The housing market continue to show signs of recovery after a soft first quarter. The latest hint: yesterday’s better-than-expected rise in existing home sales. Purchases advanced at the strongest pace in over eight years, reaching a new post-recession seasonally adjusted high of 5.49 million units in June. The update follows last week’s bullish news that new residential construction in June is close to a post-recession high while sentiment in the home-building industry this month is near a ten-year high.

The encouraging trend in housing these days boosts the odds that the US economy will continue to expand in the months ahead. Housing, after all, is widely recognized as a key factor for the macro outlook. One economist argues that “Housing IS the Business Cycle.” At the very least, the revival in the housing sector will help to offset some of the recent weakness in manufacturing and retail spending.

“Buyers have come back in force, leading to the strongest past two months in [house] sales since early 2007,” notes Lawrence Yun, chief economist at the National Association of Realtors, which publishes the existing home sales report. “This wave of demand is being fueled by a year-plus of steady job growth and an improving economy that’s giving more households the financial wherewithal and incentive to buy.”

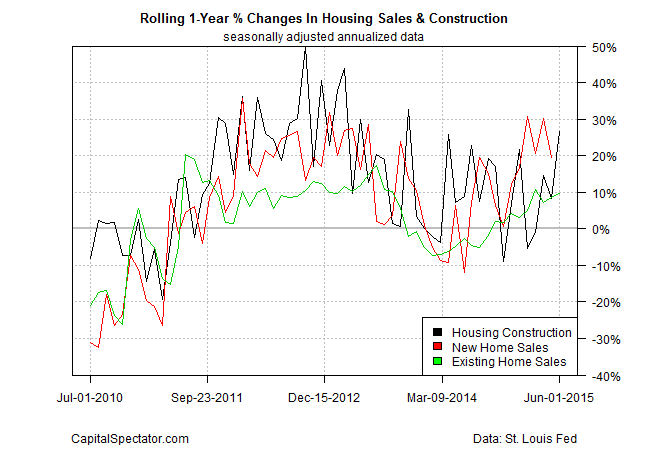

The monthly comparisons could be noise, of course, but the positive outlook holds up when we review the year-over-year changes–a clearer and more-reliable measure of the trend. As you can see in the chart below, the annual growth rate of sales and construction has turned higher in recent months, providing support for the view that the sector is poised to deliver additional fuel for the economic expansion in the near term.

“The housing market is on fire,” Thomas Costerg, a senior economist at Standard Chartered Bank in New York, tells Bloomberg. “The strength in housing could offset some of the weakness we are seeing elsewhere.”

Recession risk, in other words, remains a low-probability threat. That’s old news, of course, as The Capital Spectator’s periodic updates on the US business cycle have routinely shown (see here and here, for instance). The upbeat numbers from housing of late, however, strengthen the case for projecting moderate growth (or better?) for the foreseeable future.