Federal Reserve Chairman Jerome Powell testified in Congress yesterday that a rate cut may be near. That’s music to the ears of the bond market because it offers more fuel for extending the rally in fixed-income assets.

Every major slice of the US bond market is posting year-to-date gains, based on a set of ETFs, and the prospect of a rate cut suggests that the strong appetite for fixed-income assets will endure for the foreseeable future. Leading the way for 2019’s rally: long-term corporate bonds.

Vanguard Long-Term Corporate Bond (VCLT) closed yesterday (July 10) with a sizzling 15.6% year-to-date total return. The gain marks the best advance, by far, among the main components of the US bond market this year. Indeed, the second-best performer so far in 2019 — SPDR Bloomberg Barclays High Yield Bond (JNK) – is up 10.9% this year: a solid rally, but no match for VCLT’s surge.

In a sign of the times, an ETF that represents a broad measure of all investment-grade US debt securities — Vanguard Total Bond Market Index Fund ETF Shares (BND) — is also sitting on a tidy year-to-date increase of 6.0%.

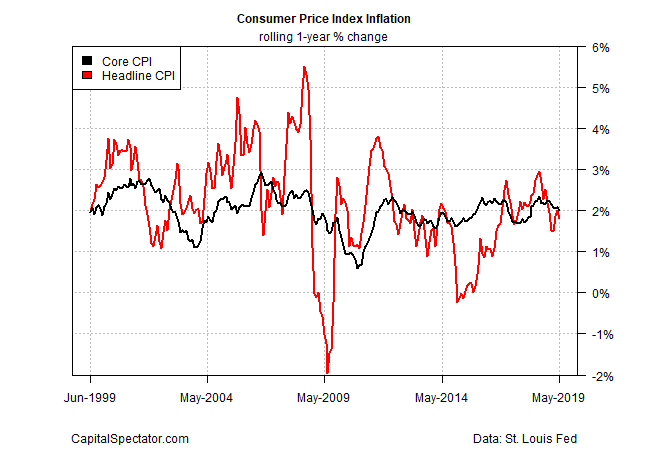

A key factor in the broad-based bond market rally is subdued inflation. Fixed-income investors live in perpetual fear that the purchasing power for the set-in-stone payouts that fixed-income securities generate will be eaten away by rising inflation. But that’s become a dormant risk in recent years, courtesy of inflation’s big fade of late.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Core inflation for consumer prices, for example, is currently rising at 2.0% on an annual basis through May, which matches the Fed’s inflation target. Headline CPI (which includes energy and food) is even softer, advancing by just 1.8%. Today’s inflation update for June is expected to report more of the same. Core CPI is on track to hold steady at 2.0% and headline pricing pressure will dip to 1.6%, based on Econoday.com’s consensus forecast. In other words, the lowflation gravy train for bonds is set to roll on for the near term, and perhaps longer.

Powell’s testimony yesterday aligns with the lowflation expectations, at least for the immediate future. “Our baseline outlook is for economic growth to remain solid, labor markets to stay strong, and inflation to move back up over time to the committee’s 2% objective,” Powell said in prepared remarks. “However, uncertainties about the outlook have increased in recent months.”

It’s those uncertainties that keep the bond market humming. All the more so with expectations that economic growth is slowing. As reported earlier this week by The Capital Spectator, the upcoming second-quarter report for US gross domestic product is on track to reflect a sharp deceleration in output, based on the median estimate for a set of nowcasts.

Not surprising, Powell’s latest comments have been widely interpreted as laying the groundwork for a rate cut at the July 31 policy meeting. In turn, that implies higher bond prices, which move inversely with interest rates. Fed funds futures are currently pricing in a near certainty that the central bank will trim its target rate, according to CME data.

Meanwhile, the Treasury market’s implied inflation forecast continues to anticipate that pricing pressure will remain below the Fed’s 2.0% target. The spread on the 5-year nominal Note less its inflation-indexed counterpart, for example, is currently projecting inflation at slightly less than 1.6%.

The market, in sum, anticipates that macro conditions will remain favorable for fixed-income assets. But not everyone’s drinking the Kool-Aid.

“Markets can make mistakes. The bond market may have over-reacted. That does worry me,” advises Colin Harte of the multi-asset solutions team at BNP Paribas Asset Management. “A lot of people have expectations of central banks being very accommodative and sensitive to financial markets. There’s a danger in that.”

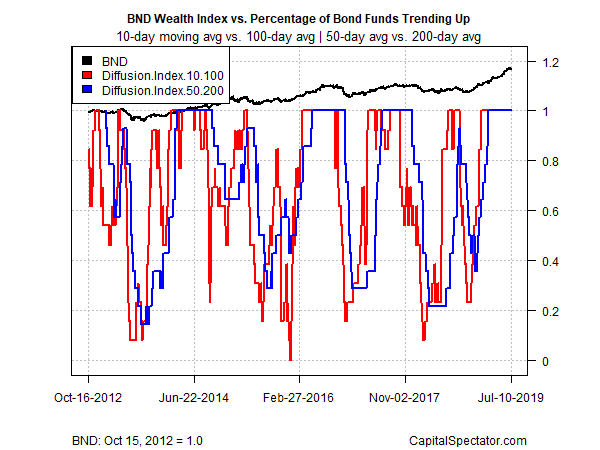

Perhaps, but at the moment the crowd is in a celebratory mood and pricing bonds as if the potential for inflation danger in the near term is virtually nil. Indeed, a measure of momentum in the fixed-income market continues to reflect something approximating nirvana, based on two measures of the price trend for the funds listed above.

The first metric compares each ETF’s 10-day moving average with the 100-day average — short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) offers an intermediate measure of the trend (blue line). The indexes range from 0 (all funds trending down) to 1.0 (all funds trending up). Using prices through yesterday’s close shows that all the bond ETFs remain in a strong bullish posture. The implication: the rally in everything still has room to run.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Will Bond Rally Be Extended by Rate Cuts? - TradingGods.net