There’s renewed talk of a looming US recession these days. One argument that’s topical is the view that we’re overdue for a downturn. The current expansion, which began in mid-2009 (based on NBER data), is now six years old, which ranks as above average for the post-World War II era. By some accounts, that’s a smoking gun. But it’s debatable if the age of expansions per se is truly a factor that determines the timing of contractions. Financial and economic context, in other words, is critical. Meantime, some economists argue that because the recovery from the Great Recession has been slow, the length of the expansion will be longer than usual. In any case, the current profile suggests that recession risk is low, based on the published numbers to date.

Monitoring recession risk requires a number of techniques, including a review of labor market trends. Let’s consider how the business cycle looks from three perspectives: jobless claims, the Federal Reserve’s Labor Market Conditions Index, along with a markets-based estimate of recession risk. Running these figures through a probit model suggests that the probability is low that NBER will declare June 2015 as the start of a new recession. We’ll have a clearer view of how last month stacks up when I update the Economic Trend & Momentum indices in a few weeks. Meantime, the early clues suggest that macro risk is still low for the US.

Let’s start with jobless claims. Based on monthly averages of this leading indicator, recession risk probability is under 5% at the moment.

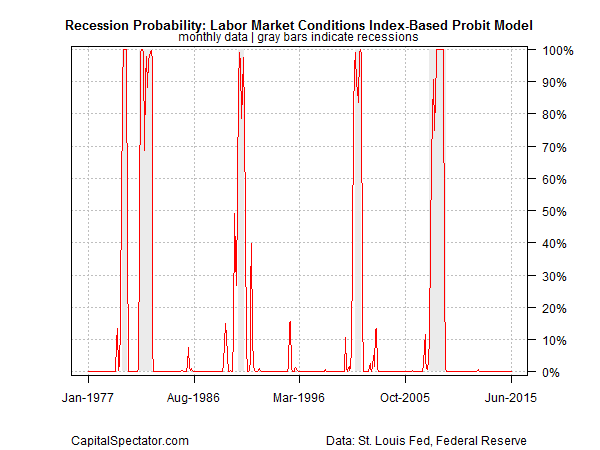

A similar message emerges from the Fed’s Labor Market Conditions Index, a dynamic factor model that analyzes 19 indicators. Using this benchmark as a guide implies that recession risk was virtually nil as of last month.

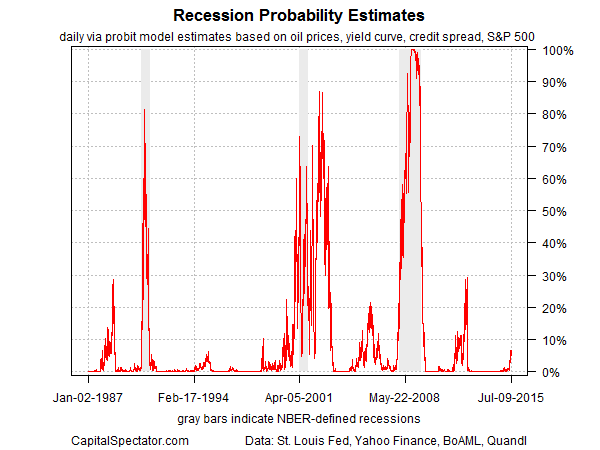

Finally, consider a real-time approximation of economic conditions via a probit model that crunches the numbers on four data sets: the US stock market (S&P 500); the Treasury yield curve (10-year yield less the 3-month T-bill yield); the credit spread (BAA-rated bond yield less AAA yield); and spot crude oil prices (based on the US benchmark, West Texas Intermediate). The current estimate with this analysis still points to growth. The probability that an NBER-defined recession has started for the US has ticked up lately, according to this methodology, but it’s still quite low in historical terms–under 10% as of July 9.

The basic message: it’s unlikely that a new recession started in June. That’s an encouraging clue for anticipating that CapitalSpectator.com’s monthly review of conventional economic numbers through last month (once all the figures are published) will tell a similar story.

Yes, macro conditions could change quickly. That’s a reminder that ongoing and frequent analysis is essential. But for the moment, the case for arguing that the US economy is stumbling requires a fair amount of guesswork about the future.

Pingback: 07/10/15 - Friday Interest-ing Reads -Compound Interest Rocks