US Treasury yields continued to rise yesterday, with the rate on the benchmark 10-year Note reaching 2.50%–the highest level since last September, based on data from Treasury.gov. Meanwhile, the 2-year yield—considered the most sensitive spot on the yield curve for rate expectations—ticked up to a four-year high of 0.75% on Wednesday (June 10).

The Treasury market has been dropping signals lately that rates are headed higher (as I’ve been discussing in recent weeks), and yesterday’s trading reaffirms the upward bias that’s been bubbling anew. The deflation trade, as Ambrose Evans-Pritchard notes, has gone “horribly wrong,” in the US and around the world.

Deciding if US rates will continue to rise from here is largely dependent on the economic numbers in the days and weeks ahead, starting with today’s monthly update on retail sales. Based on Econoday.com’s consensus forecast, the outlook is positive, with spending set to post a solid rebound in May after several months of disappointing numbers.

Meantime, recent data for the labor market paints an encouraging profile. After last week’s surprisingly strong rise in payrolls for May, along with jobless claims sticking close to a 15-year low, the Labor Department this week advised that job openings in April jumped to a 15-year high.

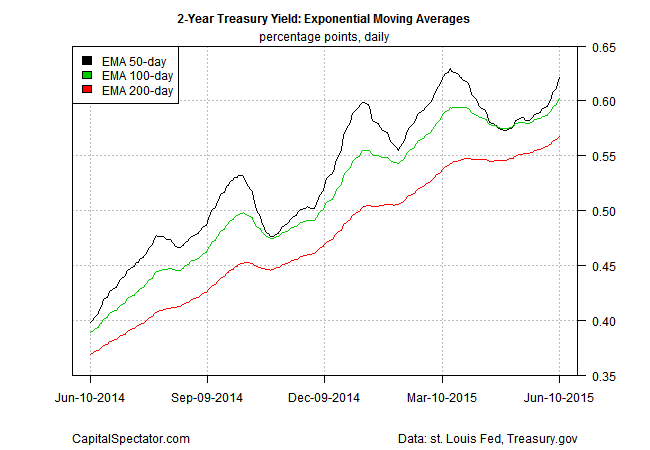

The net result is that the Treasury market is focused on the rising possibility that the Federal Reserve will start raising interest rates in the near future, perhaps as early as September. But as the chart below shows, Mr. Market is inclined to do the heavy lifting ahead of a formal announcement from the central bank.

The World Bank yesterday joined the IMF in asking the Fed to delay tightening. But using inflation-adjusted base money supply as a guide, it seems that Yellen and company have been in squeeze mode for some time. Real M0 money supply growth has crashed to a thin 1% year-over-year gain, which is to say that growth has been effectively flat lately for the first time in three years. That’s a world below the 30%-plus annual increases in M0 in late-2013/early 2014.

Not surprisingly, upward momentum for the 2- and 10-year yields is strengthening in the current climate.

Keeping rates moving higher is increasingly a data-dependent task. Disappointing numbers on the macro front could reverse the renewed influence of the bond vigilantes in a heartbeat. But as long the US labor-market data remains firm, the odds appear skewed in favor of higher rates and vigilantism of the fixed-income variety.

I’ve always thought of bond vigilantes as bond market participants who are concerned about fiscal policy (especially deficits), not market participants anticipating changes in monetary policy.

Pingback: Thursday Morning Links | timiacono.com