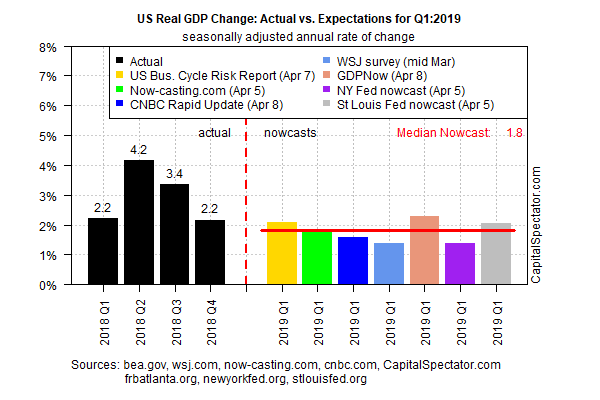

Revised nowcasts for the US economy edged higher in recent days, but the Bureau of Economic Analysis is still expected to report a slowdown in growth for the first-quarter report on gross domestic product (GDP) that’s due on April 26.

The “advance” GDP report is expected to show that output increased 1.8% in Q1, based on a set of estimates compiled by The Capital Spectator. The revised nowcast marks a slight improvement over the previous outlook from late-March, but a 1.8% increase still reflects a softer trend vs. recent history. If today’s projection is accurate, the economy is on track to decelerate for a third straight quarter, easing from the modest 2.2% gain in last year’s Q4.

The IMF advises that the global economy is also slowing, adding to macro headwinds facing the US in 2019. In an update published yesterday, the IMF says world output will rise 3.3% this year, down from October’s 3.7% forecast. For the US, the new full-year estimate has been trimmed to a 2.3% increase for 2019, down from previous 2.5% estimate.

“After strong growth in 2017 and early 2018, global economic activity slowed notably in the second half of last year, reflecting a confluence of factors affecting major economies,” the IMF advises.

China’s growth declined following a combination of needed regulatory tightening to rein in shadow banking and an increase in trade tensions with the United States. The euro area economy lost more momentum than expected as consumer and business confidence weakened and car production in Germany was disrupted by the introduction of new emission standards; investment dropped in Italy as sovereign spreads widened; and external demand, especially from emerging Asia, softened.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

But while the pace of expected growth for the US and the world has decelerated, forecasters still anticipate that the expansion will stay strong enough to stave off a new recession, at least for the near term. That outlook aligns with The Capital Spectator’s business cycle profile for the US, as reported in late March.

The recent deceleration in US economic activity in last year’s second half is expected to spill over into 2019’s first quarter, but there are signs that the slowdown may be stabilizing. A fresh run of numbers for a broad range of indicators shows that the deterioration in the macro trend has ended, at least for now, based on analyzing the data published to date.

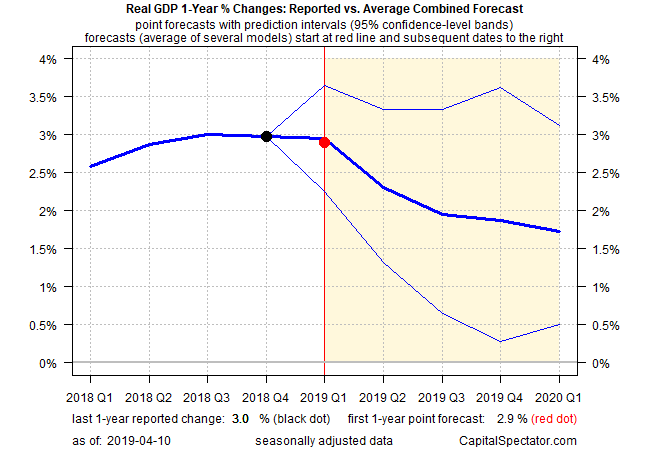

Although a US recession isn’t imminent, the prospects remain low that we’ll see a material upturn in economic activity in the foreseeable future. Looking ahead via projections of the US GDP trend on a year-over-year basis suggests that economic activity remains on track for a downshift. The Capital Spectator’s average estimate via a set of combination forecasts indicates that the point forecast for this year’s annual first-quarter increase will slow fractionally to a 2.9% pace from 3.0% in Q4 and continue to soften in the quarters ahead.

It’s still reasonable to expect that the long-running US expansion will prevail through this June, when it will match the 120-month growth record set in 1991-2001, according to NBER data. The growth outlook, however, remains subdued, based on numbers published to date.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report