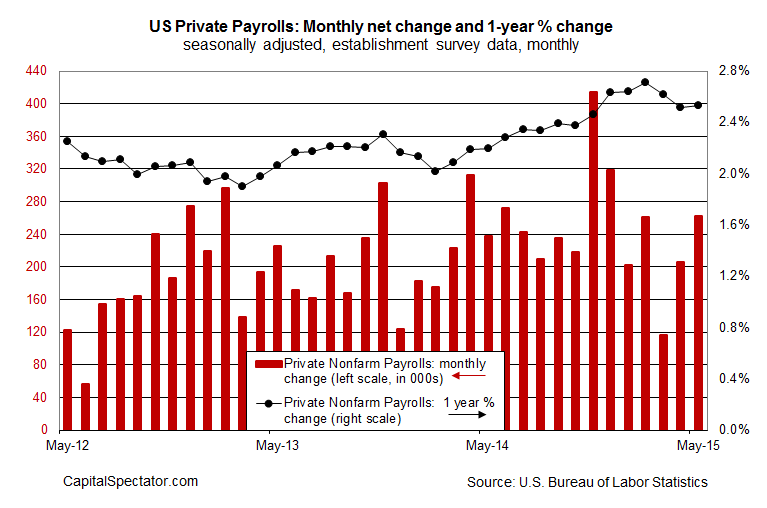

US private payrolls increased by a healthy 262,000 in May, the Labor Department reports—substantially more than the consensus forecast of a 215,000 gain, based on Econoday.com’s data. The news is another clue that boosts the odds for a second-quarter rebound. But when we look past the noise of the monthly fluctuations, today’s update reminds that not much has changed, which is to say that a solid, steady year-over-year growth rate for private payrolls endures.

The annual pace of growth ticked up in today’s report, but just barely. Nonetheless, the key point is that payrolls increased just slightly above the 2.5% rate in May vs. the year-earlier level. That’s virtually unchanged from April’s year-over-year gain. The main takeaway: the private sector continues to mint jobs at an encouraging pace. But that’s unremarkable. Why? Because that upbeat message has been with us all along from the perspective of the annual comparison.

Granted, the annual pace is slightly slower compared with last year’s fourth-quarter. But the deceleration is trivial in the grand scheme of the broad trend. The usual suspects prefer to play up the drama by sensationalizing the fluctuations in the monthly comparisons. That’s a useful tactic for attracting attention, but it’s misguided for analyzing the business cycle. The fact remains that the growth rate for payrolls has been fairly steady in terms of the year-over-year change, which is a far more reliable measure of the trend vs. the monthly changes that tend to dominate the headlines.

In any case, today’s results reaffirm the generally healthy numbers for job creation, which suggests that the Federal Reserve’s plans to start raising interest rates remain a viable prospect, perhaps as early as September. Indeed, in the wake of today’s labor market release the benchmark 10-year Treasury yield is trading slightly above the 2.40% mark (as of mid-morning New York time) for the first time since last October. Surprising? Not particularly. As I noted earlier this week, the Treasury market has been skeptical of the recession forecasts spewing forth from some corners–a skepticism that appears a bit more reasonable in the wake of today’s release on payrolls.

Where did the Treasury market get the idea that recession risk is low? A careful reading of the data is one possibility–a subject that’s been a regular feature on CapitalSpectator.com in recent weeks—see here, here, and here, for instance.

The future’s still uncertain, of course. The good news is that recent history is relatively clear. The catch is that you have to be looking at the numbers objectively. As it turns out, that’s still a challenge for some folks.

Pingback: Wall Street National | Return Of The Bond Vigilantes - Wall Street National

Pingback: Wall Street National | Can A Weak Industrial Sector Drag Down The U.S. Economy? - Wall Street National

Pingback: Wall Street National | The Treasury Market Is Still Pricing In A Rate Hike - Wall Street National