What a difference a month makes for anticipating Thursday’s “advance” GDP report for the first quarter. In late-March economists were projecting US growth at 1.5%-plus, perhaps even in the low-2% range by some accounts (seasonally adjusted annual rate). But expectations have fallen on hard times in recent weeks and the government’s preliminary estimate of economic output in Q1 has been cut to as low as 0.1% by one firm’s reckoning. Econoday.com’s consensus forecast of 0.7% is firmer, but this estimate still represents a sharp deceleration from the already sluggish 1.4% pace in last year’s Q4.

The crowd’s bracing for a stall-speed GDP report, in other words. If the prediction holds up, the news will mark a considerable deterioration in expectations. As recently as late-February, The Wall Street Journal reported that the US economy was starting 2016 on “solid footing”.

The Q1 GDP data may look ugly, but it’s still not obvious that a new recession is on the near-term horizon. The three-month average of the Chicago Fed National Activity Index through last month continued to hold well above the tipping point that marks the start of downturns. There’s also no sign of high recession risk in the March macro profile via The Capital Spectator’s proprietary business cycle model.

The optimistic view is that a weak Q1 GDP number is another soft patch that will soon give way to stronger growth. There’s some support for this narrative, although there’s plenty of data to support a darker view as well. The next major opportunity for an attitude adjustment, for good or ill, arrives in next week’s April update on US payrolls.

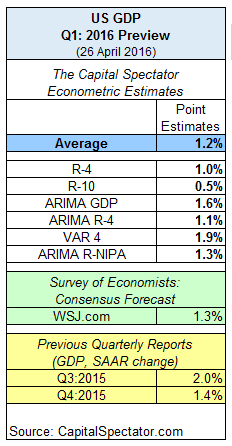

Meantime, here’s how several estimates of the Q1 GDP report compare, including The Capital Spectator’s average econometric forecast—a relatively rosy 1.2%.

The Atlanta Fed’s Apr. 19 nowcast is looking for a substantially weaker gain in Thursday’s report—a mere 0.3%. The latest estimate marks a dramatic collapse from the nearly 3% projection in early February.

Here are the various forecasts that are used to calculate CapitalSpectator.com’s average estimate:

As updated estimates are published, based on incoming economic data, the chart below tracks the changes in the evolution of The Capital Spectator’s projections.

Finally, here’s a brief profile for each of The Capital Spectator’s GDP forecast methodologies:

R-4: This estimate is based on a multiple regression in R of historical GDP data vs. quarterly changes for four key economic indicators: real personal consumption expenditures (or real retail sales for the current month until the PCE report is published), real personal income less government transfers, industrial production, and private non-farm payrolls. The model estimates the statistical relationships from the early 1970s to the present. The estimates are revised as new data is published.

R-10: This model also uses a multiple regression framework based on numbers dating to the early 1970s and updates the estimates as new data arrives. The methodology is identical to the 4-factor model above, except that R-10 uses additional factors—10 in all—to forecast GDP. In addition to the data quartet in the 4-factor model, the 10-factor forecast also incorporates the following six series: ISM Manufacturing PMI Composite Index, housing starts, initial jobless claims, the stock market (Wilshire 5000), crude oil prices (spot price for West Texas Intermediate), and the Treasury yield curve spread (10-year Note less 3-month T-bill).

ARIMA GDP: The econometric engine for this forecast is known as an autoregressive integrated moving average. This ARIMA model uses GDP’s history, dating from the early 1970s to the present, for anticipating the target quarter’s change. As the historical GDP data is revised, so too is the forecast, which is calculated in R via the “forecast” package, which optimizes the parameters based on the data set’s historical record.

ARIMA R-4: This model combines ARIMA estimates with regression analysis to project GDP data. The ARIMA R-4 model analyzes four historical data sets: real personal consumption expenditures, real personal income less government transfers, industrial production, and private non-farm payrolls. This model uses the historical relationships between those indicators and GDP for projections by filling in the missing data points in the current quarter with ARIMA estimates. As the indicators are updated, actual data replaces the ARIMA estimates and the forecast is recalculated.

VAR 4: This vector autoregression model uses four data series in search of interdependent relationships for estimating GDP. The historical data sets in the R-4 and ARIMA R-4 models noted above are also used in VAR-4, albeit with a different econometric engine. As new data is published, so too is the VAR-4 forecast. The data sets range from the early 1970s to the present, using the “vars” package in R to crunch the numbers.

ARIMA R-NIPA: The model uses an autoregressive integrated moving average to estimate future values of GDP based on the datasets of four primary categories of the national income and product accounts (NIPA): personal consumption expenditures, gross private domestic investment, net exports of goods and services, and government consumption expenditures and gross investment. The model uses historical data from the early 1970s to the present for anticipating the target quarter’s change. As the historical numbers are revised, so too is the estimate, which is calculated in R via the “forecast” package, which optimizes the parameters based on the data set’s historical record.

Pingback: 04/26/16 – Tuesday’s Interest-ing Reads | Compound Interest-ing!