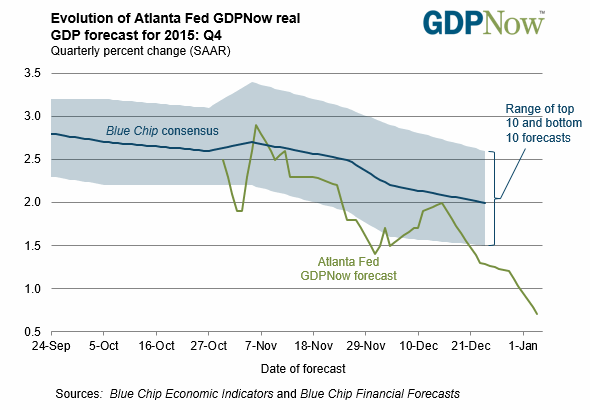

The Atlanta Fed’s widely followed GDPNow model kicked off the new year with a hefty downgrade for fourth-quarter growth expectations. Deutsche Bank jumped on the pessimism bandwagon on Tuesday. Adding to the gloom is yesterday’s numbers on auto sales for December and Monday’s weak data on manufacturing for 2015’s end. Is it time to throw in the towel for projecting US growth? No pressure, but today’s ADP Employment Report for December could drop a crucial clue.

Meantime, let’s get up to speed on how the figures have evolved for 2016 so far. The Atlanta Fed’s new estimate for the Q4 GDP report that’s due later this month is worrisome. Unfortunately, the previous forecast wasn’t all that pretty either. The bottom line: Monday’s revised estimate slumped to a tepid 0.7% quarterly increase, which is a stall-speed number. If the prediction holds up, US growth will stumble well below Q3’s 2.0% pace.

Managing expectations down certainly appeals to Deutsche Bank, which cut its Q4 GDP forecast by one percent point to 0.5%, courtesy of soft numbers for trade, construction and manufacturing. But it gets worse, the bank advised via Reuters: the weak growth projection “still might be too high in light of what could be much larger inventory liquidation than what we have assumed.”

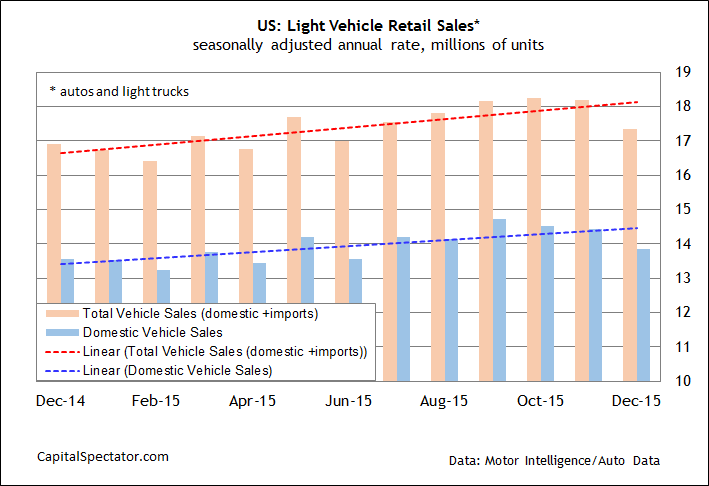

The appetite for light vehicles suffered a degree of liquidation last month. Sales slumped to a seasonally adjusted 17.34 million units last month, a relatively sizable monthly setback in the context of recent history, according to Auto Data. The news suggests that retail sales in 2015’s final month may be weaker than previously assumed.

If darkness is spreading across the macro horizon for the US we’ll probably see the evidence in ADP’s estimate for December private payrolls that’s due later this morning. This will be a critical stress test for expectations. The labor market’s generally upbeat profile in recent history has been the foundation for anticipating that the economic recovery will roll on. If this pillar gives way, all bets are off.

For what it’s worth, the outlook for today’s ADP release is moderately optimistic. If the crowd is wrong and the numbers fall well short of expectations, economic confidence will continue to suffer.

To be fair, analyzing the US business cycle from the perspective of a broad set of indicators still points to an ongoing expansion. But we’re clearly hitting some turbulence. The question is whether this week’s numbers—including Friday’s official job report from Washington—will deliver a major attitude adjustment?