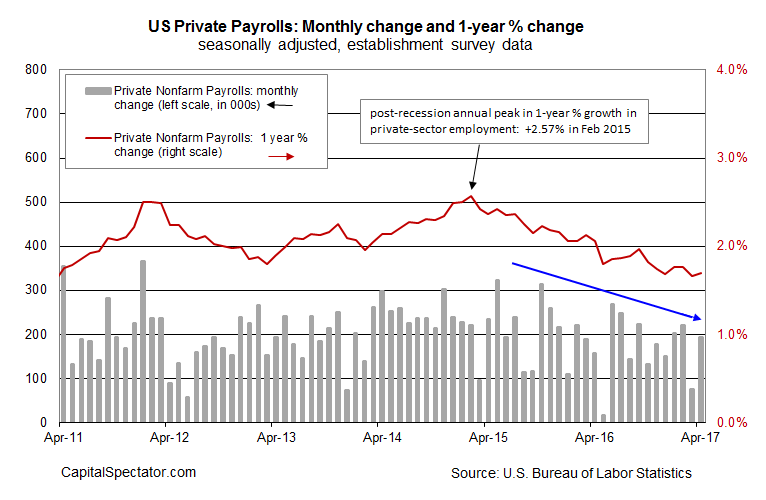

The pace of job creation picked up sharply in April, the Labor Department reports. The solid increase suggests that the weak gain in March, which was revised down, was an anomaly. That’s an encouraging sign, and for the moment it revives the view that the US labor market is still expanding at a healthy if unspectacular rate. Nonetheless, the latest numbers also reaffirm that the year-over-year comparison is still signaling a decelerating trend, which has been playing out over the past two years.

The monthly comparison for April, however, marks a timely rebound. Private payrolls rose 194,000 last month, a sharp improvement over March’s weak 77,000 advance. But the broader trend, for both monthly and year-over-year changes, continues to highlight the reality that workforce growth continues to slow.

Private payrolls increased 1.69% in April vs. the year-earlier month, a fractionally higher gain vs. the previous update. But there’s nothing in today’s results to suggest that the two-year-old downshift in job creation is stabilizing, much less reversing.

For now, the case for expecting that the downshift will end or reverse rests largely on expectations that the Trump administration will deliver pro-growth policies that make a difference. Maybe, but the hard data for employment doesn’t offer much support for that view, at least not yet.

But some analysts think that the numbers have a decent chance of providing more impressive results in the months ahead.

“Labor market conditions remain robust and continue to tighten,” says Ward McCarthy, chief financial economist at Jefferies LLC. “This data will keep the Fed on track for a preferred 2017 normalization timeline of rate hikes in June and September and the first step toward balance-sheet normalization in December.”

The danger is focusing on the latest monthly result as the basis for assuming that the macro trend is destined to accelerate. Anything’s possible, of course, but the more reliable annual data suggests a degree of caution is still in order.

That said, the roughly 1.7% pace is still strong enough to keep the economy moving forward for the near term. But using the numbers in hand tells us that the growth cycle for payrolls has passed its prime and continues to age. That’s not terrible, assuming that the slow fade of recent vintage remains intact. That’s my base-case assumption, largely because that’s been the trend for the past two years. The risk factor is that the Fed continues to tighten in the months ahead. If so, will that push the year-over-year trend lower at a sharper pace? In that case, there could be trouble ahead for the macro profile – trouble that’s not conspicuous via the latest rebound for the monthly comparison.

Ideally, the Fed’s tightening is sufficiently gradual so as to minimize or eliminate any fallout on labor-market growth. But that begs the question: What defines “gradual” for rate hikes in the current climate? The answer is a work in progress in an economic climate for which there’s little if any precedent from a monetary policy perspective, i.e, reversing an unprecedented degree of policy stimulus.

The worst-case scenario would be if the growth in employment is strong enough to convince the Fed to keep tightening but the marginal effect on consumer spending and future hiring plans turns out to be a net negative, if only on the margins. It’s premature to assume that this will be fate, or even that it’s likely. Perhaps next week’s retail sales data for April will provide deeper clarity for evaluating this risk.

The good news is that retail spending’s annual pace continued to hold above the 5% mark in March for a third month — the best run of growth in five years. It’s an encouraging sign, and one that would be strengthened if the April numbers deliver a repeat performance.

Pingback: Labor Department Reports the Pace of Job Creation Up - TradingGods.net

Pingback: Stock Market Volatility and Recessions: A Primer - Investing Matters