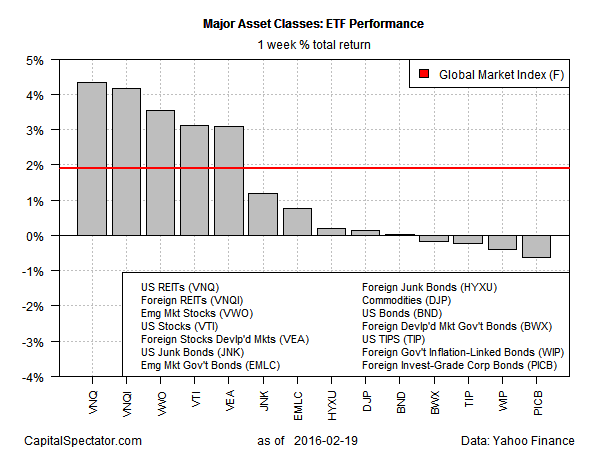

Stock markets around the world bounced last week, based on a set of proxy ETFs representing the major asset classes. Breaking with the recent bias for selling risk, global equities (along with REITs and US high-yield bonds) posted solid gains for the shortened four-day trading week in the US through Feb. 19.

Last week’s leader: US real estate via the Vanguard REIT (VNQ), which added 4.3%. The biggest loser last week: foreign corporate bonds via PowerShares International Corp Bond (PICB), which eased 0.6% for the four trading days through Feb. 19.

The tailwind lifted an ETF-based version of the Global Market Index (GMI.F). This passively managed benchmark that holds all the major asset classes in market value weights rebounded handsomely last week, rising 1.9%.

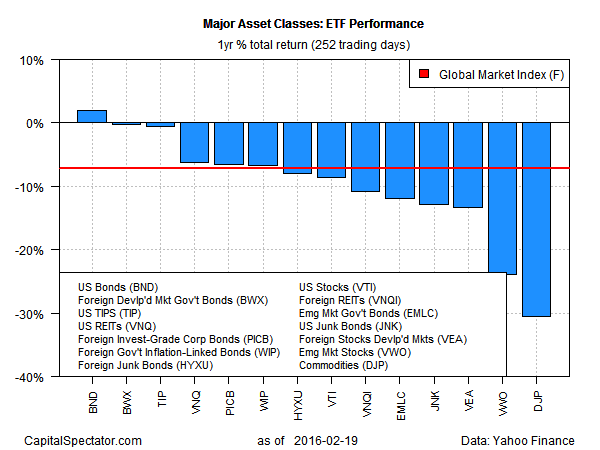

Despite last week’s risk-on revival, trailing one-year total returns remain overwhelmingly in the red for most of the major asset classes and GMI.F. Although last week’s results pare the declines, most of the major asset classes remain firmly under water across the 252 trading days through Feb. 19. Broadly defined commodities (DJP) continue to suffer the biggest setback, sliding more than 30% as of last Friday. US investment-grade bonds are the lone exception for the annual comparison at the moment. Vanguard Total Bond Market (BND) is ahead by 1.8% for the trailing one-year period.

The big question for the week ahead: Is the latest round of firmer pricing a sign that a degree of stabilization is unfolding in the markets after a rough start to 2016? Or is last week’s pop another installment of the dead-cat bounce? One reason for remaining cautious: negative momentum continues to dominate pricing behavior for the major asset classes. For instance, the 50-day moving averages for the three equity ETFs in the charts above that represent global stocks—VTI, VEA, and VMO—remain below the respective 200-day averages. In other words, interpreting last week’s bounce as the start of a sustained rally for risky assets still falls into the category of speculation at the moment. Will the long odds for thinking otherwise find more support this week?

Pingback: 02/22/16 – Monday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Is Sainsburied? | Vestact's – Quirk with quark