US jobless claims rose last week, the Labor Department reports, although new filings remain close to four-decade lows. Despite the latest jump, today’s news suggests that the labor market is still expanding. As a result, any blowback from the recent turmoil in global markets and diminished expectations for the world economy has yet to make a serious dent in the forward momentum for the US macro trend.

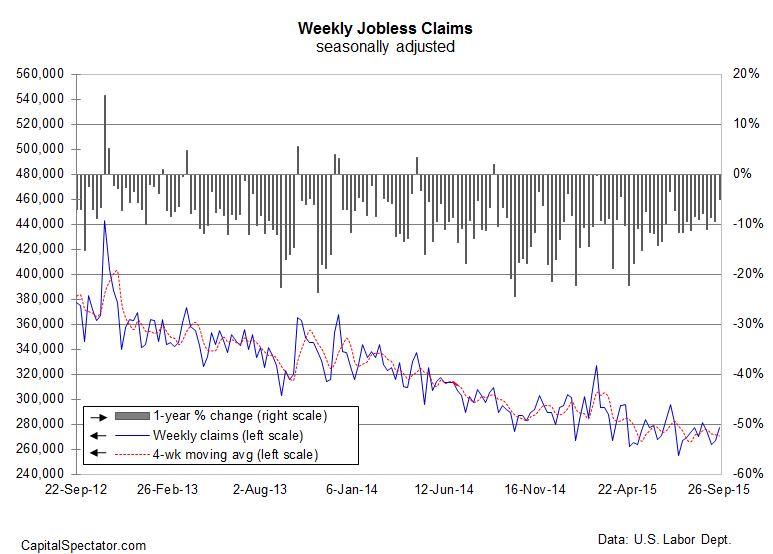

New filings for unemployment benefits increased 10,000 to a seasonally adjusted 277,000 for the week through Sep 26. But that’s still near the four-decade low of 255,000 that was briefly touched back in July. Jobless claims bounce around a lot in the short term, but there’s no mistaking the downward trend that’s been in place this year. The year-over-year change for claims continues to radiate a bullish glow—new filings dropped 5.1% last week vs. the year-earlier level. In fact, claims have declined in annual terms in every week since August 2014.

If there’s a recession lurking in the near future, there’s no sign of it in this leading indicator. Quantifying the probability of new downturn based on jobless claims through Sep. 26 via a probit model continues to show that the odds are low that NBER–the official arbiter of US business cycle dates–will declare last month as the start of a new recession. The upbeat signal follows the positive trend that was still bubbling in last month’s business cycle review.

“Layoff activity remains modest,” Tom Simons, an economist at Jefferies LLC, tells Bloomberg, “Labor-market conditions are pretty tight. The slack continues to decline.”

Today’s update on claims suggests that tomorrow’s September report on payrolls from Washington will deliver encouraging news too. Yesterday’s ADP Employment Report for last month also projects a healthy number for the official data from the Labor Department that’s due on Friday. No wonder that economists overall are looking for good news. Econoday.com’s consensus forecast for private-sector jobs calls for a 195,000 increase in September, a substantial improvement after August’s weak gain of just 140,000.

The weak spot in the US economy is still manufacturing, as today’s update from the Institute for Supply Management reminds. The ISM Manufacturing Index slipped to 50.2 last month, close to the neutral mark of 50 that separates growth from contraction.

Markit’s revised figures for the US Manufacturing Purchasing Managers’ Index (PMI) reflects a moderately stronger pace for the sector in September, but this data is also showing a sharply softer rate of growth. But as Markit’s chief economist reminds,

The manufacturing sector only accounts for around one-tenth of the economy, and robust service sector data – as indicated by last week’s flash PMI results – indicate that the wider economy remains in good health, albeit with signs that businesses have become more worried about the outlook. The survey data suggest that the economy continued to grow at a 2.2% annualized rate in the third quarter and added 207,000 jobs in September.

In other words, when you strip out all the noise and refrain from cherry-picking an indicator or two to promote a certain agenda, one key theme emerges intact: the US is still poised to grow at a moderate pace. That could change, depending on what the numbers reveal in the days and weeks ahead. But for the moment, arguing that the US economy is slipping over to the dark side still requires a fair amount of speculation and a concerted effort at ignoring the broad set of indicators published to date.