September has been kind to undervalued shares, offering investors a reason to wonder if this long-suffering slice of the US equity market is finally due to lead over its growth counterparts. A few weeks is hardly a reliable gauge, but hope springs eternal… again.

The current issue of Barron’s captured the zeitgeist for hopeful value investors, asking: “Is the great value-stock rotation finally upon us? Some signs indicate it is here, and it would be about time for fans of inexpensive stocks.”

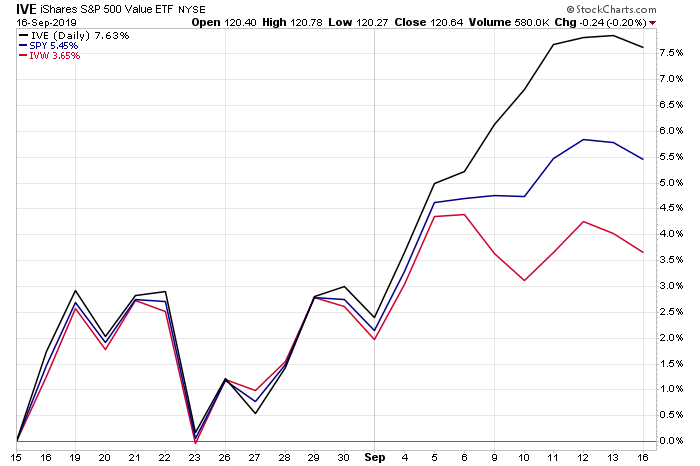

Recent market action offers a degree of support, based on a set of ETFs. For example, iShares S&P 500 Value (IVE) – a large-cap value fund – has outperformed its growth counterpart (IVW) and the broad market (SPY) by a sizable margin lately. A similar value edge is visible in the small-cap market too.

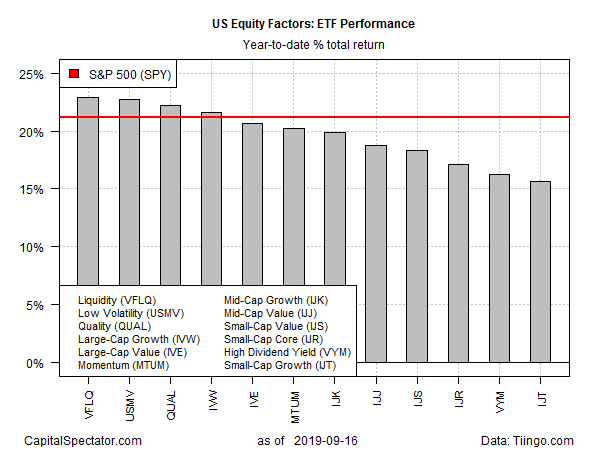

But a couple of weeks could be noise. Indeed, year-to-date results reveal that liquidity and low-volatility factors are comfortably in the lead.

Vanguard US Liquidity Factor (VFLQ) is the top performing US equity factor ETF this year. The fund is up 22.9% in 2019 through yesterday’s close (Sep. 16). A close second is the low volatility factor via iShares MSCI Minimum Volatility USA (USMV), which is ahead by 22.7%.

The year-to-date return for iShares S&P 500 Value (IVE) trails, but only modestly: the ETF is up 20.6% this year.

Is the value rally finally poised to take off? “I’m a little skeptical that this has legs,” says Aaron Dunn, co-director of value equity at Eaton Vance. “This is more of a momentum reversal and the valuations aren’t that compelling anymore.”

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

A complicating factor is the potential for blowback for the global economy following the attacks on Saudi Arabia’s oil-production facilities over the weekend. “I’m not sure the global economy is in a state where it’s going to be able to absorb [higher oil prices] if [they] stay elevated,” advises Peter Boockvar, chief investment officer at Bleakley Advisory Group.

But value stocks represent an unusual bargain, Barron’s counters: “The Russell 1000 Value Index trades at about 17 times trailing earnings compared with 27 times for the Russell 1000 Growth Index. That 10-point gap is one of the largest divergences since the global financial crisis.”

Is the discount enough to give value an edge – at a time when the US economy is facing what appears to be an extended period of softer growth, perhaps to the point of threatening a recession?

It’s fair to say that skepticism abounds, which is a byproduct of value’s long-running underperformance vs. growth.

“This recent activity that you’ve seen in value over growth hasn’t been accompanied with massive participation,” says Chris Hempstead, an ETF consultant and former head of ETF sales at Deutsche Bank. “Sure, there might be some people positioning the way it’s suggesting, but I would probably guess that the trend is going to continue, growth is going to be in favor, momentum’s going to be in favor and value’s going to still lag.”

Maybe, but for the moment the value crowd (along with contrarians) have the wind at their back.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: September Has Been Kind to Undervalued Shares - TradingGods.net

Pingback: This Week’s Best Investing Articles, Research, Podcasts 9/20/2019 - Stock Screener - The Acquirer's Multiple®

Pingback: Value Stocks Rebound More than a Flash in the Pan? - TradingGods.net