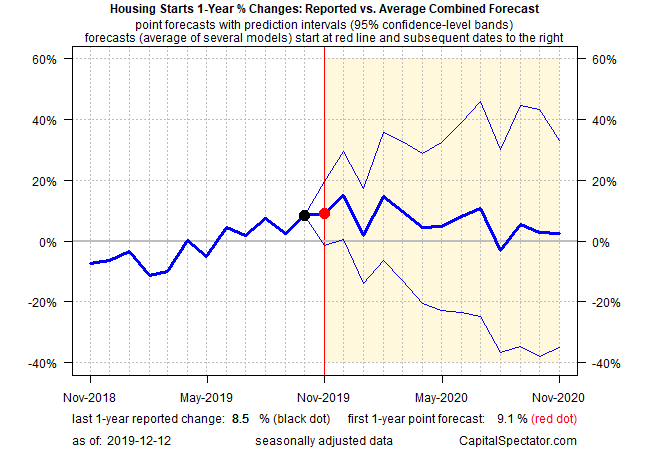

A bullish counterpoint to expecting payrolls growth to stumble can be found in projections for housing starts, which are on track to post an extended run of modest expansion after recent struggles. If correct, the housing sector (a critical source for expanding payrolls and juicing consumer spending) will be a vital source for supporting economic activity in the year ahead.

The weak corner of the economy is in manufacturing/industrial production, where a mild recession continues to prevail. The contraction looks set to roll on in 2020 in terms of the one-year trend. As a result, industrial activity will likely remain a drag on the economy for the foreseeable future.

The main takeaway from these forecasts: there’s a reasonably solid case for expecting that the recent downshift in economic growth will stabilize in early 2020. Expecting a material acceleration in output and consumption, by contrast, doesn’t look obvious, at least not yet. The same can be said for the flip side: recession risk remains low for the immediate future.

Perhaps the incoming numbers scheduled for the remainder of this year will paint a different outlook, but for now our baseline forecast continues to favor an extension of the recent slow-growth trend.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Will Economic Activity Pick Up in the New Year? - TradingGods.net

Pingback: Bilal’s Top Picks: Righteous Economic Growth / Business Cycle Dying? / Most Popular Hive Exclusives - Macro Hive