If the Federal Reserve needed another excuse to postpone a second interest-rate hike, today’s March report on residential housing construction fits the bill. Housing starts slumped last month, dealing a downside surprise to market expectations for a modest bump. The news follows last week’s disappointing data on retail spending and industrial activity at the end of the first quarter.

The outlook for next week’s initial estimate of Q1 GDP is already dangerously low–at a stall-speed 0.3%, according to the Atlanta Fed’s Apr. 13 nowcast. Today’s release certainly doesn’t offer any reason to think that the tepid GDP projection is set to rise ahead of the official GDP numbers on Apr. 29.

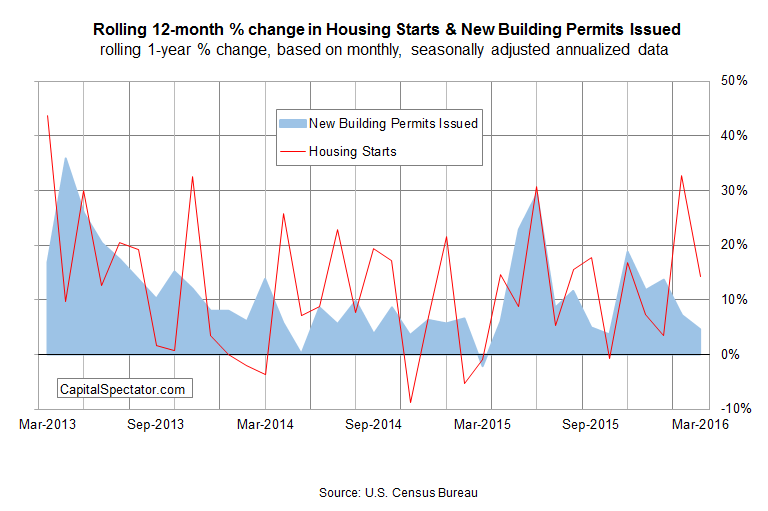

Newly issued building permits for housing also retreated last month. There’s still a decent year-over-year growth trend, particularly for starts. But today’s numbers don’t paint a flattering profile for the housing sector.

Looking past the monthly noise still leaves for optimism. Housing starts advanced 14.2% last month vs. the year-earlier level (via seasonally adjusted annualized data). That’s a decent pace but it’s middling at best relative to recent history.

Newly issue building permits, however, look substantially weaker. Considered a leading indicator for starts, permits in March climbed a soft 4.6% vs. the level from a year ago—the weakest gain in five months.

“The housing recovery seems stuck in neutral,” Millan Mulraine, deputy head of U.S. research and strategy at TD Securities, observes via Bloomberg. “We’ve seen strength in the labor market, improvement in consumer confidence, yet the housing recovery has been in low gear.”

Is the weak housing recovery a problem for the macro outlook? Not yet, but the April figures could be telling. Meantime, the economy’s soft patch rolls on. The numbers overall aren’t yet fatal for calling a new NBER-defined recession, as noted in this past week’s update of The US Business Cycle Risk Report. But the updates of late have been lackluster to negative–industrial production and retail sales fell in March, for instance.

The main roadblock for an all-out pessimistic view is the labor market, which still looks solid. In fact, last week’s update on jobless claims revealed that new filings for unemployment benefits dipped to the lowest level in early April since 1973!

Is the upbeat data for payrolls sufficient to overcome weakness elsewhere in the economy? Probably, but the answer may change if indicators from other corners continue to stumble.

In any case, it’s likely that the Federal Reserve will take a pass on tightening monetary policy at next week’s FOMC meeting. Nonetheless, one of the Fed heads who’s voting “yea” or “nay” these days on monetary matters thinks that the markets are too dovish on the prospects for rate hikes. “The very shallow path of rate increases implied by financial futures-market pricing would likely result in an overheating that necessitates the Fed eventually raising interest rates more quickly than is desirable, which could endanger the ongoing recovery and continued growth,” says Boston Fed President Eric Rosengren. But those comments predate today’s update on housing starts.

Pingback: Housing Starts in March Decline - TradingGods.net