US real estate and fixed-securities provided diversification benefits during last week’s widespread selling that weighed on most other markets around the world, based on a set of ETFs through Friday’s close (Dec. 17).

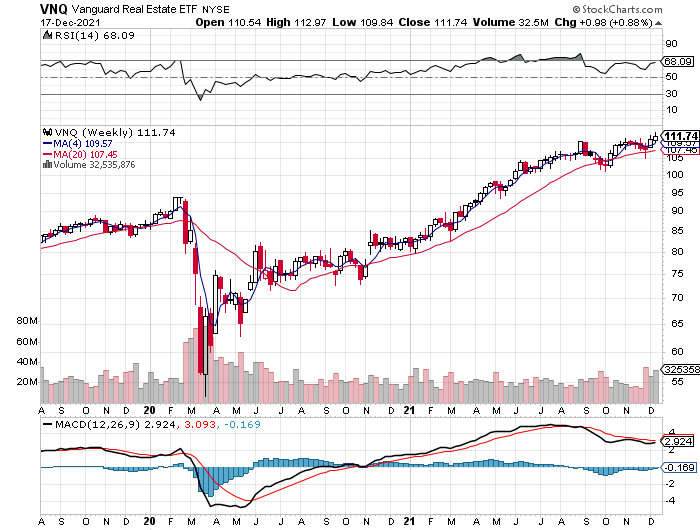

Vanguard US Real Estate (VNQ) – a proxy for US-listed real estate investment trusts (REITs) — posted the leading performance last week for the major asset classes. The fund rallied for a second week, gaining 0.9%. The increase lifted the ETF to just below a record high at the end of the trading week.

A broad measure of US bonds also rose last week. Vanguard Total Bond Market (BND) ticked up 0.4%. Despite the increase, BND continues to trade in range as the market digests the conflicting signals for monetary policy and the economic outlook — factors that are key inputs for bonds.

The Federal Reserve last week signaled that it is pivoting away from the strong monetary stimulus bias it has maintained during the pandemic and shifting, on the margins for now, to a more hawkish outlook to fight elevated inflation. The central bank’s evolving focus comes amid rising uncertainty for the US economy. Although next month’s fourth-quarter GDP report is expected to post a strong rebound from Q3’s weak gain, the bounce is expected to fade in the first half of 2022.

In addition to the potential for stronger economic headwinds due to the spread of the Omicron variant of the coronavirus, new uncertainty over the fate of President Biden’s Build Back Better (BBB) legislation adds another risk to the macro calculus for 2022. Factoring in lower odds that the bill will become law, Goldman Sachs on Sunday cut its forecast for US economic growth in the new year. “A failure to pass BBB has negative growth implications,” the investment bank advises in a report after Sen. Joe Manchin announced he wouldn’t support the bill, which effectively kills the legislation in a closely divided Senate.

Most markets lost ground last week. The biggest loser: stocks in emerging markets. Vanguard FTSE Emerging (VWO) tumbled 2.5%, leaving the ETF at its lowest close since August.

Widespread market losses weighted on the Global Market Index (GMI.F) — an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETF proxies. GMI.F dropped 1.3% last week. This benchmark has fallen in five of the past six weeks.

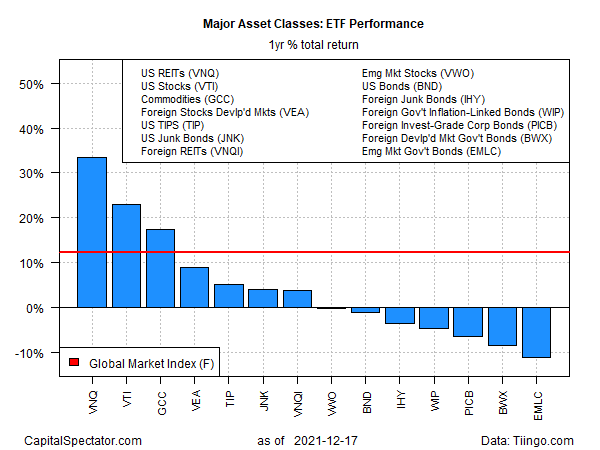

US REITs continue to lead for the one-year window by a wide margin. Vanguard US Real Estate (VNQ) is ahead by a strong 33.5% vs. the year-ago level (after factoring in distributions). US stocks are in second place, but VTI’s 23.0% one-year gain remains well behind VNQ’s gain.

Half of the major asset classes are under water for the one-year window. The biggest loser: government bonds in emerging markets via EMLC, which has lost 11.2% over the past 12 months.

GMI.F, by contrast, is up a strong 12.2% for the trailing one-year period.

Most of the major asset classes are posting moderate drawdowns as of Friday’s close, ranging from a trivial 0.3% peak-to-trough decline for US REITs (VNQ) to a bit more than a 9% drawdown for government bonds in developed markets ex-US (BWX).

The three downside outliers: emerging markets stocks (VWO), emerging markets bonds (EMLC) and commodities (GCC), which are currently posting drawdowns in excess of 10% declines.

GMI.F’s current drawdown is -2.9%.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report