Investors just can’t get enough of low (and falling) yields. There’s a “nearly insatiable global demand for yield,” observes Aaron Kohli, interest-rate strategist at BMO Capital Markets. Where this ends and what it portends is unknown. Meantime, yields continue to tick lower, dipping below zero in some corners. Let’s call it the Star-Trek factor. As the crowd chases bonds with record low payouts, the fixed-income crew is exploring strange new worlds, boldly venturing to go where no investor has gone before.

Consider the sub-zero realm in Germany, which earned the dubious distinction yesterday as the first country in the euro area to auction government bonds with negative yields. The news is hardly a shock, given that existing bonds have recently been trading at negative yields lately. Germany’s 10-year, for instance, has been slightly negative in recent weeks. But with the government auctioning new bonds with minus signs preceding the stated coupon payout, the new world order has reached a new official low.

The dip into negative territory for the German 10-year is all the more striking since the country’s bonds are considered among the safest assets in the world, perhaps second only to US Treasuries. But safety has a price, and one that’s slowly but persistently cutting deeper. Indeed, buying a new 10-year bond for what is effectively the Eurozone benchmark rate is guaranteed to lose money if the security is held to maturity. Safety has a new definition in the 21st century.

“It’s a new reality and I think it will be like this for quite a while,” says Philippe Gijsels, chief investment officer at BNP Paribas Fortis in Brussels.

Lest you think the dive below zero is limited to Germany, think again. Fitch Ratings late last month advised that the global total for sovereign debt with negative yields jumped to $11.7 trillion at the end of June—up $1.3 trillion from the previous month. “Worries over the global growth outlook, further fueled by Brexit, have continued to support demand for higher-quality sovereign paper in June,” Fitch explained. “Widespread adoption of unconventional monetary policies, including large-scale bond-buying programs and negative deposit rates, have driven the large increases in negative-yielding debt seen this year.” At the forefront of last month’s dip: “particularly big shifts in German, French and Japanese yield curves during June.”

US Treasuries, by comparsion, look like a bargain. The 10-year Note’s yield was a relatively compelling at 1.48% yesterday (July 13), based on daily data via Treasury.gov–close to last week’s record low of 1.37%.

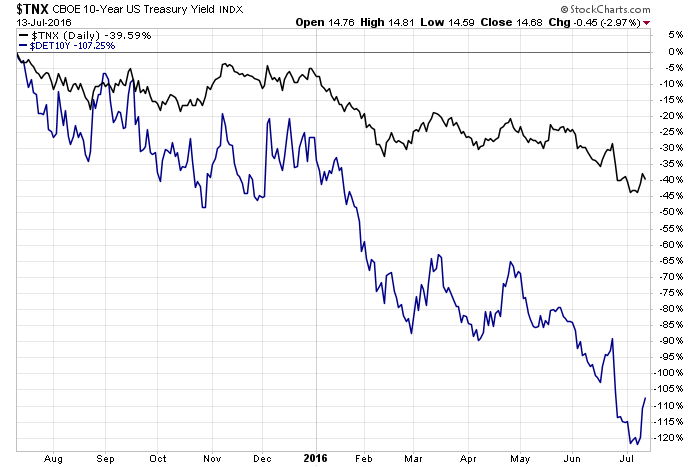

It’s reasonable to expect that even lower Treasury yields are coming, courtesy of the gravitational forces by way of yield chasing that has become a global phenomenon. To understand where this may be headed from a US perspective, we can start by reviewing a relative comparison of yield changes over the last year for the German (blue line in chart below) and US 10-year yields (black line). The question before the house: Will US yields continue to remain at relatively high premiums?

It’s possible that the gap could close by way of sharply higher yields in Germany, but soft macro conditions in Europe, combined with Brexit worries, throw cold water on that idea. Then again, perhaps the world’s appetite for higher yield—any yield!—will suddenly dry up as investors learn to accept the new normal and the slow erosion of wealth that’s now standard with owning a sovereign bond portfolio that’s populated with “safe” German and Japanese fixed-income securities.

The alternative scenario is that global investors make a final stand and pursue a return on principal within the strange new world of sovereign debt. Even with all the currency risk that comes packaged with cross-border investing, the relative allure of American paper is almost certainly too strong to resist.

By that logic, all roads lead to the US, which implies that the current 10-year yield could look like an incredible bargain down the road.

Unless… US economic growth accelerates, which would be the mother of all complicating factors for Treasury investors.

Meanwhile, the US equity market finds no reason to worry. In fact, the prospect of even lower interest rates may be pumping up stock prices. In a world where yield is going the way of the dodo, the crowd seems to be placing a premium on the stock market’s dividend payouts. The SPDR S&P 500 ETF (SPY), a proxy for US equities, has a trailing yield of roughly 2%, according to Morningstar.com. Two percent, one could argue, is an offer that the crowd can’t refuse. But with US stocks trading at all-time highs this week, at a time when the macro outlook is still challenged, piling into equities for a modest 2% payout may not be the low-risk proposition that it appears to be.

Investors, in other words, don’t have a lot of great choices. But until further notice, US stocks and US Treasuries offer relatively compelling values, or so it seems.

Captain’s log, stardate 7.14.2016. First officer Mr. Stock Market in temporary command. We’re picking up distress signals from the USS Sovereign Bond. We’ve requested instructions from Star-Fed Command, but no response. We’ve decided to beam aboard Sovereign and investigate. Report to follow.

Pingback: Global Demand for Yield - TradingGods.net

Seems as though the Elitists are trying to control the Deflation, to their advantage—this is what Deflation looks like when the Elites Control, the Currency, Monetary Policy, and Fiscal Policy. Time the depose them.