The Treasury market’s implied inflation forecast continues to rise, but the source of this reflationary trend is born of a growing divergence between nominal and real (inflation-adjusted) Treasury yields. Explaining the divergence and pondering the implications can take several paths. But no matter your preference, all roads begin with monitoring the data that highlights this expanding gap.

The first point to note: the spread between nominal less inflation-indexed Treasury rates continues to rise – an increase that many analysts cite as a key indicator for the revival in reflation sentiment. The spread for 5-year maturities, for example, edged up yesterday (Feb. 8) to 2.31 percentage points, an 8-year high.

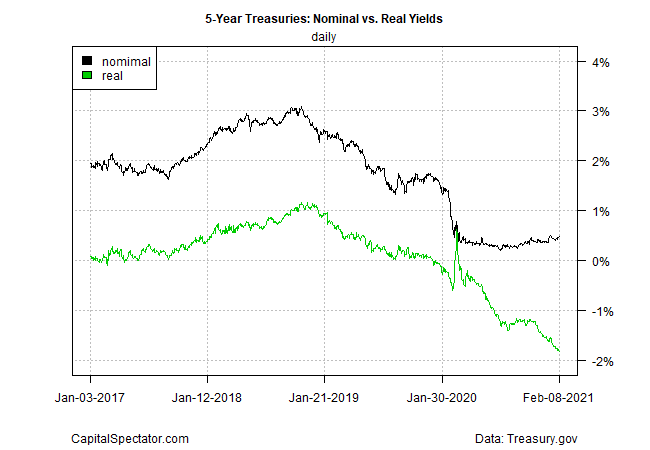

The key driver for this reflationary trend is primarily due to an ongoing slide in the real Treasury yield, supported by a relatively mild rise (so far) in the nominal yield. Here’s how the rates for 5-year maturities compare since 2017. Note the expanding divergence over the past year:

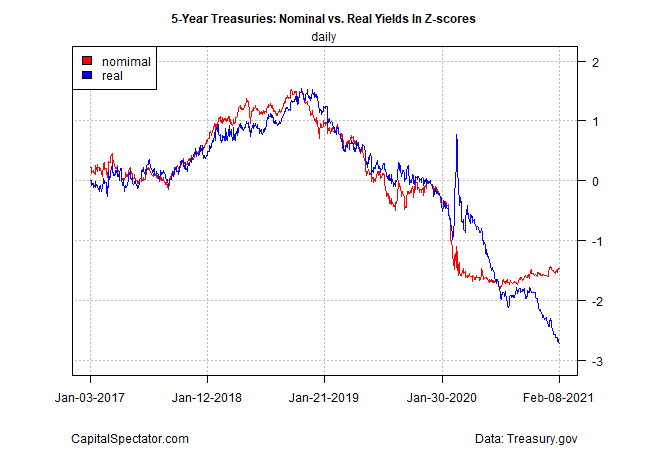

For a clearer visual comparison, let’s transform the 5-year yields into z-scores, which measure standard deviations from the mean:

Prior to the pandemic, the nominal and real 5-year yields were closely correlated. Over the last year, however, the relationship broke down. Clearly, the coronavirus crisis has altered the relationship. It’s unclear if this is a temporary or permanent change, but for the moment it’s significant, and increasingly so, thanks mostly to a real yield that’s dropping like a stone.

Untangling the underlying economic logic is a work in progress, but there are several possibilities to consider. One is that the yield divergence reflects investor confidence that the Fed will keep inflation under control, supported by secular disinflationary forces. The central bank has recently announced that it will allow pricing pressure to run hot above its 2% target for a period of time, but the crowd appears to be convinced that materially higher levels of inflation remain a low-probability scenario.

Another view is that the Treasury market generally, and inflation-protected securities in particular, is no longer functionary properly. As a result, market-based yields aren’t a reliable gauge. Central to this idea is the Fed’s relatively aggressive management of yields. One of several smoking guns in this line of reasoning: the central bank’s unusual intervention in the bond last spring to reverse a spike in corporate bond yields.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Whatever the explanation, investors should watch how nominal and real Treasury yields evolve in 2021. Although the economic rationale for diverging Treasury yields is open for debate, the investment implications are cut and dry. Indeed, when you purchase a Treasury security you’re locking in a yield. Holding a nominal Treasury is the equivalent of locking in a nominal yield (with a floating real yield). Inflation-protected Treasuries (TIPS) offer the opposite mix: locking in a real yield with a floating nominal rate.

On that basis, buying a 5-year TIPS assures a negative real yield to the tune of -1.83%, an exceptionally unattractive proposition. The counter-argument is that if inflation rises, the potential for capital gains in TIPS, combined with the inflation-adjusting-payout mechanics of these bonds, may offset the unappealing state of real yields at the moment. A related case for buying TIPS is that the bonds remain attractive as a short-term trade, assuming that real yields continue to fall.

But for longer-term/buy-and-hold investors the key question is whether future inflation will rise enough to offset a near-2% negative real yield? That’s a high bar, at least based on current inflation data.

But the future will be different, the inflationistas predict. Thanks to several converging regime shifts, including a massive spending program backed by the Biden administration, the reflation trend is just beginning.

This much is clear: a mild and temporary runup in inflation won’t offset the deeply negative real yields in 5-year TIPS. If you’re buying and holding this maturity, you’re assuming that a hefty dose of reflation is near and it will be brutal.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Growing Divergence Between Nominal and Real Treasury Yields - TradingGods.net