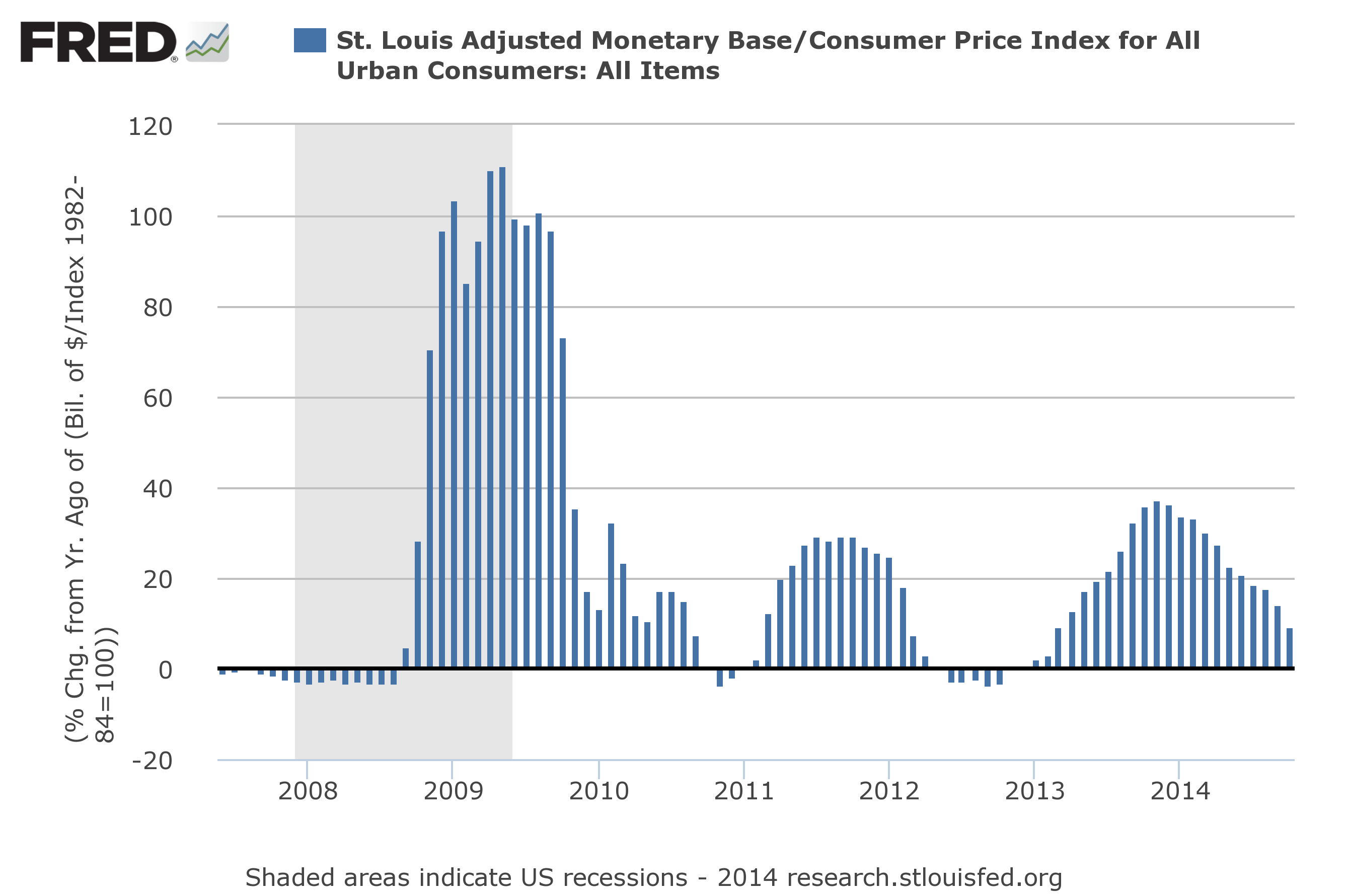

The Federal Reserve is reportedly on track to start raising interest rates next year, but the tightening is already underway if only in relative terms. Indeed, there’s a conspicuous directional change in the year-over-year comparison in the real (inflation-adjusted) monetary base. The substantial deceleration of the growth rate that’s been unfolding this year isn’t surprising at this point, but it serves as a reminder that the central bank’s plan to normalize policy is a process rather than a single date in the future when the Fed funds rate increases.

The process is also risky to the extent that economic growth remains wobbly. True, the US economy has been a relatively strong performer this year compared with Europe and Japan. But the last two times since the Great Recession that the Fed squeezed the rate of growth in the real monetary base (2010 and 2012) the results were less than encouraging and the economy stumbled. Will it be different this time? A stress test is coming, perhaps as early as next year’s first quarter.

For now, it’s clear that pace of growth for high-powered-money is receding, advancing less than 10% on a year-over-year basis for the first time since early 2012. As of October 2014, the St. Louis Fed’s measure of the monetary base increased 9.5% vs. a year ago in real terms – down from a 36% rise at the end of last year.

Meantime, a broad set of economic and financial indicators suggest that the macro trend for the US remains upbeat. That’s a signal (based on what we know today) for expecting that the economy can withstand the monetary tightening that’s unfolding. There’s still plenty of uncertainty about what happens next, however, partly because the outlook for the global economy is looking a bit more challenged these days. Today’s update on manufacturing in the Eurozone, for instance, paints a discouraging profile via the November read on the purchasing managers index (PMI). “With the final PMI coming in below the flash reading, the situation in euro area manufacturing is worse than previously thought,” notes Chris Williamson, chief economist at Markit Economics.

For now, however, US monetary policy is still moving toward something approximating “normal.” But if the third attempt at paring the growth in money supply is to avoid the macro turbulence that plagued the previous rounds of tightening, the US economic momentum of late must remain intact in the months ahead. So far, there’s nothing in the data to suggest otherwise. Cautious optimism is subject to revision, however, depending on what we see in the incoming data.

This week’s main event on that score is the update on payrolls due out on Friday (Dec. 5). At the moment, the crowd’s expecting another round of encouraging news. Private payrolls are expected to rise 215,000 in November, marginally better than October’s 209,000 advance, according to the consensus forecast via Briefing.com. Hold that though as we wind through the week ahead.