Today’s December updates on retail sales and industrial production for the US delivered disappointing news. Negative comparisons weighed on both indicators for last month, raising more doubts about the strength of the US economy. There’s also a bit of good news on the margins in the year-over-year comparisons. Nonetheless, it’s hard to overlook the deterioration in these numbers as last year came to a close.

Let’s start with retail spending. Last month’s 0.1% decline marks the first monthly setback since September. The good news is that the year-over-year pace picked up for headline spending. Retail sales rose 2.2% in December vs. the year-earlier level—the strongest annual advance since July. Meanwhile, stripping out gasoline sales reveals that spending climbed 3.9% in annual terms last month, roughly in line with the year-over-year gain in the previous month. The stability in spending ex-gas reflects a degree of resilience that’s not obvious in the monthly comparison.

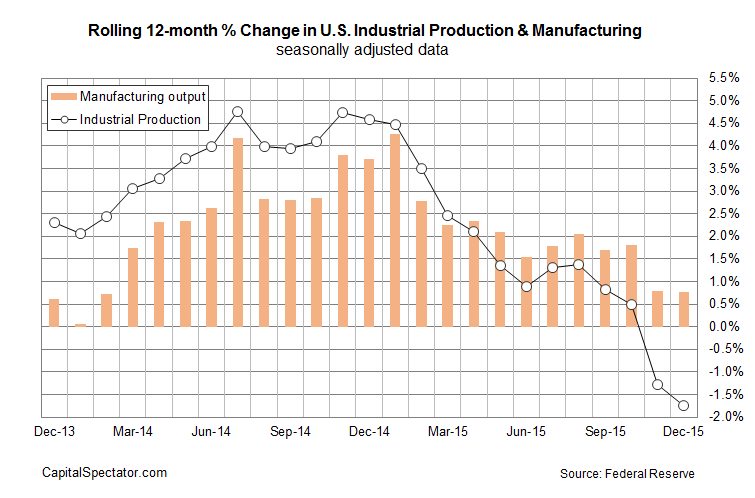

Moving on to industrial production, output fell 0.4% in December–the third monthly decline in a row. In contrast with retail sales, the year-over-year comparison is negative for the industrial sector, and sinking deeper into the red. Production fell 1.8% for the year through December, marking an acceleration vs. the decline posted in November, which delivered the first round of red ink in annual terms since late-2009.

Note, however, that the manufacturing component for industrial activity is still posting a year-over-year gain for December. The annual growth for manufacturing is weak, but it’s stable at +0.8% for the second month in a row. That’s a tepid gain, but it could be a clue for thinking that output will stabilize in the months to come.

Grasping at straws? Perhaps. But given last week’s strong numbers for nonfarm payrolls in December, it’s premature to assume the worst for the US economy.

Nonetheless, the sight of weak numbers for retail sales and industrial production certainly raises the stakes. Reacting to today’s soft data for retail sales, an economist at the Jefferies Group said that “there isn’t anything encouraging in this report. It’s very disappointing,” Thomas Simons tells Bloomberg. “The labor market is in good shape, which suggests the outlook is probably better than this.”

What does all this mean for recession risk? The latest batch of numbers doesn’t help, but there’s still enough forward momentum to keep the broad trend in the positive column through the end of 2015 and probably into January. But the margin for error is dwindling… again. I’ll have an update on how the latest releases impact the nowcast for the macro profile in this weekend’s update of the US Business Cycle Risk Report.

Meantime, the headwinds for growth are blowing harder, which means that next week’s updates could be decisive, for good or ill. The margin for disappointment, in short, has evaporated and we’re again we’re moving dangerously close to the red zone. Is it another false warning? Possibly. It wouldn’t be the first time in the post-2008 era that the economy has stalled, or come close to stalling, and then reaccelerated.

We’ll know more in a week or two, once the rest of the hard numbers for December are published. But until further notice, it’s going to be a bumpy ride as the crowd struggles to figure out what comes next.

Jim,

Did I miss the latest posting of the Crash Risk Index??

Thanks!

Bob Tavano

Pingback: Retail Sales and Industrial Production Decline for December

The last update was early Dec:

http://www.capitalspectator.com/us-equity-market-risk-rises-to-2-month-high/

In addition, I also wrote about a component of CRI last week, that painted a worrisome profile:

http://www.capitalspectator.com/is-a-bear-market-growling-for-us-stocks/

It’s all a moot point now–the cat seems to be out of the bag.